Market Analysis

In-depth Analysis of Subsea Well Access Systems Market Industry Landscape

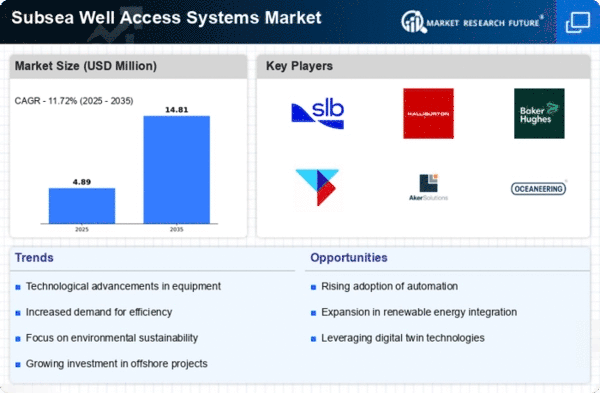

Several factors affecting the growth trajectory of the Subsea Well Access Systems Market have come up recently, including competitive landscape issues that shape its growth path. One factor that has significantly contributed to this expansion is increased drilling activities targeting offshore oil and gas reserves. Other drivers include growing technological advancements within this sector. For example, ROVs (remotely operated vehicles) and AUVs (Autonomous Underwater Vehicles). These developments reduce operational costs, leading to improved safety levels for personnel performing tasks at sea, thus making Sub Sea Well Access Systems more attractive options for investors from within the energy sector. The market will grow by constantly seeking to improve the efficiency and safety of subsea operations through technological advancements. To this effect, the Subsea Well Access Systems market is influenced by environmental considerations and regulatory frameworks. To a greater extent, stricter environmental regulations with an emphasis on sustainable practices have led to the adoption of technologies that minimize environmental effects resulting from production activities. In addition, government policies also influence the dynamics of the market through impacting investment decisions within the oil and gas industry. Policies in many countries are being adopted to encourage the uptake of cleaner technologies and environmentally friendly practices. These include subsidies, tax incentives, and legal structures promoting the application of Sub Sea Well Access Systems, which may not be unaffected by market dynamics but will greatly impact firms' decisions to invest in these advanced technologies. Government support becomes important when there is widespread use of Sub Sea Well Access Systems throughout the whole industry. The Subsea Well Access Systems market is growing because of industry collaborations and partnerships. Big oil and gas companies have joined hands with technology providers and engineering firms to come up with integrated systems that address the inherent challenges in subsea operations. Despite these growth drivers, high capital costs associated with Subsea Well Access Systems still make the installation and maintenance of such systems a complex process. Exploration activities, technological advancements, environmental considerations, government policies, and collaborative efforts within the industry are some of the factors influencing the Subsea Well Access Systems market.

Leave a Comment