Supportive Regulatory Frameworks

The Sodium Sulfur Battery Market benefits from supportive regulatory frameworks that promote the adoption of clean energy technologies. Governments worldwide are implementing policies and incentives aimed at reducing carbon emissions and fostering the transition to renewable energy sources. These regulations often include subsidies for energy storage systems, tax incentives for manufacturers, and mandates for renewable energy integration. As a result, the sodium sulfur battery sector is likely to see increased investment and development, as companies seek to capitalize on these favorable conditions. The regulatory landscape is evolving, with many countries setting ambitious targets for renewable energy adoption, which could further bolster the Sodium Sulfur Battery Market in the coming years.

Advancements in Battery Technology

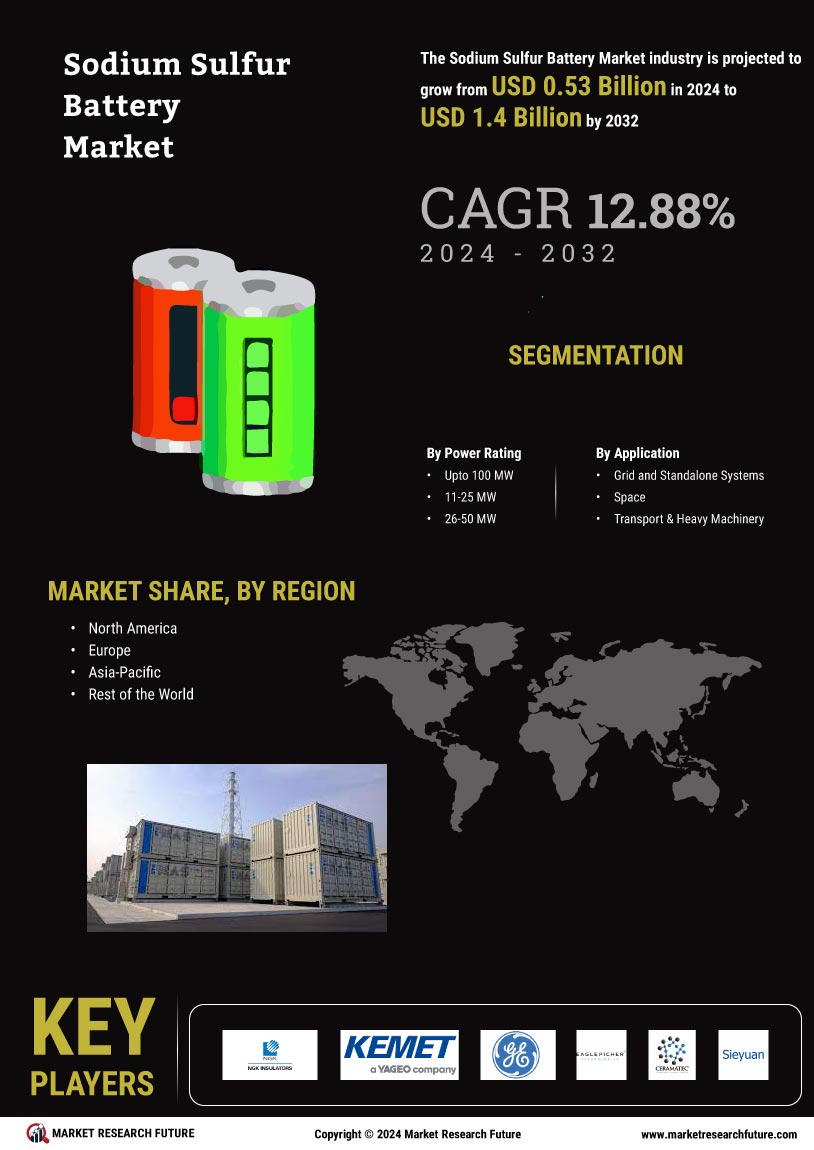

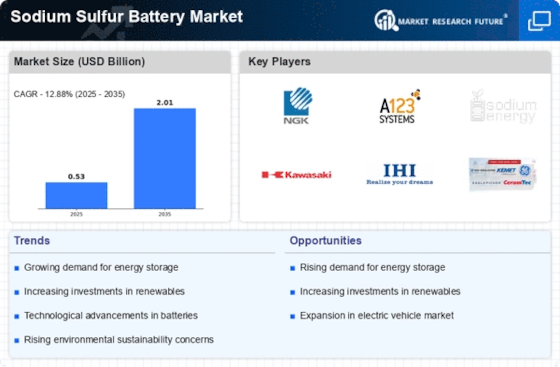

Technological innovations are propelling the Sodium Sulfur Battery Market forward, as advancements in battery technology enhance performance and efficiency. Recent developments in materials science and engineering have led to improved thermal stability and energy output of sodium sulfur batteries. These batteries are now capable of operating at higher temperatures, which is advantageous for various industrial applications. Furthermore, the integration of smart technologies in battery management systems is optimizing the performance of sodium sulfur batteries, making them more attractive for energy storage solutions. The market for advanced battery technologies is expected to grow significantly, with sodium sulfur batteries likely to capture a substantial share due to their unique advantages. This evolution in technology is crucial for the Sodium Sulfur Battery Market, as it positions these batteries as a viable alternative to traditional energy storage systems.

Growing Interest in Electric Vehicles

The rising interest in electric vehicles (EVs) is significantly impacting the Sodium Sulfur Battery Market. As the automotive sector shifts towards electrification, the demand for efficient and high-capacity batteries is escalating. Sodium sulfur batteries, with their high energy density and long lifespan, are being explored as potential candidates for EV applications. This trend is further supported by the increasing investments in EV infrastructure and the development of fast-charging technologies. Market analysts predict that the EV battery market will reach USD 100 billion by 2027, with sodium sulfur batteries likely to play a crucial role in meeting the energy demands of next-generation electric vehicles. This growing interest in EVs is expected to drive innovation and expansion within the Sodium Sulfur Battery Market.

Rising Focus on Sustainable Energy Solutions

The Sodium Sulfur Battery Market is witnessing a rising focus on sustainable energy solutions, as stakeholders increasingly prioritize environmental responsibility. The shift towards sustainable practices is prompting industries to seek energy storage options that minimize ecological impact. Sodium sulfur batteries, which utilize abundant and non-toxic materials, align well with these sustainability goals. Furthermore, their ability to store large amounts of energy makes them suitable for applications in renewable energy systems, such as solar and wind farms. As organizations commit to reducing their carbon footprints, the demand for sustainable energy storage solutions is likely to grow. This trend indicates a promising outlook for the Sodium Sulfur Battery Market, as it positions itself as a key player in the transition towards a more sustainable energy future.

Increasing Demand for Energy Storage Solutions

The Sodium Sulfur Battery Market is experiencing a surge in demand for energy storage solutions, driven by the need for efficient energy management systems. As renewable energy sources like solar and wind become more prevalent, the requirement for reliable storage systems to balance supply and demand intensifies. Sodium sulfur batteries, known for their high energy density and long cycle life, are emerging as a preferred choice for large-scale energy storage applications. According to recent estimates, the energy storage market is projected to reach USD 200 billion by 2026, with sodium sulfur batteries playing a pivotal role in this growth. This trend indicates a robust future for the Sodium Sulfur Battery Market as it aligns with global efforts to enhance energy security and sustainability.