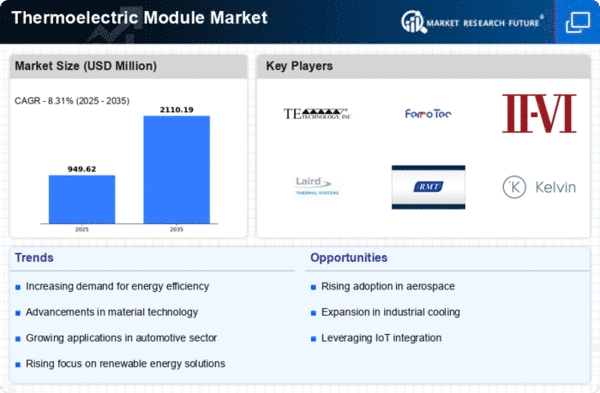

Market Growth Projections

The Global Thermoelectric Module Market Industry is poised for substantial growth, with projections indicating a market value of 0.88 USD Billion in 2024 and an anticipated increase to 2.11 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate of 8.28% from 2025 to 2035, reflecting the increasing adoption of thermoelectric technologies across various sectors. The market's expansion is likely driven by factors such as advancements in material science, rising energy efficiency demands, and government support for clean energy initiatives. These projections underscore the potential for thermoelectric modules to play a pivotal role in future energy solutions.

Advancements in Material Science

Recent advancements in material science are propelling the Global Thermoelectric Module Market Industry forward. Innovations in thermoelectric materials, such as bismuth telluride and skutterudites, have led to improved efficiency and performance of thermoelectric modules. These materials exhibit enhanced thermoelectric properties, enabling better heat-to-electricity conversion rates. As a result, applications in refrigeration, power generation, and waste heat recovery are becoming more viable and economically attractive. The ongoing research and development efforts in this field suggest a robust growth trajectory, with the market projected to reach 2.11 USD Billion by 2035, indicating a strong future for thermoelectric technologies.

Government Initiatives and Support

Government initiatives aimed at promoting clean energy technologies are significantly influencing the Global Thermoelectric Module Market Industry. Various countries are implementing policies and providing funding to support the development and commercialization of thermoelectric technologies. These initiatives often focus on reducing greenhouse gas emissions and enhancing energy efficiency. For instance, subsidies and grants for research in thermoelectric materials and applications can stimulate innovation and market growth. Such supportive measures are likely to create a favorable environment for the adoption of thermoelectric modules, further driving market expansion in the coming years.

Growing Demand for Energy Efficiency

The Global Thermoelectric Module Market Industry is experiencing a surge in demand driven by the increasing emphasis on energy efficiency across various sectors. As industries strive to reduce energy consumption and carbon footprints, thermoelectric modules offer a viable solution for waste heat recovery and energy generation. For instance, in automotive applications, these modules can convert excess heat from engines into usable electrical energy, enhancing overall vehicle efficiency. This trend is expected to contribute significantly to the market, with projections indicating a market value of 0.88 USD Billion in 2024, reflecting a growing recognition of thermoelectric technology's potential.

Rising Applications in Automotive Sector

The automotive sector is increasingly recognizing the benefits of thermoelectric modules, which is a key driver for the Global Thermoelectric Module Market Industry. With the automotive industry focusing on improving fuel efficiency and reducing emissions, thermoelectric generators are being integrated into vehicles to harness waste heat from engines. This application not only enhances vehicle performance but also contributes to sustainability goals. As the automotive market evolves, the demand for thermoelectric modules is expected to grow, with a projected compound annual growth rate of 8.28% from 2025 to 2035, indicating a robust future for this technology.

Increasing Adoption in Renewable Energy Systems

The integration of thermoelectric modules in renewable energy systems is a notable driver for the Global Thermoelectric Module Market Industry. As the world shifts towards sustainable energy solutions, thermoelectric technology plays a crucial role in enhancing the efficiency of solar and geothermal energy systems. For example, thermoelectric generators can be used alongside solar panels to convert excess heat into electricity, thereby maximizing energy output. This synergy not only improves the overall efficiency of renewable systems but also aligns with global sustainability goals. The anticipated growth in this sector is likely to be significant, contributing to the overall market expansion.