Top Industry Leaders in the Tool steel Market

*Disclaimer: List of key companies in no particular order

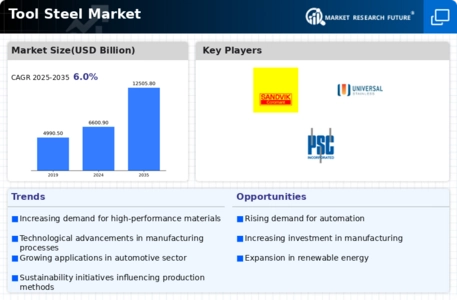

Tool steel Top listed global companies in the industry are:

- Voestalpine AG (Austria)

- Sandvik (Sweden)

- Baosteel Group (China)

- Samuel Son & Co (Canada)

- Hitachi Metal (Japan)

- Eramet SA (France)

- Schmiedewerke Gröditz (Germany)

- Universal Stainless (US)

- QiLu Special Steel Co. Ltd. (China)

- Hudson Tool Steel Corporation (US)

- GERDAU S.A. (Brazil)

- Pennsylvania Steel Company (US)

- Nachi-Fujikoshi Corp (Japan), and others.

Hardening the Edge: A Look at the Tool Steel Market Landscape

The global tool steel market, projected to reach a tempered $8.16 billion by 2030, is a highly competitive arena where established players clash with innovative newcomers. Understanding the strategies shaping this competition, the factors influencing market share, and emerging trends is crucial for forging a successful path in this dynamic environment.

Key Players and their Strategies:

- Global Titans: Giants like Böhler Edelstahl and Hitachi Metals leverage their extensive research and development resources, diverse product portfolios, and established distribution networks to cater to a broad range of industries. Böhler excels in high-performance grades for demanding applications, while Hitachi focuses on cost-effective solutions for specific regions.

- Regional Champions: Companies like China National Star and Sumitomo Metal Industries dominate specific geographical markets by tailoring offerings to regional regulations and industry needs. China National Star caters to China's booming manufacturing sector with affordable tool steel grades, while Sumitomo focuses on high-precision tool steels for Japan's demanding automotive industry.

- Technology Trailblazers: Startups like Carpenter Technology Corporation and Uddeholm AB are disrupting the market with innovative approaches. Carpenter focuses on advanced alloys with superior wear resistance and heat tolerance, while Uddeholm pushes the boundaries of additive manufacturing for customized tool steel components.

Factors for Market Share Analysis:

- Product Diversity: Offering a variety of tool steel grades with diverse properties like hardness, toughness, and machinability caters to diverse customer needs and expands market reach.

- Innovation Quotient: Continuously investing in research and development to create new tool steel grades with improved performance, sustainability, and cost-effectiveness is crucial for market leadership. Carpenter's development of wear-resistant alloys exemplifies this.

- Cost Optimization: Balancing advanced features with affordability is crucial, especially in price-sensitive segments. China National Star's cost-effective tool steels have secured a strong foothold in emerging markets.

- Customer Focus: Providing tailored tool steel solutions and comprehensive after-sales support, including heat treatment and technical expertise, fosters customer loyalty and market penetration. Uddeholm excels in this area with its customized additive manufacturing solutions.

Emerging Trends and Company Strategies:

- Sustainability Integration: Reducing environmental impact through eco-friendly production processes and developing tool steels with longer lifespans are gaining traction. Hitachi's use of recycled materials exemplifies this trend.

- Industry-Specific Focus: Targeting high-growth sectors like automotive, aerospace, and energy with specialized tool steels and industry-specific knowledge is a growing trend. Sumitomo's high-precision tool steels for the automotive industry cater to this need.

- Additive Manufacturing Impact: Utilizing 3D printing for customized tool steel components with complex geometries and near-net shapes is a promising trend. Uddeholm actively researches and utilizes this technology.

- Digitalization and Smart Tools: Integrating sensors and data analytics into tool steels enables real-time performance monitoring, predictive maintenance, and data-driven optimization of machining processes.

Overall Competitive Scenario:

The tool steel market presents a dynamic landscape where tradition meets innovation, cost-effectiveness duels with high-performance, and regional players wrestle with global giants. Success hinges on continuous innovation, a diversified product portfolio, and agility in adapting to emerging trends. Companies prioritizing sustainability, industry-specific solutions, and digitalization hold a strong hand in this ever-evolving market.

Latest Company Updates:

October 2023- Markforged has revealed the latest editions of its H13 Tool Steel and D2 Tool Steel filaments for its Metal X 3D printing system. The latest filaments are reformulations of Markforged's most popular tool steels, with both materials having an updated binder that is said to result in more flexible and less brittle filament.

November 2023- ASC Steel Deck, a steel roof and floor deck manufacturer, announced plans to unveil a new structural sidelap connection system called the DeltaGrip DG4 Tool on Nov. 8 at the National Council of Structural Engineers Associations' Structural Engineering Summit, held next week in Anaheim, Calif. In a Nov. 2 news release announcing the launch, ASC Steel Deck said the new tool builds upon the previously proven success of ASC Steel Deck's original DeltaGrip system with added benefits, including higher connection strength, faster cycle times, and increased durability. The pneumatic tool employs a quadruple punch through three layers of steel, delivering a durable punch crimping action that interlocks the connection between deck panels at the side laps. The company said the new interlock creates a stronger, more durable connection than a screwed sidelap and is most comparable to a 'welded' sidelap connection. ASC Steel Deck added that, compared to the previous DeltaGrip generation, the re-engineered DG4 Tool boosts connection strength by up to 26% and stiffness by up to 48%. The tool's optimized four-tooth punch and strengthened steel frame generate 35% more crimping force, amplifying the punching forces to form an incredibly secure mechanical connection between panels. An end-of-cycle air dump valve reduces cycle times by 17% across all steel gauges. Upgraded components like braided air lines and a rugged handle further improve reliability in the field.