Thioglycolic Acid Size

Thioglycolic Acid Market Growth Projections and Opportunities

The Thioglycolic Acid industry is closely connected to a range of market factors that are based on a mutual relationship and are decisive for the trends. A major drive, to mention, is the rapidly evolving market demand from the cosmetic and personal care industry. Thioglycolic Acid is a main element for hair removal products with personal hygiene showing clear emphasis, the demand for such products especially associated with the hair removal area has been increasing at a steady rate. This trend provides for further market's expansion because of the growing demand for the substitution of Thioglycolic Acid which is reflected by the increase of the market share

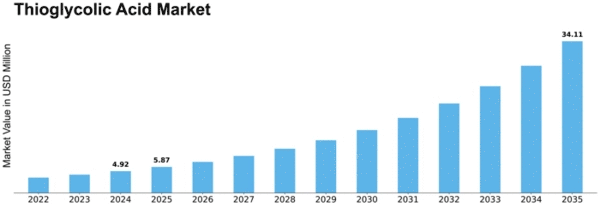

Market forecast shows that the Thioglycolic Acid Market is projected to reach a revenue above 95.7usd million by the years forecasted. Thioglycolic Acid Market is supposed to cross its CAGR in 3.5% per year by 2030.

Also, the chemical industry is one of the major factors that helps determine the stock market success in this segment. Thioglycolic Acid (TGA) is also utilized in many chemical processes, for instance, the production of commodity chemicals and intermediates which are used in textile, pharmaceutical, and agriculture sectors. In the similar fashion as these industries boom; so does the demand for Thioglycolic Acid. Being multipurpose, Thioglycolic Acid is often used in the manufacture of chemicals for different fields thereby making it a desirable chemical for the industries.

Similarly to the previous factor, regulatory policies significantly influence the Thioglycolic Acid market. Stringent laws and standards concerning the use of chemicals in the chemicals industry in different industries, particularly in cosmetics and personal care items, may therefore be engenders as market dynamics. Adherence to these pointers becomes very critical for appending companies for the purpose of forwarding their operations and holding their market share.

The world’s economic situation constitutes a very important factor and how this affects the market Thioglycolic Acid. Economic shifts such as recession, currency exchange rates, and overall financial conditions can reduce the ability to buy goods by individuals and companies. Therefore, these factors are the reason for the variation in Thioglycolic Acid demand, because companies have to react to the situation with the economic conditions by making changes to their production and procurement processes.

It is worth mentioning that technological evolutions lead to the growth and development of the Thioglycolic Acid market. This field is constantly being explored which has lead to the development of improved manufacturing techniques and advancements in uses of Thioglycolic Acid. Companies who put their money into and take ownership of the latest technologies stand the main chance of dominating the market in the long run leading to trendsetter effect and change in consumer purchasing patterns.

The impact on the environment and sustainability is becoming more and more the decisive factors when selecting Thioglycolic acid on the market. With industries becoming more process of conscious, there is a need to establish newer alternatives that are more sustainable and eco-friendly. An unshakable part of these changes could be market participants that understand this change and focus on environment certifications.

Leave a Comment