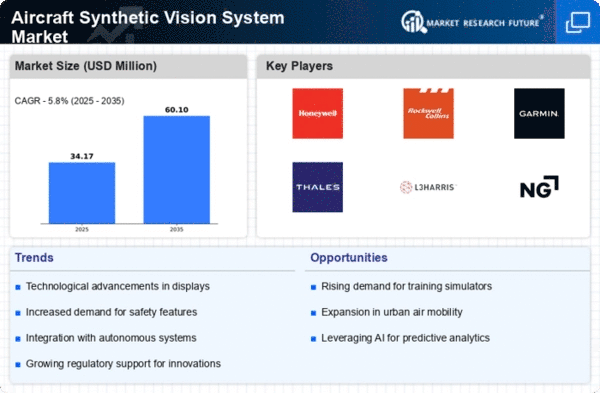

The Aircraft Synthetic Vision System Market is currently characterized by a dynamic competitive landscape, driven by technological advancements and increasing demand for enhanced safety features in aviation. Key players such as Honeywell (US), Rockwell Collins (US), and Garmin (US) are strategically positioned to leverage innovation and partnerships to maintain their competitive edge. Honeywell (US) focuses on integrating advanced analytics and artificial intelligence into its systems, while Rockwell Collins (US) emphasizes partnerships with airlines to enhance user experience. Garmin (US) is known for its commitment to user-friendly interfaces and robust customer support, which collectively shapes a competitive environment that prioritizes technological sophistication and customer-centric solutions.In terms of business tactics, companies are increasingly localizing manufacturing and optimizing supply chains to enhance operational efficiency. The market appears moderately fragmented, with several key players exerting influence over various segments. This fragmentation allows for niche players to emerge, yet the collective strength of major companies like Thales (FR) and L3Harris Technologies (US) ensures that competition remains robust and innovation-driven.

In November Thales (FR) announced a strategic partnership with a leading aerospace manufacturer to develop next-generation synthetic vision systems. This collaboration is expected to enhance Thales's capabilities in integrating augmented reality features, thereby improving pilot situational awareness. Such partnerships are indicative of a trend towards collaborative innovation, which may redefine product offerings in the market.

In October L3Harris Technologies (US) unveiled a new synthetic vision system that incorporates machine learning algorithms to predict potential hazards during flight. This development not only showcases L3Harris's commitment to technological advancement but also positions the company as a leader in proactive safety measures. The integration of AI into synthetic vision systems is likely to become a standard expectation among consumers, further intensifying competition.

In September Garmin (US) expanded its product line by introducing a cost-effective synthetic vision system aimed at smaller aircraft operators. This strategic move is significant as it opens new market segments and addresses the growing demand for affordable yet advanced aviation technologies. By catering to a broader audience, Garmin (US) is likely to enhance its market share and influence.

As of December the competitive trends in the Aircraft Synthetic Vision System Market are increasingly defined by digitalization, sustainability, and AI integration. Strategic alliances are shaping the landscape, fostering innovation and enhancing product offerings. The shift from price-based competition to a focus on technological differentiation and supply chain reliability is evident. Companies that prioritize innovation and adaptability are likely to thrive, as the market continues to evolve towards more sophisticated and integrated solutions.