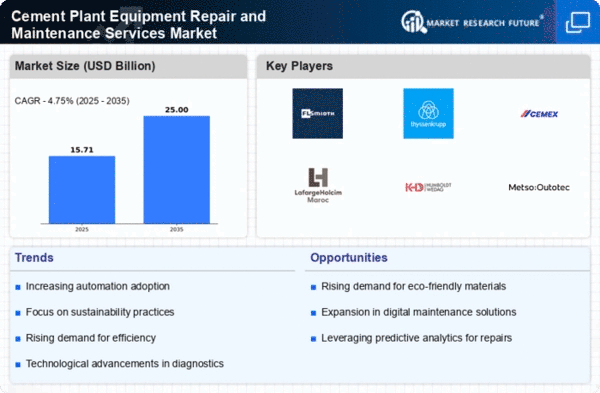

The Cement Plant Equipment Repair and Maintenance Services Market is characterized by a competitive landscape that is increasingly shaped by technological advancements and sustainability initiatives. Key players such as FLSmidth (DK), Thyssenkrupp (DE), and LafargeHolcim (CH) are actively pursuing strategies that emphasize innovation and operational efficiency. FLSmidth (DK) has focused on enhancing its digital solutions, which aim to optimize plant performance and reduce downtime. Meanwhile, Thyssenkrupp (DE) has been investing in strategic partnerships to bolster its service offerings, particularly in predictive maintenance technologies. LafargeHolcim (CH) appears to be leveraging its global footprint to expand its service capabilities, particularly in emerging markets, thereby enhancing its competitive positioning.The market structure is moderately fragmented, with a mix of established players and regional specialists. Key business tactics include localizing manufacturing to reduce costs and optimize supply chains, which is becoming increasingly vital in a market that demands rapid response times. The collective influence of these major players is significant, as they not only set industry standards but also drive innovation through competitive pressures.

In November FLSmidth (DK) announced a partnership with a leading AI firm to develop predictive maintenance solutions tailored for cement plants. This strategic move is likely to enhance operational efficiency and reduce maintenance costs for clients, positioning FLSmidth as a leader in digital transformation within the sector. The integration of AI into maintenance practices could potentially revolutionize how equipment reliability is managed, thus providing a competitive edge.

In October Thyssenkrupp (DE) launched a new service platform aimed at streamlining repair processes for cement plant equipment. This initiative is significant as it not only enhances customer engagement but also allows for real-time monitoring of equipment health, thereby reducing unplanned downtimes. Such advancements indicate Thyssenkrupp's commitment to leveraging technology to improve service delivery and operational efficiency.

In September LafargeHolcim (CH) expanded its service offerings in Latin America through the acquisition of a regional maintenance firm. This acquisition is strategically important as it allows LafargeHolcim to tap into local expertise and enhance its service capabilities in a rapidly growing market. The move reflects a broader trend of consolidation within the industry, as companies seek to strengthen their market presence and service offerings.

As of December the competitive trends in the Cement Plant Equipment Repair and Maintenance Services Market are increasingly defined by digitalization, sustainability, and the integration of AI technologies. Strategic alliances are becoming more prevalent, as companies recognize the need to collaborate to enhance their service capabilities and technological offerings. Looking ahead, competitive differentiation is likely to evolve from traditional price-based competition to a focus on innovation, technology integration, and supply chain reliability, suggesting a transformative shift in how companies position themselves in the market.