Top Industry Leaders in the Subsea Well Access Systems Market

*Disclaimer: List of key companies in no particular order

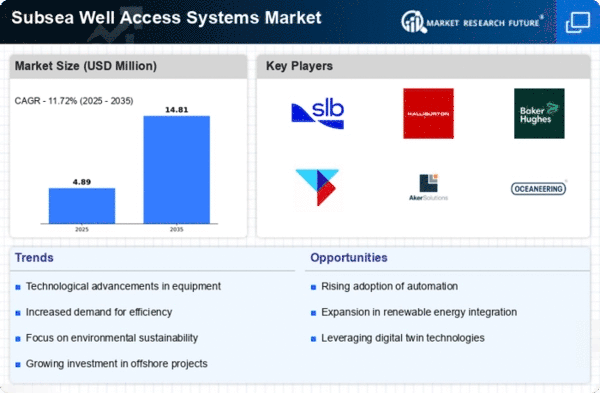

Top listed global companies in the Subsea Well Access Systems industry are:

National Oil Varco (U.S), GE Baker Hughes(U.S.), Riverstone holdings (Singapore), Subsea 7 (U.K.) TechnipFmc Technologies Inc. (U.K.), and Helix (U.K.). Schlumberger Ltd.(U.S.), Halliburton Corporation (U.S.), Weatherford international(U.S.), Aker solutions (Norway), GMC Deepwater (U.K.), and Tenaris (U.S.)

Bridging the Gap by Exploring the Competitive Landscape of the Subsea Well Access Systems Top Players

The subsea well access systems market is a complex and dynamic space, fueled by the relentless pursuit of hydrocarbons in increasingly challenging offshore environments. This domain demands robust, reliable, and efficient technologies to unlock resources trapped beneath the waves. Success hinges on navigating a competitive landscape teeming with established players, rising challengers, and a constant influx of innovative solutions.

Key Player Strategies:

Market Leaders: Giants like Baker Hughes, GE Oil & Gas, Aker Solutions, and TechnipFMC occupy the apex, leveraging their extensive experience, diverse portfolios encompassing the entire subsea value chain, and global reach. They prioritize strategic partnerships, acquisitions, and relentless R&D, aiming to solidify their positions and dictate industry trends.

Challengers on the Rise: Smaller, nimble players like Oceaneering, Saipem, and Subsea 7 are carving their niches through specialization. They focus on specific segments like well intervention, riserless well systems, or SURF (Subsea Umbilicals, Risers, and Flowlines) solutions, often boasting superior cost-effectiveness and agility.

National Champions: State-owned enterprises like China National Offshore Oil Corporation (CNOOC) and Oil and Natural Gas Corporation (ONGC) are flexing their muscles in their respective regions, driven by government incentives and ambitions for energy independence. They may pose significant challenges to established players in specific geographies.

Factors Shaping Market Share:

Technology & Innovation: The race for ever-more efficient, cost-effective, and environmentally friendly technologies is paramount. Advancements in automation, materials science, and digitalization hold the key to unlocking deeper reserves and optimizing production. Players who demonstrate a clear commitment to cutting-edge solutions will gain an edge.

Project Portfolio & Execution Capabilities: Securing major contracts in deepwater or complex reservoir projects can significantly boost market share. Players with a proven track record of successful project execution, coupled with a diverse portfolio catering to various field types, attract more operators.

Regional Focus & Local Content: Understanding the intricacies of specific regions and complying with local content regulations are crucial for success. Establishing strong regional presences, building strategic partnerships with local players, and investing in local manufacturing capabilities can create significant competitive advantages.

Sustainability & Environmental Concerns: The push for cleaner energy sources and the need to minimize environmental impact are reshaping the industry. Players offering solutions that reduce emissions, optimize energy consumption, and minimize ecological footprint will emerge as future leaders.

New & Emerging Trends:

Digitalization & Automation: The integration of big data analytics, artificial intelligence, and robotics is transforming the subsea landscape. Automated drilling systems, smart well completions, and real-time production monitoring offer operational efficiency, cost savings, and improved safety.

Modularization & Standardization: Modular subsea equipment systems are gaining traction, enabling faster installations, easier maintenance, and increased flexibility. Standardization initiatives across the industry further streamline operations and reduce costs.

Focus on Deepwater & Harsh Environments: The quest for resources is pushing boundaries into ever-deeper and harsher environments. Technologies for extreme pressures, temperatures, and corrosive conditions are in high demand, opening doors for specialized players with expertise in these domains.

Alternative Energy Sources: The rise of offshore renewable energy like wind farms is creating demand for adapted subsea well access technologies. This segment presents new opportunities for established players and innovative startups alike.

Overall Competitive Scenario:

The subsea well access systems market is characterized by intense competition, with constant technological advancements, evolving customer needs, and regional dynamics shaping the landscape. While established players maintain their dominance, niche players and national champions are carving their spaces. Innovation, diversification, regional focus, and a commitment to sustainable solutions will be the key differentiators for success in this turbulent yet promising market. Understanding these trends and the strategies adopted by various players will be crucial for navigating the depths of this complex and ever-evolving industry.

Latest Company Updates:

National Oil Varco (NOV):

- Dec 15, 2023: Announced the launch of its next-generation Moineau subsea wellhead system, designed for improved well integrity and operational efficiency in harsh environments. (Source: NOV press release)

GE Baker Hughes:

- Jan 10, 2024: Showcased its Subsea Connect platform at the Offshore Technology Conference (OTC) in Houston, highlighting its capabilities for remote monitoring and optimization of subsea well systems. (Source: GE Baker Hughes website)

Riverstone Holdings:

- Oct 18, 2023: Announced the acquisition of Well Ops International, a provider of subsea well intervention services, expanding its offerings in the well access market. (Source: Riverstone Holdings press release)

Subsea 7:

- Jan 9, 2024: Completed the installation of the world's longest subsea production system for Equinor's Arctic Hammerfest LNG project in Norway. (Source: Subsea 7 press release)

TechnipFMC:

- Jan 12, 2024: Unveiled its Subsea iFEED offering at OTC, providing integrated front-end engineering and design services for subsea field developments. (Source: TechnipFMC website)