Growth of the Rental Market

The ongoing growth of the rental market serves as a fundamental driver in the Tenant Billing Software Market. As more individuals opt for rental living arrangements, the demand for efficient billing solutions escalates. Recent data indicates that rental properties have seen a 15% increase in occupancy rates, further emphasizing the need for effective tenant billing systems. This growth presents an opportunity for software providers to innovate and offer tailored solutions that address the unique challenges faced by landlords and property managers. Consequently, the Tenant Billing Software Market is poised for expansion, driven by the increasing number of rental properties and the corresponding need for streamlined billing processes.

Focus on Customer Experience

Enhancing customer experience is a pivotal driver in the Tenant Billing Software Market. As tenants increasingly expect transparency and convenience in their billing processes, property managers are compelled to adopt software that meets these expectations. Features such as online payment options, automated reminders, and detailed billing statements are becoming standard. Data indicates that properties utilizing advanced tenant billing solutions report a 30% increase in tenant satisfaction. This focus on customer-centric solutions is likely to propel the Tenant Billing Software Market forward, as property managers strive to retain tenants and reduce turnover rates.

Regulatory Compliance and Reporting

The necessity for regulatory compliance and accurate reporting is a significant driver in the Tenant Billing Software Market. Property managers must adhere to various financial regulations, which necessitates robust billing systems capable of generating compliant reports. The increasing complexity of financial regulations has led to a heightened demand for software that can automate compliance processes. Recent findings show that approximately 40% of property managers cite compliance as a primary concern, driving them to invest in reliable tenant billing solutions. This trend underscores the importance of compliance features within the Tenant Billing Software Market, as they provide peace of mind and reduce the risk of penalties.

Rising Demand for Digital Solutions

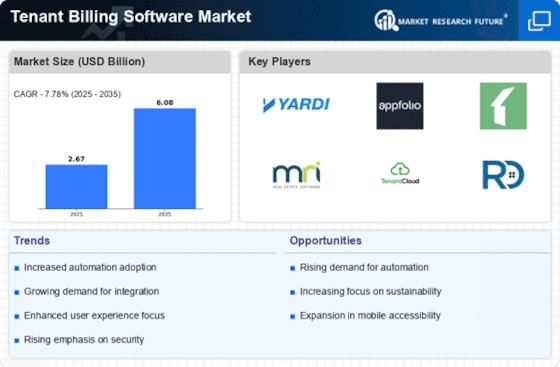

The Tenant Billing Software Market experiences a notable surge in demand for digital solutions as property management firms increasingly seek to streamline their operations. This trend is driven by the need for efficient billing processes, which can reduce administrative burdens and enhance cash flow management. According to recent data, the adoption of tenant billing software has grown by approximately 25% over the past year, indicating a shift towards digital transformation in property management. As more landlords and property managers recognize the benefits of automated billing systems, the Tenant Billing Software Market is likely to expand further, catering to a diverse range of clients from residential to commercial sectors.

Integration with Property Management Systems

The integration of tenant billing software with existing property management systems is a critical driver in the Tenant Billing Software Market. This integration facilitates seamless data exchange, allowing property managers to access billing information alongside other operational data. As property management software becomes more sophisticated, the demand for compatible billing solutions increases. Recent statistics suggest that over 60% of property managers prefer software that integrates with their current systems, highlighting the importance of interoperability. This trend not only enhances user experience but also positions the Tenant Billing Software Market as a vital component of comprehensive property management solutions.