Regulatory Support and Compliance

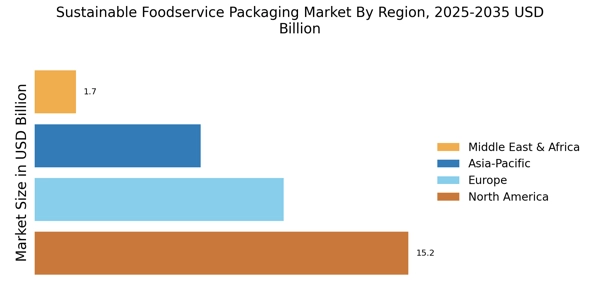

The Sustainable Foodservice Packaging Market is significantly influenced by regulatory frameworks aimed at reducing plastic waste and promoting sustainability. Governments worldwide are implementing stringent regulations that encourage the use of sustainable packaging materials. For instance, many regions have introduced bans on single-use plastics, compelling foodservice businesses to transition to eco-friendly alternatives. This regulatory support creates a favorable environment for the growth of sustainable packaging solutions, as companies strive to comply with these mandates. Market data suggests that regions with strict regulations witness a higher adoption rate of sustainable packaging, as businesses seek to avoid penalties and enhance their compliance profiles. Consequently, the regulatory landscape not only drives innovation in packaging materials but also fosters a competitive advantage for companies that prioritize sustainability.

Corporate Sustainability Initiatives

The Sustainable Foodservice Packaging Market is increasingly shaped by corporate sustainability initiatives. Many companies are recognizing the importance of integrating sustainability into their business models, driven by both consumer expectations and corporate responsibility. This trend is evident as major foodservice brands commit to reducing their environmental footprint by adopting sustainable packaging practices. Market data indicates that companies implementing sustainability initiatives can enhance their market share and improve customer retention. By investing in sustainable packaging, businesses not only meet regulatory requirements but also differentiate themselves in a crowded marketplace. This strategic focus on sustainability is likely to continue influencing the industry, as more companies recognize the long-term benefits of environmentally responsible practices.

Technological Advancements in Packaging

The Sustainable Foodservice Packaging Market is witnessing a surge in technological advancements that enhance the sustainability of packaging solutions. Innovations such as biodegradable materials, smart packaging, and improved recycling technologies are transforming the landscape. These advancements enable foodservice providers to offer packaging that not only meets consumer demands but also reduces environmental impact. For instance, the development of materials that decompose more quickly than traditional plastics is gaining traction. Market data suggests that the adoption of such technologies could lead to a significant reduction in waste generated by the foodservice sector. As technology continues to evolve, it is likely to play a crucial role in shaping the future of sustainable packaging, offering new opportunities for businesses to innovate and improve their sustainability profiles.

Growing Awareness of Environmental Impact

The Sustainable Foodservice Packaging Market is significantly influenced by the growing awareness of environmental impact among consumers and businesses alike. As information about the detrimental effects of plastic pollution becomes more widespread, stakeholders are increasingly motivated to seek sustainable alternatives. This heightened awareness is prompting foodservice providers to evaluate their packaging choices critically. Market data indicates that a substantial percentage of consumers are actively seeking out brands that prioritize sustainability, which in turn pressures companies to adopt eco-friendly packaging solutions. This trend not only drives demand for sustainable materials but also encourages collaboration among industry players to develop innovative packaging solutions. The collective effort to address environmental concerns is likely to shape the future trajectory of the sustainable foodservice packaging market.

Consumer Demand for Eco-Friendly Solutions

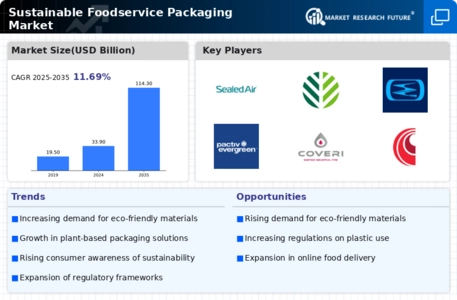

The Sustainable Foodservice Packaging Market is experiencing a notable shift in consumer preferences towards eco-friendly solutions. As awareness of environmental issues grows, consumers increasingly seek products that align with their values. This trend is reflected in market data, indicating that approximately 70% of consumers are willing to pay a premium for sustainable packaging options. This demand drives foodservice providers to adopt sustainable practices, thereby enhancing their brand image and customer loyalty. The industry is responding by innovating packaging solutions that minimize environmental impact, such as compostable containers and plant-based materials. This consumer-driven shift not only influences purchasing decisions but also compels companies to rethink their supply chains and packaging strategies, ultimately fostering a more sustainable foodservice ecosystem.