Growth in Renewable Energy Sector

The Thick Film Device Market is poised to benefit from the growth in the renewable energy sector. As nations strive to transition towards sustainable energy sources, the demand for efficient energy conversion and storage solutions increases. Thick film devices are integral in applications such as solar panels and energy storage systems, where they enhance performance and durability. In 2025, the renewable energy market is projected to expand significantly, with investments in solar and wind energy reaching unprecedented levels. This trend creates opportunities for the Thick Film Device Market to innovate and provide solutions that align with the sustainability goals of various industries. The integration of thick film technology in renewable energy applications not only improves efficiency but also supports the global shift towards greener energy solutions.

Advancements in Automotive Electronics

The Thick Film Device Market is significantly impacted by advancements in automotive electronics. As the automotive sector increasingly adopts electronic components for enhanced functionality, the demand for thick film devices rises. In 2025, the automotive electronics market is expected to reach a valuation of over 300 billion dollars, with thick film devices playing a crucial role in various applications such as sensors, control units, and displays. The push towards electric vehicles and autonomous driving technologies further amplifies this demand, as these innovations require reliable and efficient electronic components. Consequently, manufacturers in the Thick Film Device Market are focusing on developing products that meet the stringent requirements of automotive applications, thereby fostering growth and innovation within the sector.

Rising Demand for Consumer Electronics

The Thick Film Device Market experiences a notable surge in demand driven by the increasing consumption of consumer electronics. As technology advances, devices such as smartphones, tablets, and wearables require more sophisticated components, including thick film devices. In 2025, the consumer electronics sector is projected to grow at a compound annual growth rate of approximately 6.5%, which directly influences the thick film device market. This growth is attributed to the rising disposable incomes and changing lifestyles of consumers, leading to higher spending on electronic gadgets. Consequently, manufacturers are compelled to innovate and enhance their product offerings, thereby propelling the Thick Film Device Market forward. The integration of thick film technology in these devices enhances performance and reliability, making it a preferred choice among manufacturers.

Miniaturization of Electronic Components

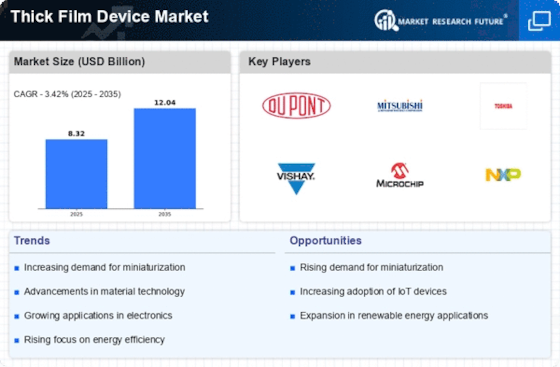

The trend towards miniaturization in electronics is a key driver for the Thick Film Device Market. As devices become smaller and more compact, the need for high-performance components that occupy minimal space intensifies. Thick film devices offer a unique advantage due to their ability to deliver reliable performance in a compact form factor. In 2025, the miniaturization trend is expected to continue, with the market for miniaturized electronic components projected to grow at a rate of 7% annually. This trend is particularly evident in sectors such as medical devices, where space constraints are critical. Manufacturers in the Thick Film Device Market are thus motivated to innovate and develop smaller, more efficient products that cater to this growing demand, ensuring their competitiveness in the market.

Increased Investment in Research and Development

The Thick Film Device Market is witnessing increased investment in research and development, which is crucial for driving innovation and enhancing product offerings. As competition intensifies, companies are allocating more resources to R&D to develop advanced thick film technologies that meet evolving market demands. In 2025, it is estimated that R&D spending in the electronics sector will exceed 100 billion dollars, with a significant portion directed towards thick film device innovations. This investment is likely to lead to breakthroughs in material science and manufacturing processes, resulting in improved performance and cost-effectiveness of thick film devices. Consequently, the Thick Film Device Market stands to benefit from these advancements, as they enable manufacturers to deliver superior products that align with the needs of various applications.