North America : Market Leader in Services

North America is poised to maintain its leadership in the Surgical Equipment Maintenance and Repair Services Market, holding a significant market share of 12.25 in 2024. The region's growth is driven by increasing healthcare expenditures, technological advancements, and stringent regulatory frameworks that ensure high standards of medical equipment maintenance. The demand for reliable surgical equipment services is further fueled by the rising number of surgical procedures and the need for compliance with safety regulations.

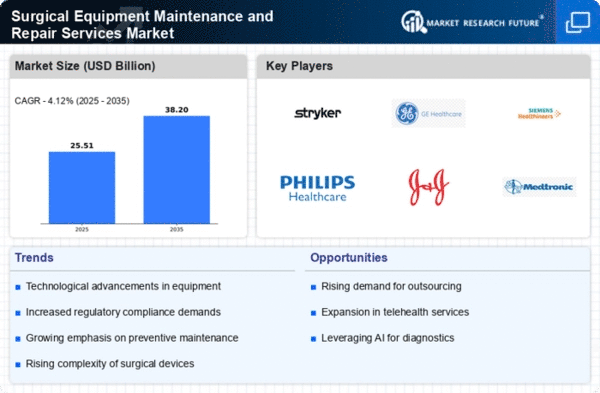

The competitive landscape in North America is characterized by the presence of major players such as Stryker, GE Healthcare, and Medtronic. These companies are investing heavily in innovative solutions and service offerings to enhance operational efficiency and patient safety. The U.S. remains the largest market, supported by a robust healthcare infrastructure and a growing emphasis on preventive maintenance practices. As the market evolves, partnerships and collaborations among key players are expected to drive further growth.

Europe : Emerging Market Dynamics

Europe's Surgical Equipment Maintenance and Repair Services Market is projected to grow, with a market size of 7.35 in 2024. The region benefits from a well-established healthcare system, increasing investments in healthcare infrastructure, and a growing emphasis on patient safety and equipment reliability. Regulatory bodies are also playing a crucial role in shaping the market, with initiatives aimed at enhancing the quality of surgical services and equipment maintenance.

Leading countries in Europe, such as Germany, France, and the UK, are witnessing a surge in demand for surgical equipment services. The competitive landscape features key players like Siemens Healthineers and Philips Healthcare, who are focusing on technological innovations and service enhancements. The European market is characterized by a mix of established companies and emerging players, fostering a dynamic environment for growth and collaboration. "The European healthcare sector is committed to ensuring the highest standards of medical equipment maintenance to enhance patient outcomes," European Commission report.

Asia-Pacific : Rapid Growth Potential

The Asia-Pacific region is rapidly emerging as a significant player in the Surgical Equipment Maintenance and Repair Services Market, with a market size of 4.5 in 2024. The growth is driven by increasing healthcare investments, a rising population, and a growing number of surgical procedures. Additionally, government initiatives aimed at improving healthcare infrastructure and access to quality medical services are acting as catalysts for market expansion.

Countries like China, India, and Japan are leading the charge in this region, with a growing presence of key players such as Fujifilm Holdings and Canon Medical Systems. The competitive landscape is evolving, with both multinational corporations and local companies vying for market share. As the demand for advanced surgical services increases, the focus on equipment maintenance and repair is expected to intensify, driving innovation and service quality in the region.

Middle East and Africa : Untapped Market Opportunities

The Middle East and Africa region is gradually emerging in the Surgical Equipment Maintenance and Repair Services Market, with a market size of 0.45 in 2024. The growth is primarily driven by increasing healthcare investments, a rising number of surgical procedures, and a growing awareness of the importance of equipment maintenance. Regulatory frameworks are also evolving, aiming to enhance the quality of healthcare services and ensure patient safety across the region.

Countries such as South Africa and the UAE are at the forefront of this growth, with a focus on improving healthcare infrastructure and service delivery. The competitive landscape is characterized by a mix of local and international players, creating opportunities for collaboration and innovation. As the region continues to develop, the demand for reliable surgical equipment maintenance services is expected to rise, paving the way for new market entrants and service providers.