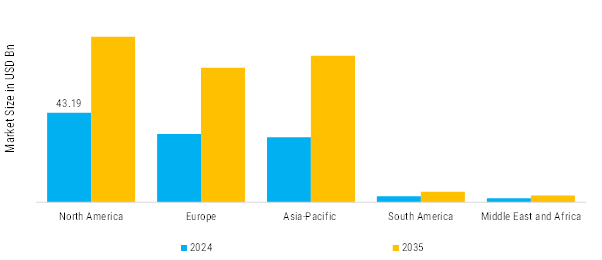

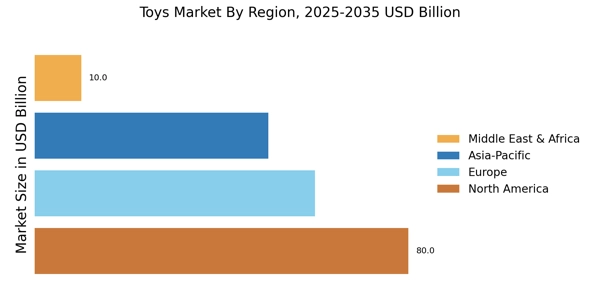

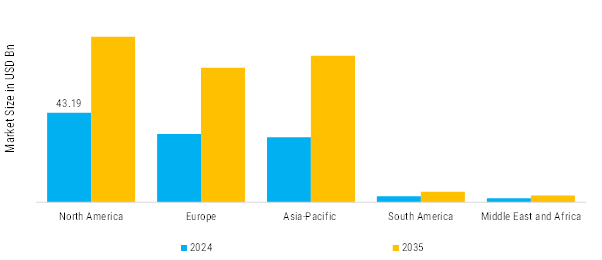

Based on region, the Global Commercial Heat-Treating Market is segmented into North America, Europe, Asia-Pacific, South America and Middle East and Africa. North America accounted for the largest market share in 2024 and is anticipated to reach USD 79.81 Billion by 2035. Asia-Pacific is projected to grow at the highest CAGR of 7.82% during the forecast period.

North America: Expanding operation market

This region is the largest contributor to global Toys and is a dynamic and competitive industry shaped by innovation, media tie-ins, and evolving consumer preferences. Dominated by major players like Hasbro, Mattel, LEGO, and Spin Master, the market thrives on both traditional toys and tech-enhanced products, including app-integrated and AI-powered toys. Licensing agreements with entertainment giants such as Disney, Marvel, and Warner Bros. drive strong demand, particularly around film and streaming releases. Post-pandemic trends have emphasized educational, screen-free play, while adult collectors and nostalgia-based products have expanded the market's demographic reach. E-commerce and social media platforms like Amazon, YouTube, and TikTok have reshaped toy marketing and sales, accelerating the shift to digital-first strategies.

The toy industry has grown substantially over time, with billions of dollars of toys sold each year in the United States alone. Even after safety considerations, injuries can result.

“National Library of Medicine”

Europe: Emerging operation Evolution

The European toys sector is a dynamic and diverse industry, known for its emphasis on safety, innovation, and educational value. Home to globally recognized brands such as LEGO (Denmark), Playmobil (Germany), and Smoby (France), the region combines traditional craftsmanship with modern technology to meet evolving consumer demands. The market is heavily regulated, particularly under EU Toy Safety Directive standards, ensuring high-quality and non-toxic products. Sustainability has become a growing focus, with companies increasingly adopting eco-friendly materials and production methods.

Asia-pacific: Rising internal Demand

The Asia-Pacific toys sector is one of the fastest-growing and most dynamic markets globally, driven by a combination of rising disposable incomes, a growing middle class, and increasing demand for both traditional and tech-enabled toys. Countries like China, Japan, India, and South Korea play a major role in manufacturing and consumption, with China serving as a global hub for toy production.

Rising disposable incomes, government programs like Make in India, and growing consumer demand for toys that are safe, instructive, and made locally are all contributing factors to the steady rise of the India Toy Market.

The market's competitive landscape is changing due to innovation, the growth of e-commerce, and a move toward STEM-based and environmentally friendly products.

South America: Demand for Traditional and Smart Toys

The toys sector in South America is a dynamic and growing industry, driven by a young population and increasing consumer spending. Countries like Brazil, Argentina, and Colombia are key markets, with Brazil being the largest in the region. The industry benefits from a strong demand for both traditional toys and modern, tech-driven products such as educational and electronic toys. Global brands like Mattel and Hasbro maintain a strong presence, but local manufacturers also play a significant role by offering culturally relevant products at more affordable prices. E-commerce is expanding rapidly, especially post-pandemic, giving consumers wider access to international brands.

Middle-East & Africa: Early Childhood Development

The Middle East and Africa (MEA) toys sector is witnessing steady growth, driven by rising disposable incomes, a young population, and increasing awareness of early childhood development. Countries like the UAE and Saudi Arabia are leading the market, with growing demand for educational toys, licensed merchandise, and tech-integrated products such as smart toys and interactive games. In Africa, urbanization and the expansion of retail infrastructure are boosting accessibility to international toy brands. E-commerce is also playing a key role, enabling wider product reach and variety.