Aging Population

The demographic shift towards an aging population is a crucial factor driving the Global Transient Ischemic Attack Market Industry. As individuals age, the risk of cerebrovascular diseases, including TIAs, escalates. The United Nations projects that by 2030, the global population aged 60 years and older will reach 1.4 billion, creating a larger cohort susceptible to TIAs. This demographic trend necessitates enhanced healthcare services and interventions tailored to older adults, thereby fostering market expansion. The increasing burden of TIAs among the elderly population underscores the importance of developing targeted therapies and preventive measures.

Rising Incidence of Stroke

The increasing prevalence of stroke globally is a pivotal driver for the Global Transient Ischemic Attack Market Industry. As per recent health statistics, stroke remains one of the leading causes of morbidity and mortality worldwide. The World Health Organization indicates that approximately 15 million people suffer from stroke annually, with a significant portion experiencing transient ischemic attacks as precursors. This alarming trend underscores the necessity for enhanced diagnostic and therapeutic interventions, thereby propelling market growth. The Global Transient Ischemic Attack Market is projected to reach 0.12 USD Billion in 2024, reflecting the urgent need for effective management strategies.

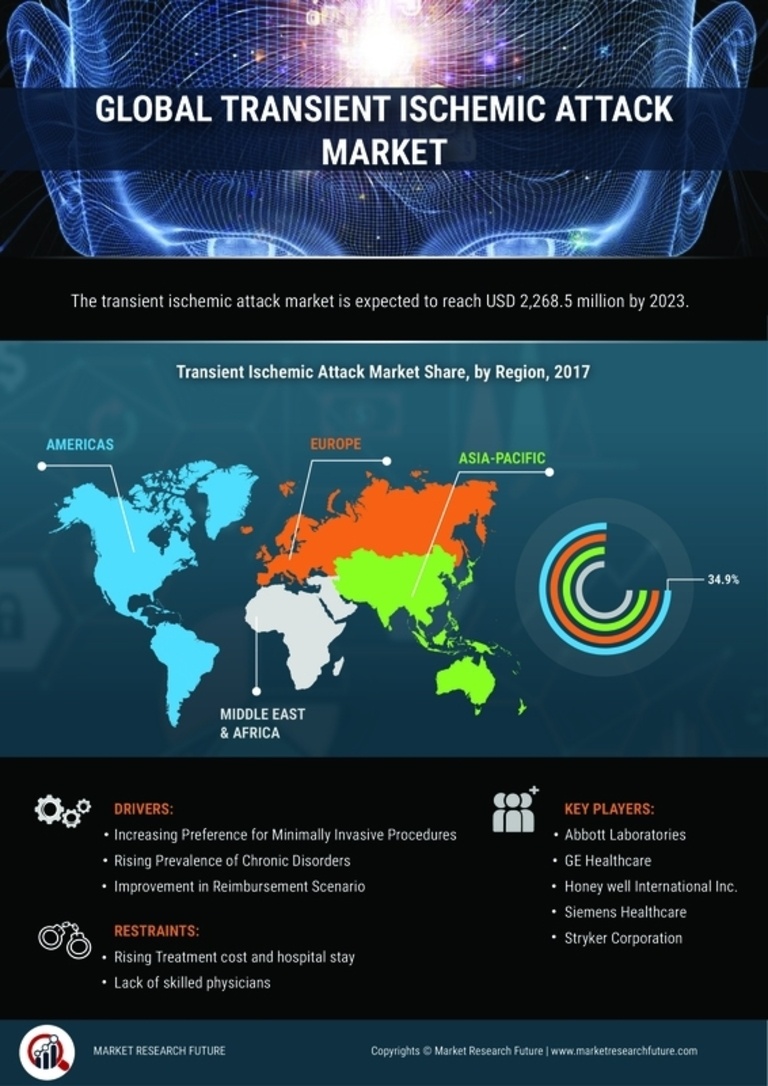

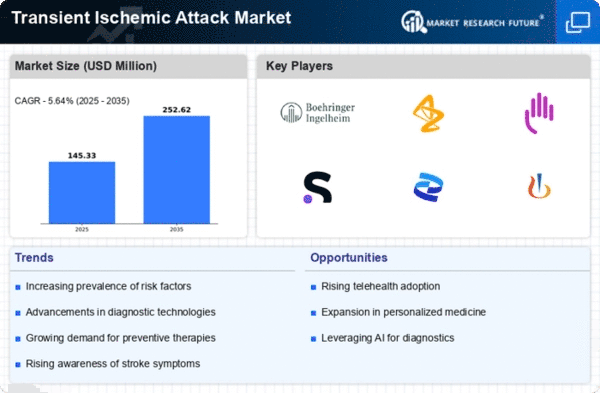

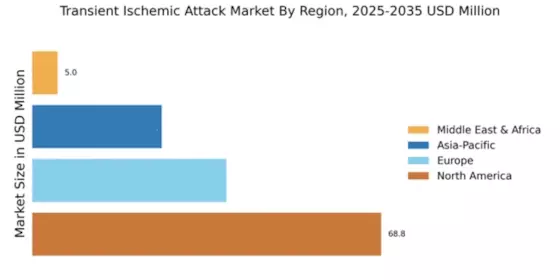

Market Trends and Projections

The Global Transient Ischemic Attack Market Industry is witnessing notable trends that indicate a robust growth trajectory. Projections suggest that the market will expand from 0.12 USD Billion in 2024 to 0.38 USD Billion by 2035, reflecting a compound annual growth rate of 11.0% from 2025 to 2035. This growth is driven by various factors, including advancements in medical technology, increased awareness, and an aging population. The market dynamics are influenced by the evolving healthcare landscape, necessitating continuous adaptation by stakeholders to meet the demands of TIA management.

Regulatory Support and Funding

Government initiatives and regulatory support play a vital role in shaping the Global Transient Ischemic Attack Market Industry. Various health authorities are implementing policies aimed at improving stroke care and funding research for innovative treatments. For example, the National Institutes of Health in the United States allocates substantial resources to stroke research, which indirectly benefits TIA management. Such funding encourages the development of new therapies and technologies, thereby enhancing patient care. This supportive regulatory environment is expected to facilitate market growth, as stakeholders are more inclined to invest in TIA-related innovations.

Increased Awareness and Education

Growing awareness regarding transient ischemic attacks and their implications is significantly influencing the Global Transient Ischemic Attack Market Industry. Public health campaigns and educational initiatives by health organizations aim to inform individuals about the symptoms and risks associated with TIAs. This heightened awareness encourages early medical intervention, which is essential for preventing subsequent strokes. As a result, healthcare systems are increasingly prioritizing TIA management, leading to a surge in demand for related services and products. The market is expected to experience a compound annual growth rate of 11.0% from 2025 to 2035, driven by these educational efforts.

Advancements in Medical Technology

Technological innovations in medical devices and diagnostic tools are transforming the landscape of the Global Transient Ischemic Attack Market Industry. The advent of portable imaging technologies and telemedicine solutions facilitates timely diagnosis and treatment, which is crucial for TIA patients. For instance, advanced MRI techniques enable rapid identification of ischemic episodes, thereby improving patient outcomes. Furthermore, the integration of artificial intelligence in predictive analytics is enhancing risk stratification for TIA patients. These advancements not only improve clinical efficacy but also contribute to the anticipated market growth, with projections indicating a rise to 0.38 USD Billion by 2035.