Increasing Vehicle Complexity

As vehicles become more complex, the demand for advanced diagnostic tools within the Automotive Diagnostic Tool Market Industry is escalating. Modern vehicles are equipped with numerous electronic control units (ECUs) and sophisticated software systems, which necessitate the use of advanced diagnostic equipment to troubleshoot effectively. This complexity is driving automotive service providers to invest in high-quality diagnostic tools that can handle a wide range of issues. Market data suggests that the number of ECUs in vehicles has increased significantly, with some models featuring over 100 ECUs. Consequently, the need for specialized diagnostic tools that can interface with these systems is becoming paramount, thereby propelling market growth.

Growth of Aftermarket Services

The Automotive Diagnostic Tool Market Industry is benefiting from the growth of aftermarket services, which are becoming increasingly vital in the automotive sector. As vehicle owners seek to maintain their vehicles for longer periods, the demand for diagnostic tools in the aftermarket is rising. Service centers and independent repair shops are investing in advanced diagnostic equipment to provide high-quality services to their customers. This trend is supported by market data showing that the aftermarket segment is projected to grow at a rate of 7% annually over the next few years. The increasing reliance on aftermarket services for vehicle maintenance and repair is likely to drive the demand for sophisticated diagnostic tools, further propelling the market.

Regulatory Compliance and Standards

The Automotive Diagnostic Tool Market Industry is significantly influenced by regulatory compliance and standards that govern vehicle emissions and safety. Governments worldwide are implementing stringent regulations aimed at reducing emissions and enhancing vehicle safety, which in turn necessitates the use of advanced diagnostic tools. These tools are essential for ensuring that vehicles meet the required standards and for conducting regular inspections. As regulations become more rigorous, automotive service providers are compelled to adopt sophisticated diagnostic solutions to remain compliant. Data indicates that the market for compliance-related diagnostic tools is expected to grow as more jurisdictions enforce stricter regulations, thereby creating opportunities for manufacturers in the automotive diagnostic sector.

Rising Demand for Electric Vehicles

The Automotive Diagnostic Tool Market Industry is witnessing a notable shift due to the rising demand for electric vehicles (EVs). As more consumers opt for EVs, the need for diagnostic tools tailored to these vehicles is becoming increasingly critical. Electric vehicles have unique components and systems that require specialized diagnostic capabilities, such as battery management systems and electric drivetrains. This trend is prompting manufacturers of diagnostic tools to innovate and develop solutions that cater specifically to the needs of EVs. Market analysis indicates that the EV segment is expected to account for a substantial share of the automotive market, further driving the demand for specialized diagnostic tools designed for electric vehicles.

Technological Advancements in Automotive Diagnostic Tools

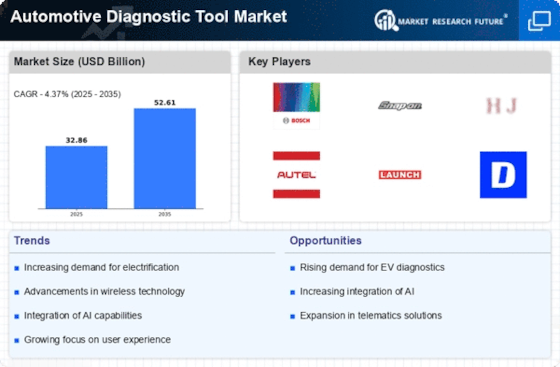

The Automotive Diagnostic Tool Market Industry is experiencing a surge in technological advancements, which are reshaping the landscape of vehicle diagnostics. Innovations such as artificial intelligence and machine learning are being integrated into diagnostic tools, enhancing their accuracy and efficiency. These technologies enable real-time data analysis, allowing technicians to identify issues more swiftly and accurately. Furthermore, the incorporation of cloud computing facilitates remote diagnostics, which is becoming increasingly popular among service centers. According to recent data, the market for advanced diagnostic tools is projected to grow at a compound annual growth rate of approximately 8% over the next five years. This growth is indicative of the industry's shift towards more sophisticated and user-friendly diagnostic solutions.