Growth in Construction Sector

The construction sector is witnessing a surge in the adoption of synthetic polymers, driven by their versatility and durability. Materials such as polyvinyl chloride (PVC) and acrylonitrile butadiene styrene (ABS) are increasingly utilized in building applications, including pipes, insulation, and flooring. The synthetic polymer market is projected to benefit from this trend, with the construction segment anticipated to grow at a rate of 4.5% annually. This growth is fueled by urbanization and infrastructure development initiatives, which require materials that offer both performance and longevity. As the construction industry continues to evolve, the role of synthetic polymers in enhancing building efficiency and sustainability is likely to expand, indicating a promising outlook for the synthetic polymer market.

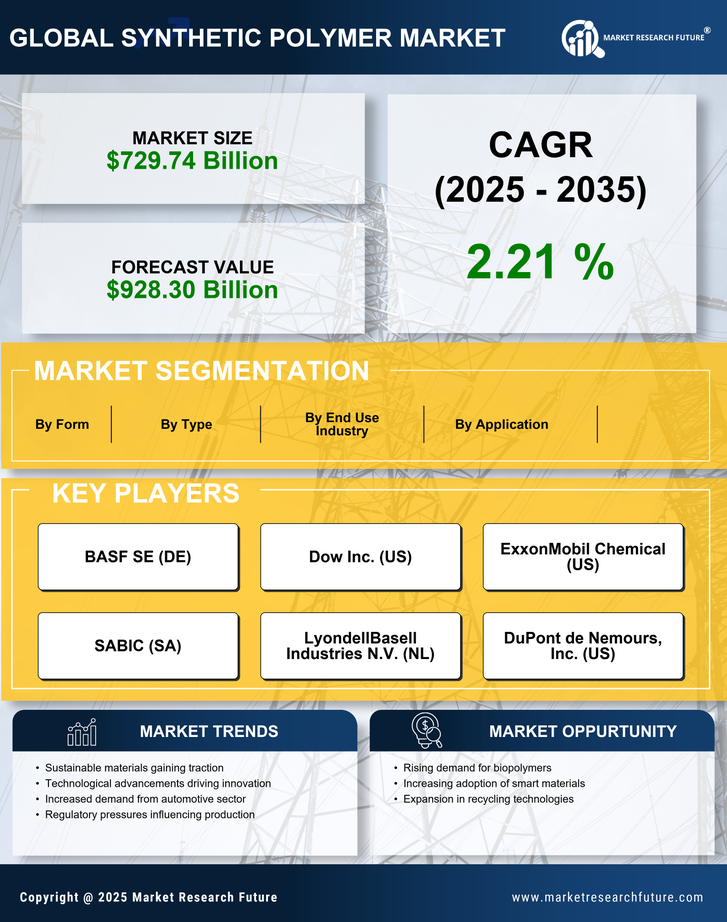

Increasing Focus on Sustainability

The synthetic polymer market is increasingly influenced by a growing emphasis on sustainability. As environmental concerns gain prominence, manufacturers are exploring eco-friendly alternatives and recycling initiatives. The demand for biodegradable and recyclable synthetic polymers is on the rise, reflecting a shift in consumer preferences towards sustainable products. In 2023, approximately 15% of the synthetic polymer market was attributed to sustainable materials, indicating a significant trend. This focus on sustainability is likely to drive innovation within the synthetic polymer market, as companies invest in research and development to create materials that align with environmental goals. The potential for sustainable synthetic polymers to capture market share suggests a transformative shift in the industry.

Rising Demand in Automotive Sector

The automotive sector is experiencing a notable increase in the utilization of synthetic polymers, driven by the need for lightweight materials that enhance fuel efficiency. Synthetic polymers, such as polypropylene and polycarbonate, are increasingly employed in vehicle components, contributing to weight reduction and improved performance. The synthetic polymer market is projected to witness a compound annual growth rate of approximately 5.2% in this segment alone. As manufacturers strive to meet stringent emissions regulations, the demand for advanced polymer materials is likely to escalate, further propelling the growth of the synthetic polymer market. This trend indicates a shift towards more sustainable automotive solutions, where synthetic polymers play a crucial role in achieving both performance and environmental goals.

Expansion in Packaging Applications

The packaging industry is undergoing a transformation, with synthetic polymers at the forefront of this evolution. The shift towards flexible and durable packaging solutions is driving the demand for synthetic polymers, particularly polyethylene and polystyrene. The synthetic polymer market is expected to grow significantly, with the packaging segment accounting for a substantial share of the overall market. In 2023, the packaging sector represented nearly 40% of the total synthetic polymer consumption, highlighting its critical role. As consumer preferences lean towards convenience and sustainability, the adoption of innovative polymer materials in packaging is likely to increase, suggesting a robust future for the synthetic polymer market.

Technological Innovations in Polymer Production

Technological advancements in polymer production processes are significantly influencing the synthetic polymer market. Innovations such as 3D printing and bio-based polymers are reshaping the landscape, allowing for more efficient and sustainable manufacturing practices. The introduction of advanced polymerization techniques is expected to enhance the properties of synthetic polymers, making them more suitable for a wider range of applications. This trend is likely to drive growth in the synthetic polymer market, as manufacturers seek to leverage these technologies to meet evolving consumer demands. The potential for reduced production costs and improved material performance suggests that technological innovations will play a pivotal role in shaping the future of the synthetic polymer market.