Market Analysis

In-depth Analysis of Synchronous Motor Market Industry Landscape

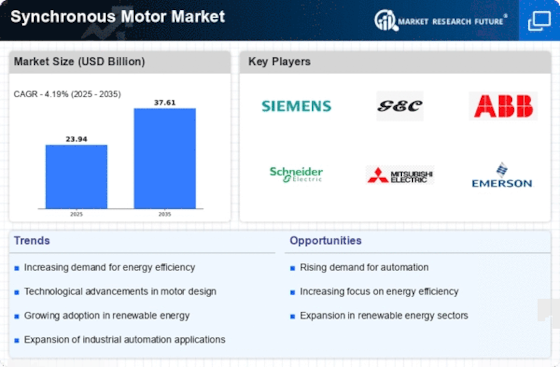

The synchronous motor market is influenced by a multitude of market factors that collectively shape its dynamics and growth trajectory. One of the primary drivers of the synchronous motor market is the increasing demand for energy-efficient and reliable electric motors across various industries. Synchronous motors, known for their efficiency and power factor correction capabilities, are gaining popularity as industries seek to optimize energy consumption and comply with stringent energy efficiency regulations. The emphasis on sustainability and the need for eco-friendly technologies further propel the adoption of synchronous motors, which contribute to reducing energy losses and enhancing overall system efficiency.

Technological advancements play a pivotal role in driving the synchronous motor market. Ongoing research and development efforts focus on improving the design, materials, and control systems of synchronous motors, leading to enhanced performance, reduced maintenance requirements, and increased lifespan. Integration of smart technologies and digital controls also enables better monitoring and predictive maintenance, addressing the demand for more sophisticated and interconnected industrial systems.

Market factors are significantly influenced by the growing industrial automation trend. Synchronous motors find extensive applications in various automated systems, including robotics, manufacturing processes, and conveyor systems. The precision and control offered by synchronous motors make them suitable for applications where synchronization with other equipment and processes is critical. As industries continue to invest in automation to improve efficiency and reduce labor costs, the demand for synchronous motors is expected to rise.

The expansion of the renewable energy sector contributes to the synchronous motor market dynamics. Synchronous generators are commonly used in renewable energy systems, such as wind turbines and hydropower plants. As the global focus on clean and sustainable energy intensifies, the deployment of synchronous motors in renewable energy projects is expected to grow. Synchronous motors play a key role in maintaining grid stability and synchronization in these applications, supporting the integration of renewable energy into the power grid.

The demand for synchronous motors is also influenced by the growth of key end-use industries. Sectors such as oil and gas, mining, and chemicals, where reliability and precision are paramount, drive the market for synchronous motors. These industries often require motors with high torque and speed control, making synchronous motors a preferred choice for various applications, including pumps, compressors, and fans.

Global economic conditions and industrial activities significantly impact the synchronous motor market. Economic growth leads to increased industrial production and infrastructure development, driving the demand for electric motors, including synchronous motors. Conversely, economic downturns may temporarily slow down investments in new projects and impact the market.

Regulatory policies and standards play a crucial role in shaping the synchronous motor market. Energy efficiency regulations imposed by governments and environmental agencies influence the adoption of synchronous motors, encouraging industries to upgrade their existing systems to meet higher efficiency standards. Incentives and subsidies for energy-efficient technologies further drive market growth, creating a favorable environment for the widespread adoption of synchronous motors.

The competitive landscape and market trends within the electric motor industry also impact the synchronous motor market. Manufacturers continually strive to differentiate their products through innovation, cost-effective solutions, and superior performance. Market trends, such as the increasing focus on electric vehicles and the electrification of various industries, influence the demand for synchronous motors designed for specific applications.

Despite the positive market factors, challenges such as the initial cost of synchronous motors, the need for skilled technicians for maintenance, and the availability of alternative motor technologies may influence market dynamics. Overcoming these challenges requires strategic initiatives, technological advancements, and effective marketing strategies by industry players.

The synchronous motor market is shaped by a combination of factors including the emphasis on energy efficiency, technological advancements, industrial automation trends, the expansion of the renewable energy sector, end-use industry growth, economic conditions, regulatory policies, and competitive dynamics. As industries continue to evolve and prioritize energy-efficient and reliable solutions, synchronous motors are poised to play a crucial role in meeting the diverse needs of modern industrial applications.

Leave a Comment