Integration of Big Data Technologies

The Transportation Predictive Analytics Market is being transformed by the integration of big data technologies. The ability to process and analyze large volumes of data from various sources, such as GPS, sensors, and social media, is revolutionizing transportation analytics. This integration allows for more comprehensive insights into traffic patterns, customer behavior, and operational efficiency. As organizations increasingly rely on data-driven strategies, the demand for predictive analytics solutions that can handle big data is expected to rise. Market analysts suggest that the adoption of big data technologies in transportation could lead to improved forecasting accuracy and operational performance, thereby driving growth in the predictive analytics sector.

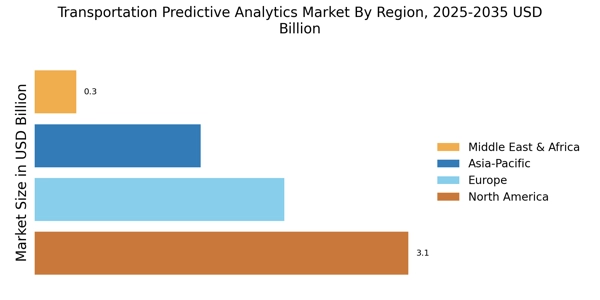

Government Initiatives and Regulations

Government initiatives and regulations play a crucial role in shaping the Transportation Predictive Analytics Market. Many governments are investing in smart transportation systems to improve infrastructure and reduce environmental impact. Policies promoting the use of data-driven decision-making in transportation planning are becoming more prevalent. For instance, funding for smart city projects often includes provisions for predictive analytics tools. This regulatory support is likely to enhance the adoption of predictive analytics solutions among public transportation agencies and private sector players alike. As a result, the market is expected to expand, driven by the need for compliance with new regulations and the desire to improve service efficiency.

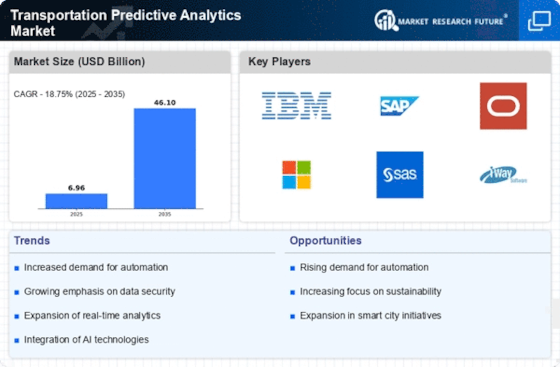

Advancements in Machine Learning and AI

The Transportation Predictive Analytics Market is significantly influenced by advancements in machine learning and artificial intelligence. These technologies enable the analysis of vast datasets, leading to more accurate predictions and insights. Machine learning algorithms can identify patterns in traffic flow, weather conditions, and vehicle performance, which can be leveraged to enhance operational efficiency. The integration of AI in predictive analytics is expected to drive market growth, as organizations seek to harness these technologies for better decision-making. Reports indicate that the adoption of AI in transportation analytics could lead to cost savings of up to 30% for logistics companies, highlighting the potential financial benefits of these innovations.

Growing Focus on Safety and Risk Management

The Transportation Predictive Analytics Market is increasingly focused on safety and risk management. With rising concerns over accidents and operational risks, predictive analytics provides valuable insights that can help organizations mitigate potential hazards. By analyzing historical data and real-time information, companies can identify risk factors and implement proactive measures to enhance safety. The market for predictive analytics in safety management is projected to grow as organizations prioritize the well-being of their employees and customers. This focus on safety not only helps in compliance with regulations but also enhances the reputation of transportation companies, making predictive analytics an essential tool in the industry.

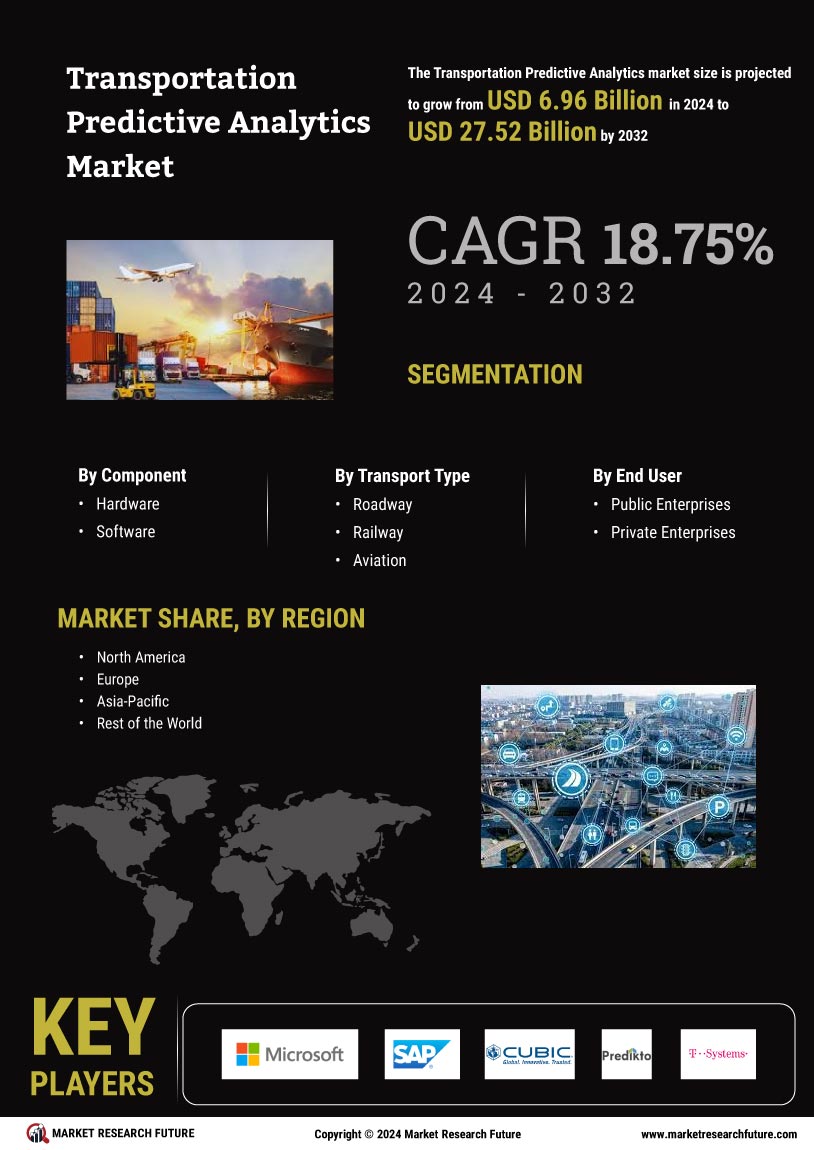

Rising Demand for Efficient Transportation Solutions

The Transportation Predictive Analytics Market is experiencing a surge in demand for efficient transportation solutions. As urbanization accelerates, cities face increasing congestion and logistical challenges. Predictive analytics offers tools to optimize routes, reduce delays, and enhance overall operational efficiency. According to recent estimates, the market for predictive analytics in transportation is projected to grow at a compound annual growth rate of over 20% through the next five years. This growth is driven by the need for real-time data analysis and decision-making capabilities, which are essential for managing complex transportation networks. Companies are increasingly adopting predictive analytics to improve service delivery and customer satisfaction, thereby solidifying its role in the transportation sector.