Market Analysis

In-depth Analysis of Transient Ischemic Attack Market Industry Landscape

The market dynamics of transient ischemic attack (TIA), also known as a mini-stroke, are influenced by various factors that impact the diagnosis, treatment, and prevention of this condition. A TIA occurs when blood flow to the brain is temporarily disrupted, often resulting in symptoms similar to those of a stroke, such as weakness, numbness, or difficulty speaking. Despite being temporary, TIAs are warning signs of potential future strokes, making early detection and management crucial.

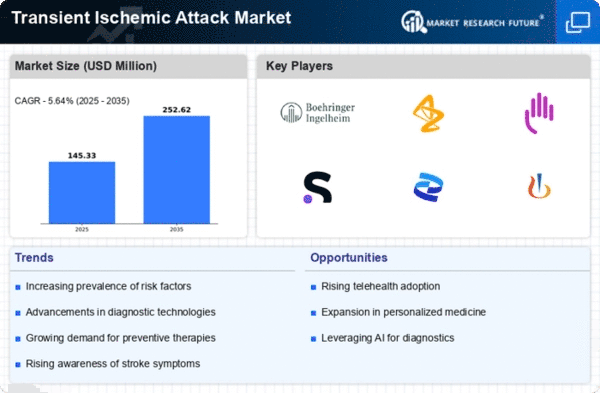

One of the key drivers of the TIA market is the increasing prevalence of risk factors such as hypertension, diabetes, and obesity. As these risk factors become more prevalent globally, the incidence of TIAs is expected to rise, driving demand for diagnostic tools and treatment options. Moreover, aging populations in many countries contribute to the growing burden of cerebrovascular diseases, including TIAs, further fueling market growth.

Advancements in medical imaging and diagnostic technologies have revolutionized the detection and characterization of TIAs. Imaging modalities such as magnetic resonance imaging (MRI), computed tomography (CT), and ultrasound play a crucial role in diagnosing TIAs and identifying underlying causes such as carotid artery disease or atrial fibrillation. Additionally, point-of-care diagnostic tests enable rapid assessment of patients presenting with TIA symptoms, facilitating prompt treatment and management.

The treatment landscape for TIAs encompasses various therapeutic approaches aimed at preventing recurrent strokes and managing underlying risk factors. Antiplatelet medications such as aspirin and clopidogrel are commonly prescribed to reduce the risk of blood clot formation and subsequent stroke following a TIA. Furthermore, interventions such as carotid endarterectomy or stenting may be recommended to address significant carotid artery stenosis, a common cause of TIAs. Additionally, lifestyle modifications including smoking cessation, dietary changes, and exercise are integral components of TIA management and prevention.

Healthcare policies and reimbursement frameworks also influence the market dynamics of TIAs. Access to timely diagnosis, treatment, and follow-up care is essential for optimizing patient outcomes and reducing the risk of recurrent strokes. Reimbursement policies for diagnostic tests, medications, and procedures vary across different healthcare systems, impacting market access and adoption of TIA management strategies. Moreover, initiatives aimed at raising awareness about TIAs and promoting preventive measures contribute to market dynamics by driving demand for screening programs and educational resources.

Collaboration among stakeholders in the healthcare ecosystem is essential for addressing the multifaceted challenges associated with TIAs. Healthcare providers, including neurologists, primary care physicians, and emergency department personnel, play a critical role in identifying and managing patients with TIAs. Additionally, partnerships between healthcare organizations, research institutions, and pharmaceutical companies drive innovation in TIA diagnostics and therapeutics, leading to improved patient outcomes.

Market dynamics in the TIA space are also influenced by regulatory considerations and technological advancements. Regulatory agencies such as the Food and Drug Administration (FDA) in the United States and the European Medicines Agency (EMA) in Europe oversee the approval and marketing of medical devices, pharmaceuticals, and interventions for TIA management. Stringent regulatory standards ensure the safety, efficacy, and quality of TIA treatments while also shaping market entry and competition.

Technological innovations continue to drive progress in TIA management, with ongoing research focused on novel diagnostic biomarkers, targeted therapies, and non-invasive treatment modalities. Advances in telemedicine and digital health technologies enable remote monitoring of patients with TIAs, facilitating timely intervention and follow-up care. Furthermore, artificial intelligence and machine learning algorithms hold promise for enhancing risk stratification and personalized treatment approaches for individuals at high risk of recurrent strokes.

Leave a Comment