Health and Safety Regulations

Health and safety regulations play a pivotal role in shaping the Foodservice Disposable Distribution System Market. With increasing scrutiny on hygiene practices, foodservice operators are compelled to adopt disposable solutions that minimize contamination risks. Regulatory bodies have established stringent guidelines that necessitate the use of single-use items in various settings, particularly in fast-food and casual dining establishments. This regulatory environment has led to a projected growth rate of 15% in the disposable market segment, as businesses seek compliance while ensuring customer safety. Consequently, the Foodservice Disposable Distribution System Market is likely to expand as operators invest in compliant disposable products.

Rising Demand for Convenience

The Foodservice Disposable Distribution System Market is experiencing a notable increase in demand for convenience-oriented products. As consumers lead busier lifestyles, the preference for ready-to-eat meals and takeout options has surged. This trend is reflected in the growing number of foodservice establishments that prioritize disposable solutions to enhance customer experience. According to recent data, the foodservice sector has seen a rise in disposable product usage by approximately 20% over the past few years. This shift indicates a clear consumer inclination towards convenience, which is likely to drive the growth of the Foodservice Disposable Distribution System Market in the coming years.

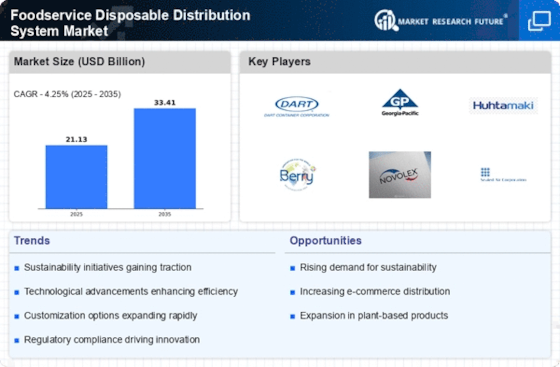

Environmental Sustainability Trends

The Foodservice Disposable Distribution System Market is increasingly influenced by environmental sustainability trends. As consumers become more environmentally conscious, there is a growing demand for eco-friendly disposable products. Many foodservice operators are now seeking biodegradable and compostable options to align with consumer preferences and corporate social responsibility initiatives. Recent studies indicate that the market for sustainable disposables is expected to grow by 25% over the next five years. This shift towards sustainability not only enhances brand image but also positions businesses favorably within the Foodservice Disposable Distribution System Market, as they cater to a more eco-aware clientele.

Expansion of Food Delivery Services

The expansion of food delivery services is a key driver for the Foodservice Disposable Distribution System Market. With the rise of online ordering platforms, foodservice establishments are increasingly relying on disposable packaging to facilitate delivery. This trend has led to a substantial increase in the demand for disposable items, as operators seek to ensure that food remains intact and presentable during transit. Recent market analyses suggest that the food delivery segment is projected to grow by 30% in the next few years, further propelling the Foodservice Disposable Distribution System Market. As delivery services continue to proliferate, the reliance on disposables is expected to intensify.

Technological Innovations in Production

Technological innovations are significantly impacting the Foodservice Disposable Distribution System Market. Advances in manufacturing processes have led to the development of more efficient and cost-effective disposable products. Innovations such as automated production lines and improved materials have enhanced product quality while reducing production costs. This technological evolution is expected to drive a 10% increase in market efficiency, allowing foodservice operators to offer competitive pricing. As a result, the Foodservice Disposable Distribution System Market is likely to benefit from these advancements, as businesses leverage technology to meet consumer demands for quality and affordability.