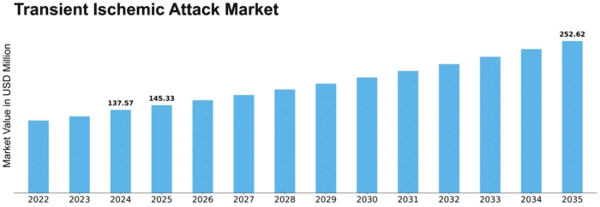

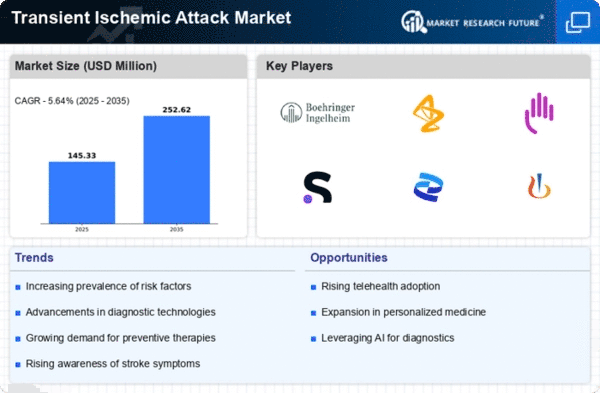

Transient Ischemic Attack Size

Transient Ischemic Attack Market Growth Projections and Opportunities

The transient ischemic attack (TIA) market is a significant aspect of healthcare, focusing on the prevention, diagnosis, and treatment of temporary disruptions in blood flow to the brain. Often referred to as "mini-strokes," TIAs are warning signs of potential strokes and require prompt medical attention to prevent more severe neurological damage. This market segment is vital due to the serious consequences associated with TIAs, including an increased risk of subsequent strokes, cognitive impairment, and disability. As awareness of TIAs grows among healthcare professionals and the general population, there is a growing demand for effective strategies to identify and manage these transient events.

Key players in the TIA market include pharmaceutical companies, medical device manufacturers, diagnostic imaging providers, and healthcare facilities specializing in stroke care. Pharmaceutical interventions play a crucial role in preventing recurrent TIAs and strokes by targeting underlying risk factors such as hypertension, hyperlipidemia, and atrial fibrillation. Medications such as antiplatelet agents (e.g., aspirin, clopidogrel), anticoagulants, statins, and blood pressure-lowering drugs are commonly prescribed to reduce the risk of clot formation, improve blood flow, and stabilize atherosclerotic plaques in the arteries supplying the brain.

In addition to pharmaceutical interventions, medical devices and diagnostic tools play a crucial role in the TIA market by enabling healthcare providers to accurately diagnose TIAs, assess stroke risk, and guide treatment decisions. Advanced imaging modalities such as magnetic resonance imaging (MRI), computed tomography (CT), and carotid ultrasound are used to visualize blood flow in the brain and identify potential causes of TIA symptoms, such as arterial stenosis or emboli. These imaging techniques help clinicians differentiate between TIAs and other neurological conditions, allowing for timely intervention and risk stratification.

Another important aspect of the TIA market is rehabilitation and secondary prevention strategies aimed at reducing the risk of recurrent TIAs and strokes. Rehabilitation programs may include physical therapy, occupational therapy, speech therapy, and cognitive rehabilitation to address deficits in motor function, activities of daily living, communication, and cognitive abilities. Lifestyle modifications, such as smoking cessation, dietary changes, exercise, and weight management, are also emphasized to control modifiable risk factors and improve overall cardiovascular health.

The TIA market is influenced by various factors, including demographic trends, epidemiological patterns, healthcare policies, and technological advancements. With an aging population and a growing prevalence of risk factors such as obesity, diabetes, and hypertension, the burden of TIAs and strokes is expected to increase globally. As a result, there is a growing emphasis on preventive measures, early detection, and comprehensive stroke care to reduce the societal and economic impact of these neurological events.

Technological innovations are driving advancements in the diagnosis and treatment of TIAs, with emerging trends such as telemedicine, artificial intelligence (AI), and remote monitoring showing promise in improving access to care and optimizing treatment outcomes. Telestroke programs enable remote consultation and decision-making between stroke specialists and healthcare providers in underserved areas, facilitating timely administration of thrombolytic therapy and other acute interventions. AI algorithms are being developed to analyze medical imaging data and assist radiologists in detecting subtle abnormalities indicative of TIAs, allowing for faster and more accurate diagnoses.

Leave a Comment