Expansion of 5G Networks

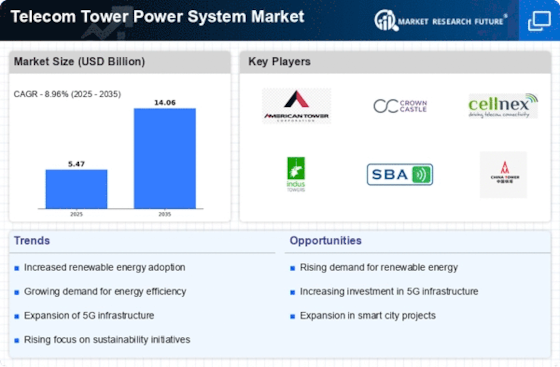

The expansion of 5G networks is poised to be a significant catalyst for the Telecom Tower Power System Market. As telecom operators roll out 5G technology, there is an increased need for more telecom towers equipped with advanced power systems to support higher data traffic and connectivity demands. The deployment of 5G is expected to require a substantial increase in infrastructure investment, with estimates suggesting that global spending on 5G infrastructure could exceed 1 trillion by 2025. This surge in investment will likely drive the demand for innovative power solutions within the Telecom Tower Power System Market.

Rising Demand for Connectivity

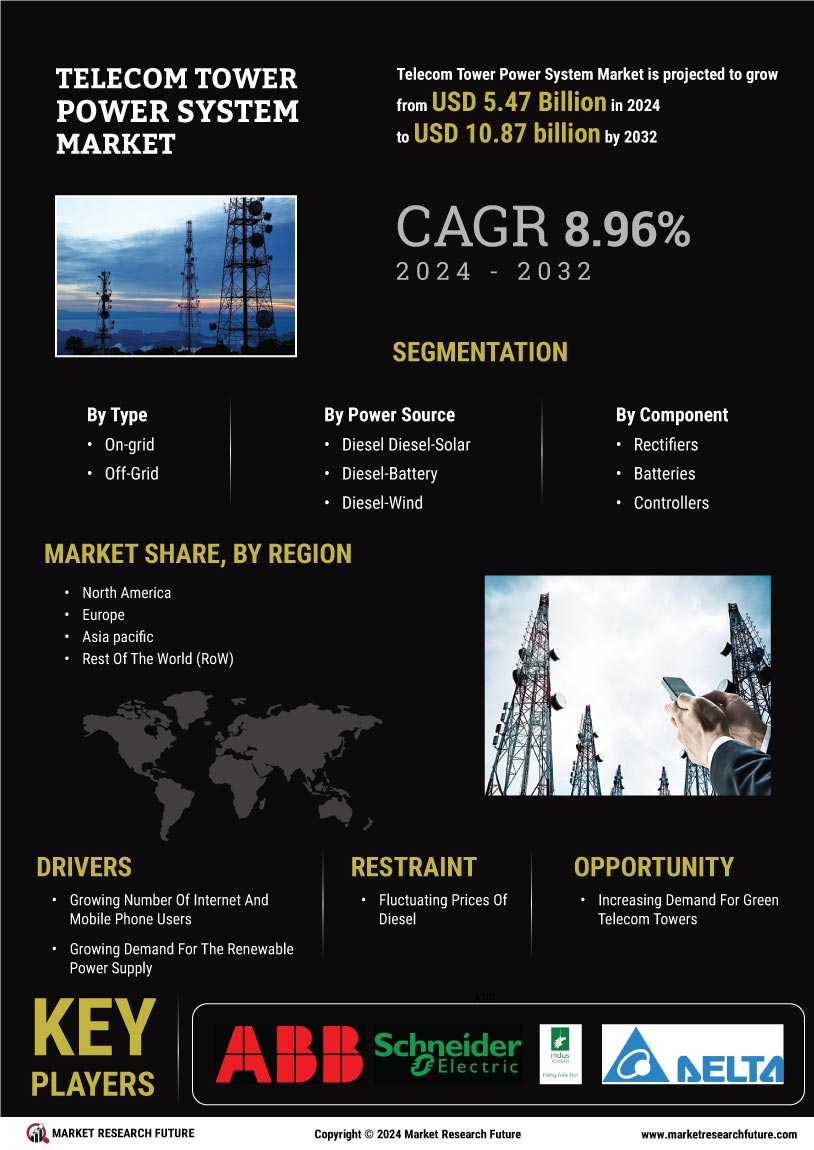

The increasing demand for connectivity across various sectors is a primary driver for the Telecom Tower Power System Market. As more individuals and businesses rely on mobile and internet services, the need for robust telecom infrastructure intensifies. This demand is particularly pronounced in developing regions, where mobile penetration rates are surging. According to recent data, the number of mobile subscriptions is projected to reach 8 billion by 2026, necessitating an expansion of telecom towers and their power systems. Consequently, telecom operators are investing heavily in power solutions to ensure uninterrupted service, thereby propelling the growth of the Telecom Tower Power System Market.

Increased Focus on Energy Efficiency

The growing emphasis on energy efficiency is a crucial driver for the Telecom Tower Power System Market. As energy costs continue to rise, telecom operators are seeking ways to reduce their energy consumption and operational expenses. This trend is leading to the adoption of hybrid power systems that combine traditional and renewable energy sources. Reports indicate that energy-efficient solutions can reduce operational costs by up to 30%, making them attractive to telecom companies. The shift towards energy-efficient power systems is likely to shape the future landscape of the Telecom Tower Power System Market.

Government Initiatives and Regulations

Government initiatives and regulations aimed at enhancing telecommunications infrastructure are driving the Telecom Tower Power System Market. Many governments are implementing policies to promote the expansion of telecom networks, particularly in underserved areas. These initiatives often include financial incentives for telecom operators to invest in new tower installations and power systems. For example, regulatory frameworks that support renewable energy integration into telecom operations are becoming more prevalent. Such policies not only facilitate the growth of the Telecom Tower Power System Market but also align with broader sustainability goals.

Technological Advancements in Power Systems

Technological advancements in power systems are significantly influencing the Telecom Tower Power System Market. Innovations such as energy-efficient power supplies, advanced battery technologies, and smart grid solutions are enhancing the operational efficiency of telecom towers. For instance, the integration of AI and IoT in energy management systems allows for real-time monitoring and optimization of power usage. This not only reduces operational costs but also minimizes environmental impact. The market for smart energy management solutions is expected to grow substantially, indicating a shift towards more sustainable practices within the Telecom Tower Power System Market.