Government Support and Subsidies

Government initiatives aimed at promoting agricultural productivity are playing a crucial role in the Greenhouse Films Market. Various countries are implementing policies that provide financial support and subsidies to farmers who invest in greenhouse technologies. This support is particularly evident in regions where agriculture is a key economic driver. For instance, programs that encourage the use of greenhouse films to enhance crop yields are becoming more prevalent. Such initiatives not only bolster the adoption of greenhouse films but also contribute to the overall growth of the agricultural sector. Market analysts project that government support could lead to a 15% increase in the adoption of greenhouse films over the next few years, underscoring the importance of policy in shaping the Greenhouse Films Market.

Consumer Preference for Fresh Produce

The growing consumer preference for fresh and locally sourced produce is significantly impacting the Greenhouse Films Market. As health-conscious consumers seek out fresh fruits and vegetables, the demand for efficient agricultural practices that ensure year-round production is increasing. Greenhouse films play a vital role in enabling farmers to cultivate crops in controlled environments, thereby meeting consumer expectations for quality and freshness. Market data suggests that the demand for fresh produce is projected to rise by 25% over the next five years, further driving the need for greenhouse technologies. This trend indicates that the Greenhouse Films Market is poised for growth as it aligns with consumer preferences for high-quality, fresh agricultural products.

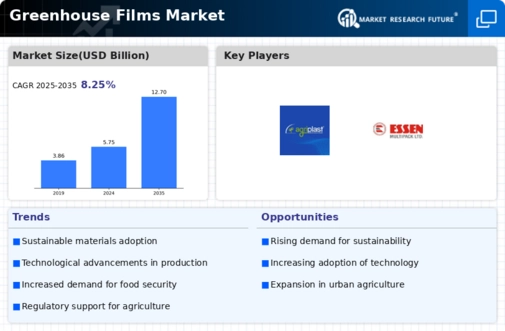

Rising Demand for Sustainable Agriculture

The increasing emphasis on sustainable agricultural practices appears to be a primary driver for the Greenhouse Films Market. As consumers become more environmentally conscious, farmers are adopting methods that minimize environmental impact. This shift is reflected in the growing market for greenhouse films, which are designed to enhance crop yield while reducing resource consumption. Reports indicate that the market for greenhouse films is projected to reach USD 3.5 billion by 2026, driven by the need for sustainable solutions. The adoption of biodegradable and recyclable films is also gaining traction, aligning with the broader sustainability goals of the agricultural sector. This trend suggests that the Greenhouse Films Market is likely to experience robust growth as sustainability becomes a core principle in farming practices.

Technological Innovations in Film Production

Technological advancements in the production of greenhouse films are significantly influencing the Greenhouse Films Market. Innovations such as the development of UV-stabilized films and anti-fogging technologies enhance the performance and longevity of greenhouse films. These advancements not only improve crop protection but also optimize light transmission, which is crucial for plant growth. The introduction of nanotechnology in film production is also noteworthy, as it enhances the physical properties of films, making them more durable and efficient. Market data suggests that the segment of technologically advanced films is expected to grow at a CAGR of 7% over the next five years. This indicates that the Greenhouse Films Market is evolving rapidly, driven by the need for improved agricultural productivity through innovative film solutions.

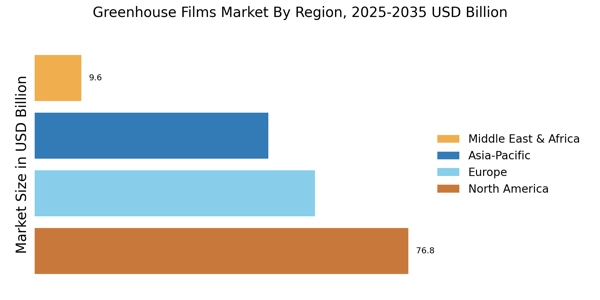

Increasing Urbanization and Space Constraints

The trend of urbanization is creating unique challenges and opportunities for the Greenhouse Films Market. As urban areas expand, the availability of arable land diminishes, prompting the need for innovative agricultural solutions. Urban farming and vertical gardening are gaining popularity, leading to a heightened demand for greenhouse films that can be utilized in limited spaces. This shift is particularly relevant in densely populated regions where traditional farming is not feasible. Market Research Future indicates that the urban agriculture segment is expected to grow by 20% in the coming years, driven by the need for efficient food production methods. Consequently, the Greenhouse Films Market is likely to adapt to these changing dynamics, focusing on products that cater to urban agricultural practices.