Expansion in Chemical Manufacturing

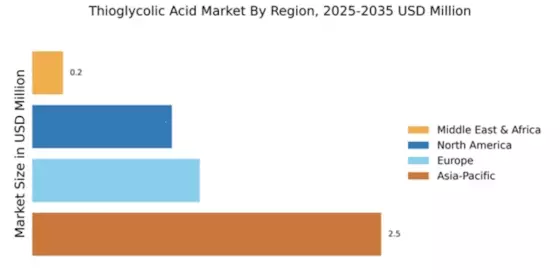

The Global Thioglycolic Acid Market Industry is significantly influenced by the expansion of the chemical manufacturing sector. Thioglycolic acid is utilized in various industrial applications, including the production of specialty chemicals and pharmaceuticals. The growth of the chemical industry, particularly in emerging economies, is likely to bolster the demand for thioglycolic acid. As manufacturers seek to enhance product performance and develop new applications, thioglycolic acid's versatility positions it as a preferred choice. This trend is expected to contribute to the market's growth trajectory, with projections indicating a market value of 113.7 USD Million by 2035.

Rising Awareness of Hair and Skin Care

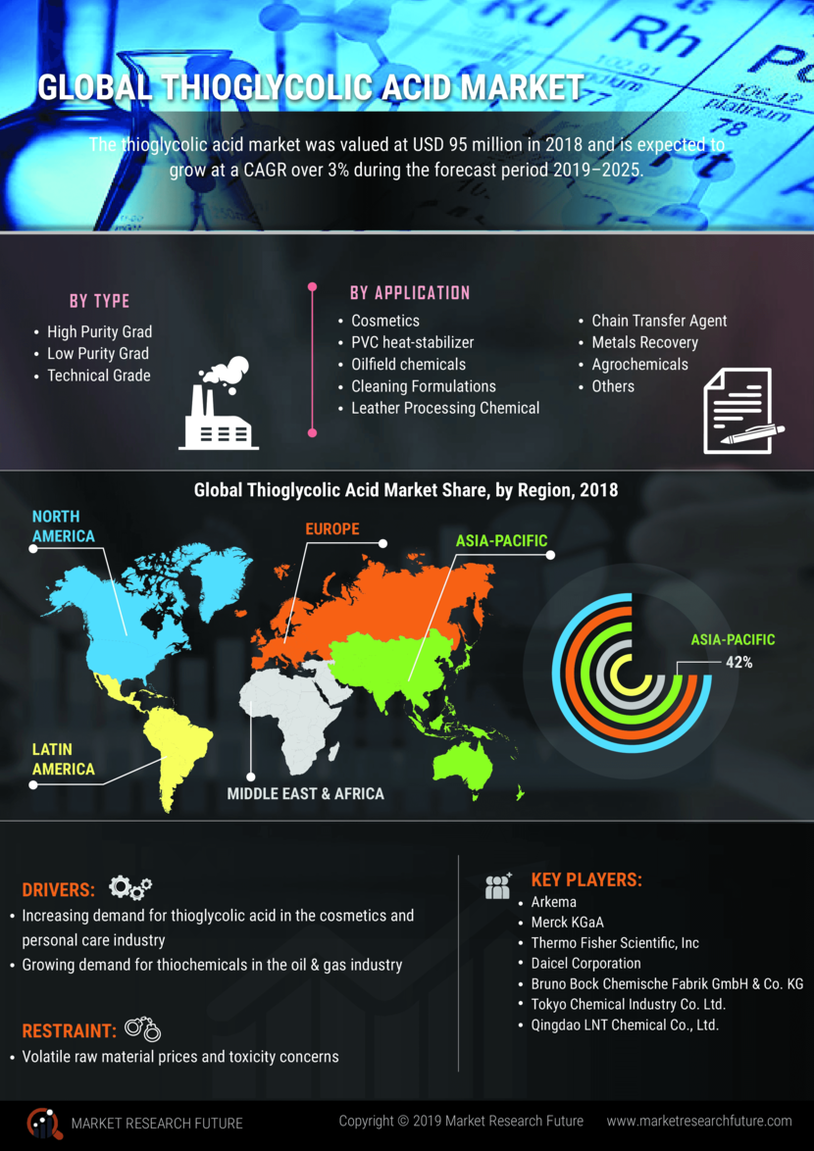

The Global Thioglycolic Acid Market Industry benefits from the increasing awareness surrounding hair and skin care among consumers. As individuals become more informed about the benefits of thioglycolic acid in promoting healthy hair and skin, its adoption in various formulations is likely to rise. This heightened awareness is particularly evident in regions with a growing middle-class population, where consumers are willing to invest in quality personal care products. The trend suggests a steady growth in the market, potentially leading to a compound annual growth rate of 3.52% from 2025 to 2035, as consumers prioritize effective and safe beauty solutions.

Growing Demand in Personal Care Products

The Global Thioglycolic Acid Market Industry experiences a notable surge in demand driven by its extensive application in personal care products, particularly in hair removal and cosmetic formulations. Thioglycolic acid serves as a key ingredient in depilatory creams and hair straightening products, appealing to consumers seeking effective beauty solutions. As the global beauty and personal care market continues to expand, the demand for thioglycolic acid is projected to increase. By 2024, the market value is estimated at 77.7 USD Million, reflecting the growing consumer inclination towards innovative and efficient personal care products.

Technological Advancements in Formulation

The Global Thioglycolic Acid Market Industry is poised for growth due to technological advancements in formulation techniques. Innovations in the production and application of thioglycolic acid enable manufacturers to enhance product efficacy and safety. These advancements facilitate the development of new formulations that cater to diverse consumer needs, including sensitive skin and specific hair types. As companies invest in research and development to create advanced products, the market is likely to witness an influx of innovative thioglycolic acid-based solutions. This trend may further solidify the market's position, contributing to its projected growth in the coming years.

Regulatory Support for Cosmetic Ingredients

The Global Thioglycolic Acid Market Industry is positively impacted by regulatory support for cosmetic ingredients. Governments and regulatory bodies are increasingly recognizing the importance of safe and effective cosmetic formulations, leading to the establishment of guidelines that promote the use of thioglycolic acid in personal care products. This regulatory backing not only enhances consumer confidence but also encourages manufacturers to incorporate thioglycolic acid into their formulations. As a result, the market is likely to experience sustained growth, driven by the assurance of safety and efficacy in cosmetic applications.