Market Trends

Key Emerging Trends in the Super Absorbent Polymer Market

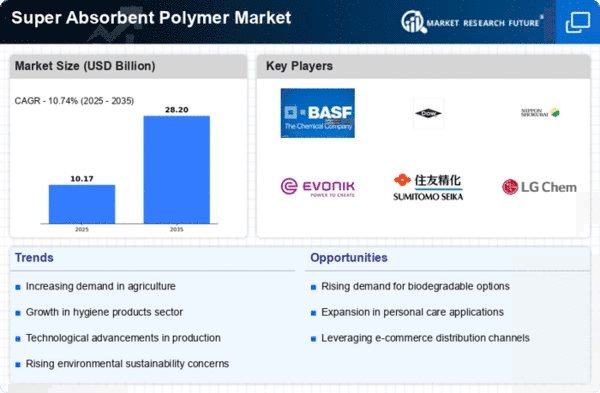

Given these trends, what does it mean for purveyors in this business? Several factors are driving significant trends within the Super Absorbent Polymer (SAP) Market, such as increased demand for hygiene products, water conservation awareness, and product application innovations. Hydrogels, which are also referred to as superabsorbing polymers, have various uses, most being used by industries for hygiene purposes. In agriculture, concern about water scarcity, coupled with the need for efficient water management, is driving recent market trends. Water retention agents in the form of super absorbent polymers are also increasingly being used in agriculture so as to improve soil's water-holding capacity and enhance irrigation efficiency. This trend supports global initiatives on optimizing agricultural use of water, promoting sustainable farming practices, and addressing regional water scarcity challenges. Product applications for SAPs have seen innovations, and this has resulted in these trends within the Super Absorbent Polymer Market. SAPs are finding uses beyond their traditional use in hygiene (18) and agriculture. They have multiple functions, including those related to packaging, medical field, construction, etc. In packaging, SAPs help in moisture absorption, hence prolonging the shelf life of products, which in turn reduces waste. The current emphasis on sustainability impacts market dynamics within the Superabsorbent Polymer Market. Manufacturers are pursuing bio-based and biodegradable alternatives to replace conventional SAPs, which raise concerns over polymer wastage. Eco-friendliness is what consumers crave today; therefore, sustainable sap made from renewable raw materials meets this requirement and contributes to wider industrial sustainability objectives. Collaborations And Partnerships Within The Industry Are Emerging Trends In The Market. Companies that manufacture or distribute super absorbent polymers are entering into collaborations with one another as a way of strengthening their position, sharing knowledge about technology, and identifying new prospects together. Such cooperation helps develop the overall superabsorbent polymer industry while fostering innovation aligned toward meeting the evolving needs of various end-use sectors. Further on, these alliances lead to innovation development in superabsorbent polymer markets, thus responding to changing needs within different industries worldwide. Global economic factors also affect market trends. Economic conditions such as consumer spending, industrial growth rates, and infrastructural development impact demand for super absorbents across all sectors. Market fluctuations due to economic reasons can make adjustments necessary for producers who must adjust sales strategies accordingly so as not to lose out on viable markets during downturns or upswings.

Leave a Comment