Top Industry Leaders in the Synchronous Motor Market

*Disclaimer: List of key companies in no particular order

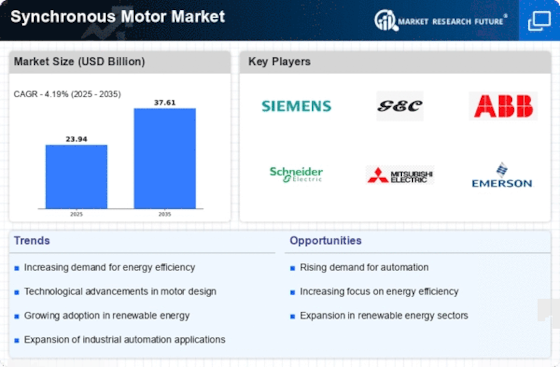

Top listed companies in the Synchronous Motor industry are:

ABB

Siemens

General Electric

Rockwell Automation Inc.

Toshiba Corporation

WEG SA

Hitachi Ltd

Bosch Group

Johnson Electric Holdings Limited

Emerson Electric Co.

Nidec Corporation

Established Player Strategies:

Technology Leadership: Industry titans like ABB, Siemens, and WEG invest heavily in R&D, focusing on high-efficiency designs, compact footprints, and improved power density. ABB's SynRM motors for industrial applications prioritize efficiency, while Siemens' interior permanent magnet (IPM) motors target EV propulsion with their lightweight and high-torque capabilities.

Diversification and Regional Focus: Major players actively diversify their product offerings across application segments like power generation, oil & gas, and industrial automation. Regional expansion is another focus, with Siemens targeting emerging markets like China and India.

Partnerships and Acquisitions: Collaborative partnerships between established players and smaller companies with specialized expertise, like Johnson Electric in micro-motors, foster innovation and market access. Strategic acquisitions, such as Nidec's purchase of WEG's motor division, aim to strengthen market presence and technology portfolio.

Factors Influencing Market Share:

Price and Performance: Balancing competitive pricing with superior performance metrics like efficiency, reliability, and longevity remains crucial for market share gains. Players like WEG excel in cost-competitive solutions, while others like Bosch Rexroth prioritize high-performance applications.

Brand Reputation and Service Network: Established brands like Siemens and ABB leverage their strong reputation and extensive service networks to secure large contracts and maintain customer loyalty.

Focus on Sustainability and Niche Markets: Growing environmental awareness drives demand for high-efficiency motors, aligning with the strategies of companies like Toshiba Eco Solutions. Niche markets like electric vertical takeoff and landing (eVTOL) aircraft see focused attention from specialized players like magniX, developing high-power density IPM motors.

Emerging Trends and Innovations:

Magnet-free Designs: Concerns about rare earth mineral dependence and cost volatility propel the development of magnet-free synchronous motors. Companies like BMW introduce magnet-free motors in EV applications, offering cost and resource advantages.

Integrated Control Systems: Smart motor solutions with embedded intelligence and connectivity to industrial IoT platforms are gaining traction. Schneider Electric's Lexium range and ABB's Ability motors exemplify this trend, enabling predictive maintenance and optimizing energy consumption.

3D Printing: Additive manufacturing opens doors for customized motor designs and lighter components, leading to lighter vehicles and higher efficiency. Companies like Collins Aerospace are exploring 3D-printed components for aerospace applications.

Overall Competitive Scenario:

The synchronous motor market remains fiercely competitive, characterized by both established players and agile newcomers. Technological advancements drive rapid innovation, demanding continuous adaptation and diversification from market participants. Success hinges on balancing cost-effectiveness with performance excellence, embracing sustainability trends, and catering to niche markets. Continued investments in R&D, strategic partnerships, and regional expansion will be key differentiators in navigating this dynamic landscape.

Latest Company Updates:

ABB:

- Launched the SynRM140 high-efficiency synchronous reluctance motor for industrial applications in June 2023. (Source: ABB press release, June 2023)

Siemens:

- Unveiled the Sinamics Perfect Harmony GH180 MV synchronous motor for high-voltage industrial applications in October 2023. (Source: Siemens press release, October 2023)

General Electric:

- Fokus on larger synchronous motors for power generation and marine applications. (Source: GE Power website)

Rockwell Automation:

- Offering integrated motor control solutions for automation systems, including PMSMs. (Source: Rockwell Automation website)