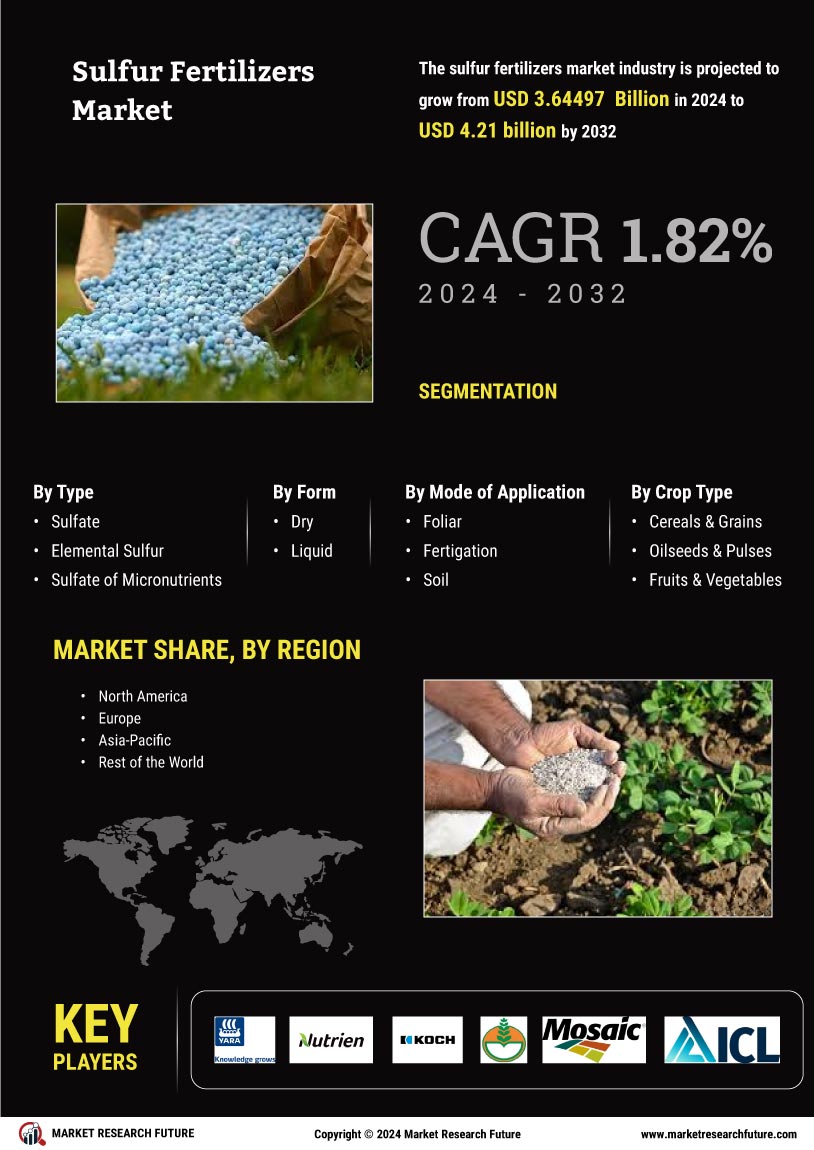

Increasing Crop Yields

The need for enhanced agricultural productivity drives the Sulfur Fertilizers Market. As global food demand escalates, farmers are increasingly turning to sulfur fertilizers to improve crop yields. Sulfur plays a crucial role in plant metabolism, influencing protein synthesis and enzyme function. In regions where sulfur deficiency is prevalent, the application of sulfur fertilizers can lead to yield increases of up to 20%. This trend is particularly evident in developing countries, where agricultural practices are evolving to meet the demands of a growing population. The Sulfur Fertilizers Market is thus positioned to benefit from this increasing focus on maximizing agricultural output.

Soil Health and Fertility Management

Soil health is paramount for sustainable agriculture, and the Sulfur Fertilizers Market is responding to this need. Sulfur fertilizers contribute to the overall fertility of the soil, enhancing its structure and microbial activity. Healthy soil is essential for nutrient retention and water management, which are critical for crop growth. The increasing recognition of the importance of soil health among farmers and agronomists is likely to drive the demand for sulfur fertilizers. Reports indicate that regions with sulfur-deficient soils are experiencing a surge in fertilizer application, thereby boosting the Sulfur Fertilizers Market. This trend underscores the vital role of sulfur in maintaining soil vitality.

Rising Awareness of Nutrient Management

The growing awareness of nutrient management among farmers is a key driver for the Sulfur Fertilizers Market. As agricultural practices become more sophisticated, farmers are increasingly recognizing the importance of balanced nutrient application. Sulfur is often overlooked, yet it is essential for optimal plant growth and development. Educational initiatives and extension services are helping to disseminate information about the benefits of sulfur fertilizers, leading to increased adoption. This trend is particularly pronounced in regions where soil testing and precision agriculture are gaining traction. Consequently, the Sulfur Fertilizers Market is poised for growth as more farmers embrace comprehensive nutrient management strategies.

Regulatory Support for Sustainable Agriculture

Government policies promoting sustainable agricultural practices are influencing the Sulfur Fertilizers Market. Many countries are implementing regulations that encourage the use of environmentally friendly fertilizers, including sulfur-based products. These policies aim to reduce chemical runoff and promote soil health, aligning with global sustainability goals. As a result, the demand for sulfur fertilizers is expected to rise, as they are often viewed as a more sustainable option compared to synthetic alternatives. The Sulfur Fertilizers Market is likely to benefit from this regulatory support, as farmers seek to comply with new standards while maintaining productivity.

Technological Advancements in Fertilizer Production

Technological advancements in the production of sulfur fertilizers are shaping the Sulfur Fertilizers Market. Innovations in manufacturing processes are leading to more efficient and cost-effective production methods. These advancements not only enhance the quality of sulfur fertilizers but also reduce environmental impact. For instance, the development of slow-release sulfur fertilizers allows for more controlled nutrient delivery, minimizing leaching and maximizing plant uptake. As these technologies become more widely adopted, they are likely to stimulate demand within the Sulfur Fertilizers Market. The integration of technology in fertilizer production is thus a pivotal factor influencing market dynamics.