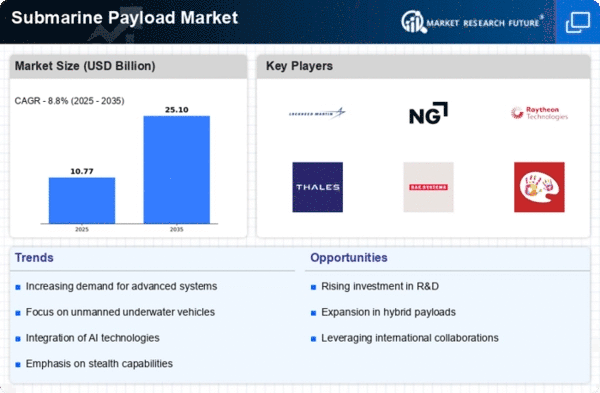

Market Growth Projections

The Global Submarine Payload Market Industry is projected to experience substantial growth over the next decade. With an estimated market value of 3.78 USD Billion in 2024, the industry is expected to reach approximately 6.06 USD Billion by 2035. This growth trajectory indicates a compound annual growth rate (CAGR) of 4.38% from 2025 to 2035. The increasing focus on advanced submarine capabilities, coupled with rising defense budgets and geopolitical tensions, is likely to sustain this upward trend. As nations continue to invest in their naval forces, the demand for innovative submarine payload solutions will remain a key driver of market expansion.

Increasing Defense Budgets

The Global Submarine Payload Market Industry is experiencing growth driven by rising defense budgets across various nations. Countries are prioritizing naval capabilities, leading to increased investments in submarine technology and payload systems. For instance, nations like the United States and China are significantly enhancing their naval fleets, which includes advanced submarines equipped with sophisticated payloads. This trend is expected to contribute to the market's expansion, with projections indicating a market value of 3.78 USD Billion in 2024. As defense budgets continue to rise, the demand for advanced submarine payloads is likely to increase, further propelling the market forward.

Growing Demand for ISR Capabilities

The demand for Intelligence, Surveillance, and Reconnaissance (ISR) capabilities is driving the Global Submarine Payload Market Industry. Submarines equipped with advanced ISR payloads are essential for gathering critical intelligence in contested environments. The ability to operate undetected while collecting data provides a strategic advantage in military operations. Countries are increasingly recognizing the importance of ISR capabilities, leading to investments in submarine payload systems that enhance these functionalities. As the need for effective ISR solutions grows, the market is expected to expand, reflecting the evolving nature of modern warfare and the strategic importance of submarines.

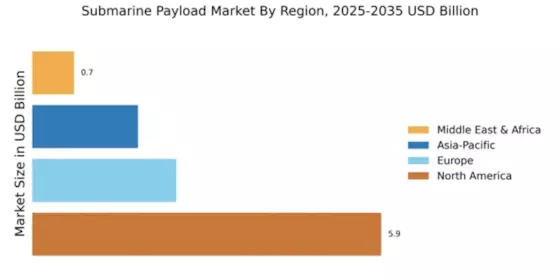

Emerging Markets and Naval Expansion

Emerging markets are contributing to the growth of the Global Submarine Payload Market Industry. Nations in Asia, the Middle East, and Africa are expanding their naval capabilities, often through the acquisition of submarines and associated payload systems. For instance, countries like India and Brazil are investing in submarine programs to enhance their maritime security and deterrence capabilities. This trend is likely to create new opportunities for manufacturers and suppliers in the submarine payload sector. As these emerging markets continue to develop their naval forces, the demand for advanced submarine payloads is expected to rise, further driving market growth.

Geopolitical Tensions and Maritime Security

Geopolitical tensions are a significant driver of the Global Submarine Payload Market Industry. As nations face increasing threats from rival states and non-state actors, the need for enhanced maritime security becomes paramount. Submarines, equipped with advanced payloads, serve as a deterrent and a strategic asset in maintaining national security. For instance, the South China Sea disputes have prompted countries in the region to bolster their naval capabilities, including submarine fleets. This heightened focus on maritime security is likely to sustain demand for submarine payloads, contributing to the market's growth trajectory in the coming years.

Technological Advancements in Payload Systems

Technological advancements play a crucial role in shaping the Global Submarine Payload Market Industry. Innovations in sensor technology, weapon systems, and communication capabilities are enhancing the effectiveness of submarine payloads. For example, the integration of unmanned underwater vehicles (UUVs) and advanced torpedoes is revolutionizing submarine operations. These advancements not only improve operational efficiency but also increase the strategic value of submarines in modern warfare. As these technologies continue to evolve, the market is projected to grow, with an anticipated value of 6.06 USD Billion by 2035, indicating a robust CAGR of 4.38% from 2025 to 2035.