Market Share

Subsea Well Access Systems Market Share Analysis

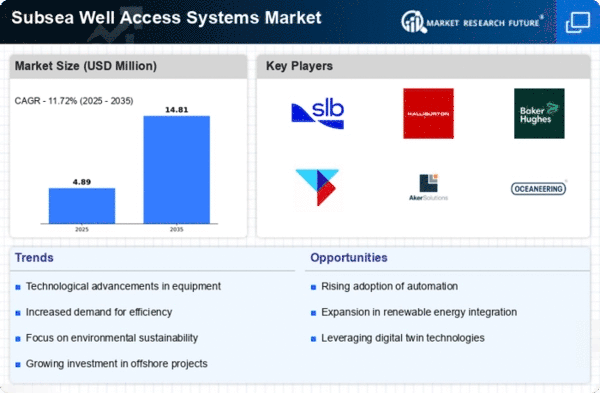

The subsea well access systems market is undergoing significant trends that are influenced by the changing landscape of offshore oil and gas exploration and production. A major trend is the constant evolution of technology, especially the improvements seen in complex and more efficient subsea well access systems. Regulatory drivers constitute key variables influencing subsea good access system dynamics. Offshore operations are subject to strict environmental policies aimed at enhancing sustainability and safety; therefore, relevant agencies institute stringent standards for them. Consequently, every manufacturer should operate under such legal frameworks, considering their specific systems meant for accessibility into wells and complying with particular safety and environmental requirements prescribed by regulators in any given oilfield operation environment. Trends in global offshore exploration activities drive the subsea well access systems market. Industry collaborations and partnerships are increasingly prevalent in the subsea well access systems market. Joint ventures and partnerships enable companies to pool resources, share expertise, and collectively address challenges associated with subsea operations. These collaborations contribute towards the development of comprehensive and integrated well-access solutions that cater to the specific needs of offshore projects, fostering efficiency and innovation in the market. Overall, economic conditions and trends influence the dynamics of the subsea well access systems market in the energy market. The growth of offshore exploration and production is determined by several factors, such as a hike or fall in oil prices, geopolitical issues, and global demand for energy. In order to anticipate changes in market demand, manufacturers within this sector must keep track of these economic indicators as well as industry trends all the time. Technological advancements, regulatory considerations, global offshore exploration activities, industry collaborations, and economic conditions have been driving dynamic trends that have been witnessed in this market for some time now. To ensure innovation occurs among these manufacturers, they must comply with stringent regulations and innovate to change exploration trends from industry partnerships while paying attention to wider macroeconomic factors influencing the economy at large. To meet the evolving needs of the offshore oil & gas industry successfully calls for a holistic approach that takes into consideration complexities inherent in Sub Sea Well Access System market.

Leave a Comment