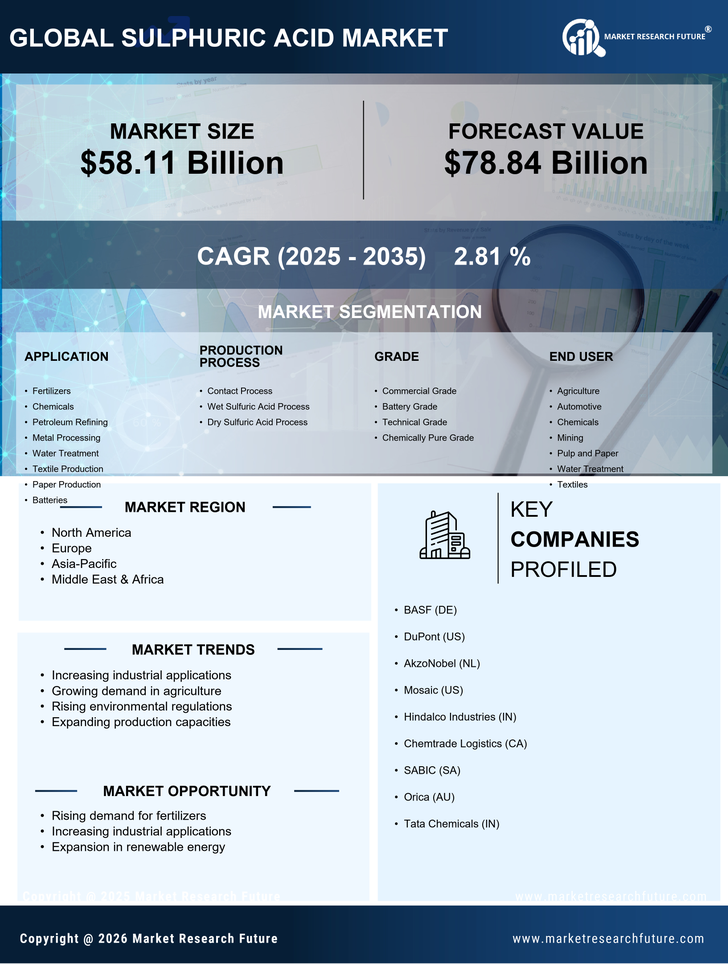

Growing Demand in Battery Production

The rise of electric vehicles and renewable energy storage solutions has led to an increased demand for batteries, particularly lead-acid batteries, which require sulphuric acid in their manufacturing process. The battery production sector is projected to expand significantly, with estimates suggesting a compound annual growth rate of over 10% in the coming years. This surge in battery demand is likely to have a profound impact on the sulphuric acid market, as manufacturers seek to secure reliable supplies of sulphuric acid to meet the needs of this burgeoning market.

Rising Demand from Fertilizer Industry

The fertilizer industry is a primary consumer of sulphuric acid, which is utilized in the production of phosphoric acid, a key ingredient in fertilizers. As agricultural practices evolve and the need for enhanced crop yields increases, the demand for sulphuric acid is expected to rise. In 2023, the fertilizer sector accounted for approximately 60% of the total sulphuric acid consumption, indicating a robust correlation between agricultural growth and sulphuric acid market dynamics. This trend suggests that as the global population continues to grow, the sulphuric acid market will likely experience sustained demand driven by the need for efficient fertilizers.

Technological Advancements in Production

Innovations in production technologies are transforming the sulphuric acid market. Enhanced production methods, such as the contact process, have improved efficiency and reduced environmental impact. These advancements not only lower production costs but also align with increasing regulatory pressures for sustainable practices. As companies adopt these technologies, the sulphuric acid market is likely to benefit from increased output and reduced waste. The integration of automation and process optimization is expected to further bolster production capabilities, thereby supporting the overall growth of the sulphuric acid market.

Industrial Applications and Chemical Manufacturing

Sulphuric acid serves as a fundamental chemical in various industrial applications, including metal processing, petroleum refining, and battery manufacturing. The chemical manufacturing sector, which utilizes sulphuric acid for producing a wide range of chemicals, has shown consistent growth. In 2023, the chemical manufacturing segment represented around 25% of the sulphuric acid market. This growth is anticipated to continue as industries seek to optimize production processes and enhance product quality, thereby driving the demand for sulphuric acid in diverse applications.

Environmental Regulations and Sustainability Initiatives

Increasing environmental regulations are shaping the sulphuric acid market, as companies are compelled to adopt more sustainable practices. Regulatory frameworks aimed at reducing emissions and promoting cleaner production methods are influencing the operational strategies of sulphuric acid producers. Compliance with these regulations often necessitates investment in cleaner technologies and processes, which can initially increase costs but may lead to long-term benefits. As sustainability becomes a priority for industries, the sulphuric acid market is likely to adapt, potentially leading to innovations that align with environmental goals.