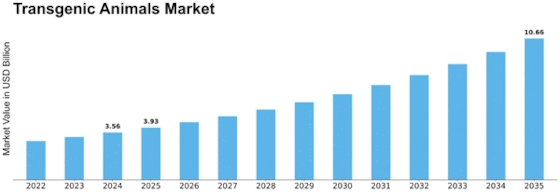

Transgenic Animals Size

Transgenic Animals Market Growth Projections and Opportunities

The TRANSGENIC ANIMALS MARKET is substantially encouraged by the demand for transgenic animals in biomedical research. Increased use of genetically changed animals in analyzing illnesses, drug development, and know-how biological tactics drives the market's growth, as researchers are looking for more sophisticated trends for their experiments. Advances in genetic engineering technologies play a pivotal function in shaping the TRANSGENIC ANIMALS MARKET. Continuous enhancements in the precision and efficiency of gene-modifying gear make contributions to the improvement of a wider range of transgenic animals with specific genetic adjustments, expanding the market's potential packages. Collaborations between the pharmaceutical and biotechnology industries and studies establishments force innovation inside the TRANSGENIC ANIMALS MARKET. Partnerships facilitate the improvement of custom-designed animal models for drug testing and research functions, fostering market growth and increasing the capabilities of transgenic animal technologies. The market is evolving with the exploration of transgenic animal applications in agriculture. Genetic changes in animals for advanced farm animals trends, disorder resistance, and improved agricultural productiveness contribute to the market's growth past biomedical research, creating new possibilities. The value-effectiveness of genetic amendment strategies influences the TRANSGENIC ANIMALS MARKET. Advances in an era that lessens the cost and time required for genetic adjustments make transgenic animals more reachable to researchers and industries, fostering increased adoption and market growth. Public belief and the reputation of transgenic animals affect the market's development. Ethical considerations, environmental worries, and societal attitudes in the direction of genetically modified organisms play a role in shaping the market panorama. Public training and recognition tasks are crucial for addressing those factors. Concerns associated with the welfare of transgenic animals are vital market elements. Ethical treatment and responsible care of genetically modified animals are vital for gaining public trust and regulatory approval, influencing market dynamics, and shaping the industry's moral practices. The stage of technological competitiveness amongst market players is a used element within the TRANSGENIC ANIMALS MARKET. Companies making an investment in current technology and staying at the forefront of genetic engineering improvements have an aggressive side, influencing market trends and innovations.

Leave a Comment