Increased Focus on Sustainability

The growing emphasis on sustainability within the telecommunications sector is driving changes in the telecom tower-power-system market. South Korean telecom companies are increasingly adopting eco-friendly practices, including the use of renewable energy sources and energy-efficient technologies. This shift is partly in response to consumer demand for greener solutions and regulatory pressures to reduce carbon footprints. As a result, the market for telecom tower-power-systems is likely to expand as companies invest in sustainable infrastructure. By 2025, it is anticipated that up to 40% of new telecom installations will incorporate renewable energy solutions, reflecting a significant transformation in operational practices.

Rising Demand for Mobile Connectivity

The increasing reliance on mobile connectivity in South Korea is a primary driver for the telecom tower-power-system market. With a population that is highly engaged in digital communication, the demand for robust mobile networks continues to surge. As of 2025, mobile data traffic in South Korea is projected to grow by approximately 30% annually, necessitating the expansion of telecom infrastructure. This growth compels telecom operators to invest in advanced power systems to support the additional towers and equipment required. Consequently, the telecom tower-power-system market is likely to experience significant growth as operators seek to enhance network reliability and efficiency.

Technological Advancements in Power Systems

Technological advancements in power systems are significantly influencing the telecom tower-power-system market. Innovations such as energy-efficient power supplies and advanced battery technologies are becoming increasingly prevalent. These developments not only reduce operational costs but also enhance the sustainability of telecom operations. In South Korea, the integration of smart grid technologies is expected to improve energy management for telecom towers, potentially reducing energy consumption by up to 20%. This trend towards modernization and efficiency is likely to propel the telecom tower-power-system market forward as operators seek to adopt these cutting-edge solutions.

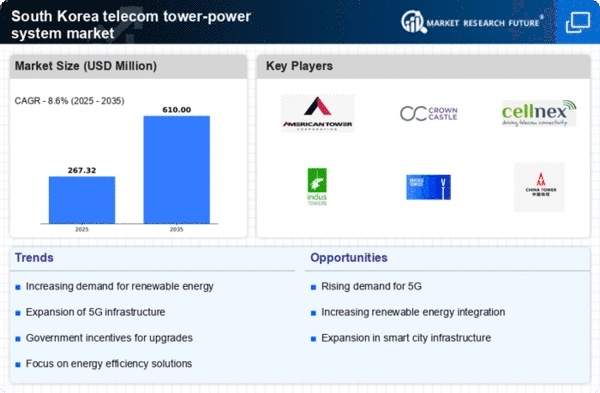

Competitive Landscape and Market Consolidation

The competitive landscape in South Korea's telecom sector is evolving. There is increasing consolidation among major players.. This trend is likely to impact the telecom tower-power-system market as larger companies seek to optimize their operations and reduce costs. Mergers and acquisitions can lead to more streamlined processes and enhanced resource allocation, which may drive demand for advanced power systems. As companies consolidate, the need for efficient and reliable power solutions becomes paramount, potentially leading to increased investments in the telecom tower-power-system market. This dynamic environment suggests a shift towards more integrated and efficient telecom infrastructure.

Government Initiatives for Infrastructure Enhancement

the South Korean government is promoting initiatives aimed at enhancing telecommunications infrastructure.. This includes substantial investments in the telecom sector, which are expected to reach around $10 billion by 2026. Such initiatives are designed to improve connectivity in urban and rural areas alike, thereby driving the demand for telecom tower-power-systems. The government's commitment to fostering a robust digital economy indicates a sustained focus on upgrading existing infrastructure and deploying new systems. As a result, the telecom tower-power-system market is poised for growth, driven by these supportive policies and funding.