Surge in Consumer Electronics

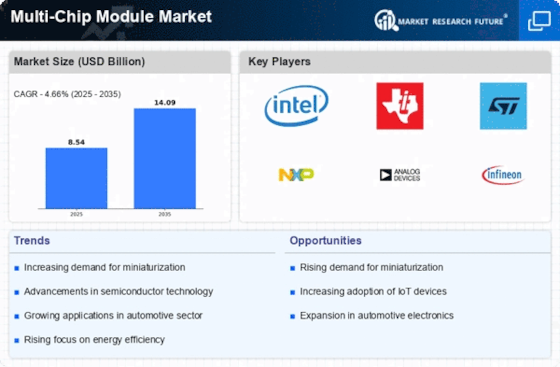

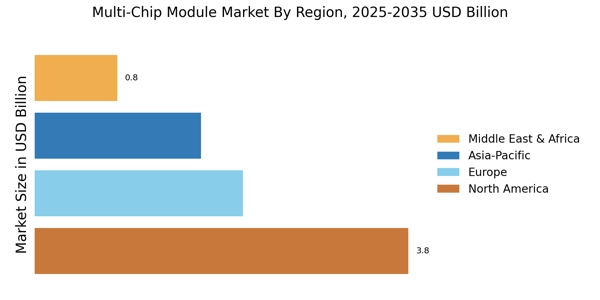

The consumer electronics sector is experiencing a surge, which significantly impacts the Multi-Chip Module Market. With the increasing demand for smartphones, tablets, and wearables, manufacturers are seeking advanced packaging solutions that can accommodate higher performance in smaller form factors. Multi-chip modules provide an effective solution by allowing the integration of various functionalities into a single package, thus optimizing space and enhancing device performance. Market data indicates that the consumer electronics market is expected to grow at a compound annual growth rate (CAGR) of over 5% in the coming years. This growth is likely to drive the demand for multi-chip modules, as companies strive to innovate and differentiate their products in a competitive landscape.

Increasing Adoption of IoT Devices

The proliferation of Internet of Things (IoT) devices is a notable driver for the Multi-Chip Module Market. As more devices become interconnected, the demand for compact and efficient solutions rises. Multi-chip modules, which integrate multiple chips into a single package, are particularly well-suited for IoT applications due to their space-saving design and enhanced performance. According to recent data, the IoT market is projected to reach a valuation of several trillion dollars by the end of the decade, indicating a substantial opportunity for multi-chip modules. This trend suggests that manufacturers are likely to invest in multi-chip technology to meet the growing needs of IoT applications, thereby propelling the Multi-Chip Module Market forward.

Growing Focus on Sustainable Technologies

The increasing emphasis on sustainability is emerging as a key driver for the Multi-Chip Module Market. As industries strive to reduce their carbon footprint and enhance energy efficiency, there is a growing demand for electronic components that align with these goals. Multi-chip modules, which can optimize power consumption and reduce material waste, are becoming increasingly attractive to manufacturers. Recent trends indicate that companies are prioritizing sustainable practices in their production processes, which may lead to a rise in the adoption of multi-chip technologies. This focus on sustainability not only addresses environmental concerns but also aligns with consumer preferences for eco-friendly products, potentially boosting the Multi-Chip Module Market.

Emerging Applications in Automotive Sector

The automotive sector is increasingly adopting advanced technologies, which serves as a significant driver for the Multi-Chip Module Market. With the rise of electric vehicles (EVs) and autonomous driving systems, there is a growing need for sophisticated electronic components that can handle complex tasks. Multi-chip modules are well-positioned to meet these requirements, as they can integrate various functionalities such as power management, communication, and processing into a single unit. Recent statistics suggest that the automotive electronics market is projected to grow substantially, potentially reaching hundreds of billions in value. This trend indicates that the demand for multi-chip modules in automotive applications is likely to increase, further propelling the Multi-Chip Module Market.

Advancements in Telecommunications Infrastructure

The ongoing advancements in telecommunications infrastructure are driving the Multi-Chip Module Market. As 5G technology continues to roll out, there is a heightened demand for high-performance components that can support faster data transmission and improved connectivity. Multi-chip modules are essential in this context, as they can facilitate the integration of multiple functionalities required for 5G applications, such as signal processing and data handling. Market analysis reveals that the telecommunications sector is expected to invest heavily in infrastructure upgrades, with billions allocated to enhance network capabilities. This investment is likely to create a robust demand for multi-chip modules, as companies seek to leverage these technologies to stay competitive in the evolving telecommunications landscape.