Increasing Demand for Fertilizers

The rising global population and the consequent need for food security are driving the demand for fertilizers, which prominently utilize sulfur compounds. In the Sulfur Chemical Market, sulfur is a critical component in the production of ammonium sulfate and other fertilizers. The market for fertilizers is projected to grow at a compound annual growth rate of approximately 3.5% over the next few years. This growth is likely to enhance the demand for sulfur, as fertilizers containing sulfur improve crop yield and quality. As agricultural practices evolve, the integration of sulfur-based fertilizers is becoming more prevalent, indicating a robust future for the Sulfur Chemical Market.

Industrial Applications and Growth

The Sulfur Chemical Market is experiencing a surge in demand from various industrial sectors, including petrochemicals, pharmaceuticals, and rubber manufacturing. Sulfur is utilized in the production of sulfuric acid, which is a fundamental chemical in numerous industrial processes. The Sulfur Chemical is expected to reach a valuation of over USD 20 billion by 2026, reflecting the increasing reliance on sulfur in industrial applications. This trend suggests that as industries expand and diversify, the demand for sulfur and its derivatives will likely continue to rise, further solidifying the position of the Sulfur Chemical Market.

Environmental Regulations and Compliance

The implementation of stringent environmental regulations is influencing the Sulfur Chemical Market. Governments are increasingly mandating the reduction of sulfur emissions from industrial processes, which is leading to innovations in sulfur recovery technologies. These regulations are driving the demand for sulfuric acid and other sulfur-based chemicals that comply with environmental standards. The market for sulfur recovery is projected to grow significantly, as industries seek to minimize their environmental footprint while maintaining production efficiency. This regulatory landscape indicates a shift towards sustainable practices within the Sulfur Chemical Market, potentially enhancing its growth prospects.

Emerging Markets and Economic Development

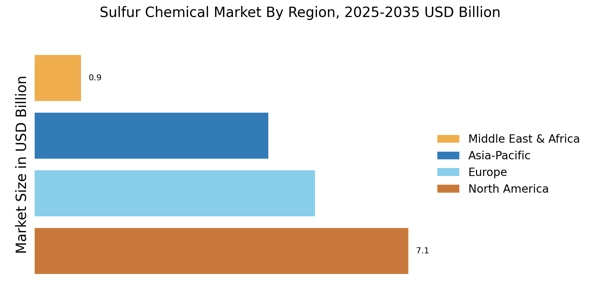

Emerging economies are witnessing rapid industrialization and urbanization, which is contributing to the growth of the Sulfur Chemical Market. Countries in Asia and Africa are increasingly investing in infrastructure and agricultural development, leading to a heightened demand for sulfur-based products. The sulfur market in these regions is expected to expand as industries such as construction and agriculture flourish. This economic development is likely to create new opportunities for sulfur producers, as the need for sulfur in various applications becomes more pronounced. The growth in emerging markets suggests a promising future for the Sulfur Chemical Market.

Technological Innovations in Sulfur Production

Advancements in technology are playing a pivotal role in shaping the Sulfur Chemical Market. Innovations in extraction and processing techniques are enhancing the efficiency of sulfur production, thereby reducing costs and environmental impact. For instance, new methods in sulfur recovery from natural gas and oil refining are becoming more prevalent, leading to increased availability of sulfur. The market is also witnessing the development of novel sulfur-based products that cater to diverse applications, from agriculture to pharmaceuticals. These technological innovations are likely to drive growth in the Sulfur Chemical Market, as they enable producers to meet the evolving demands of various sectors.