Research Methodology on Storage in Big Data Market

1.Introduction

This research aims to understand the market potential and segmentation of Storage in the Big Data market. The research draws upon secondary research, primary interviews with data experts and industry stakeholders, and Market Research Future (MRFR) internal analysis to understand the current status of the storage in the Big Data market in terms of market size and segmentation.

2. Research scope

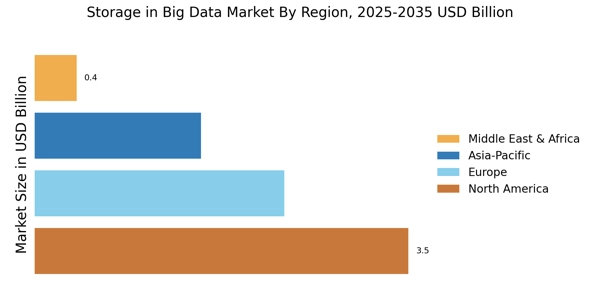

The scope of the research is focused on assessing the storage in the Big Data market from the year 2023 to the year 2030. The research is segmented into four regions: North America, Europe, Asia-Pacific, and Rest of the World. The research looks at the various components of the market such as technology, services, and end-user and applications.

3. Research methodology

In order to understand the precise projection and estimates of the Storage in the Big Data market, MRFR followed a systematic and structured approach to our research. We employed a combination of qualitative and quantitative research methods to create a lucid understanding of the industry dynamics and current status of the industry.

The research involves a set of research activities such as:

a) Secondary research

This is an extensively used method of data analysis as it helps to validate the existing data/information and also lays down a foundation for primary investigations. Secondary research involves reading market reports and white papers, industry magazines, news sites, etc. This allows us to analyze the current market trends and estimate the future growth potential.

b) Primary research

Primary research deals with the collection of data directly. We conducted interviews with industry experts and stakeholders to gather first-hand information on Storage in the Big Data market. The information gathered was verified through further investigations and was then used in the continual process of validating the existing data and determining the future course of action in the market.

c) Desk research

Desk research or desk studies are an integral part of MRFR's research process. It involves an extensive search of existing literature, newspapers, magazines and other published material to gain insights into the current market.

d) Data triangulation

Data triangulation involves the process of validating the data collected from both primary and secondary research. This is done by comparing the data obtained from different sources and by analyzing the different perspectives inherent in that data.

4. Market segmentation

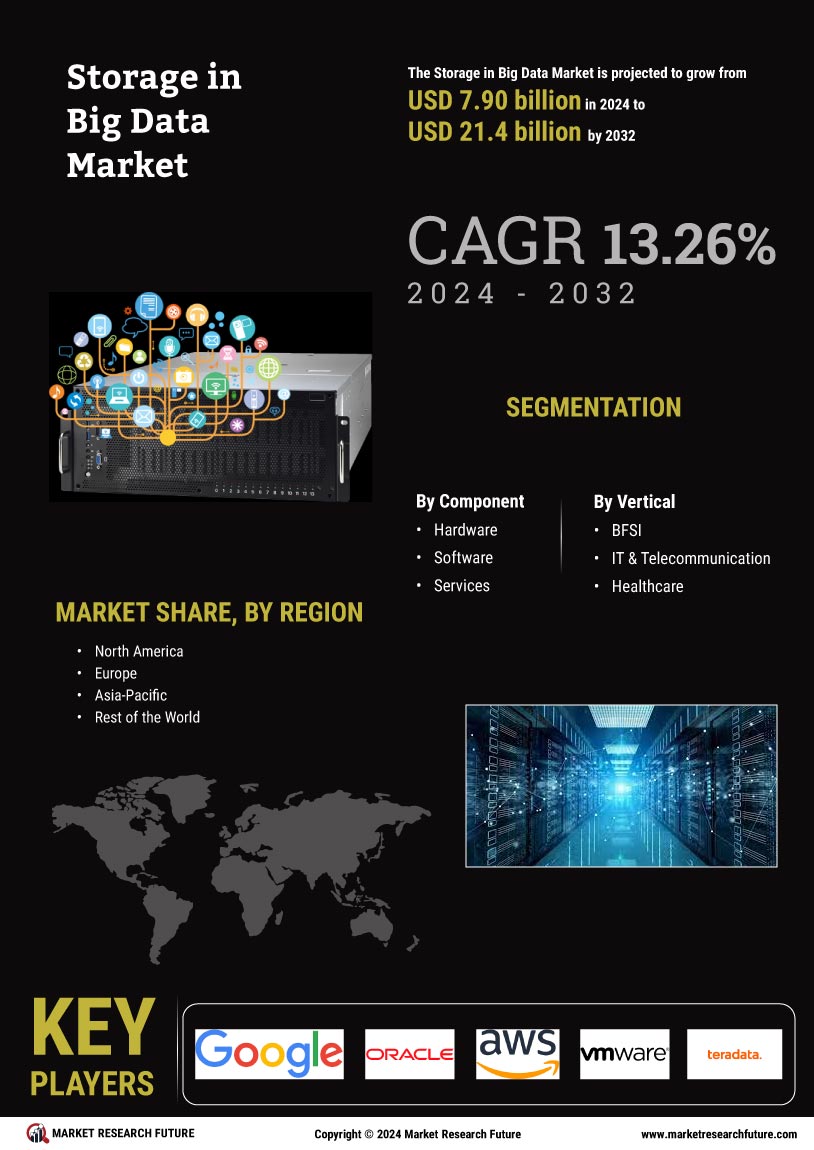

The Storage in the Big Data market has been segmented based on components (solutions and services), end users, and regions.

5. Result and conclusion

The research was a detailed appraisal of the Storage in the Big Data market based on primary and secondary sources of data. It includes an in-depth analysis of the market dynamics, competitive landscape, market segmentation and competitive positioning to gain insights into the current and future market scenario. The research was conducted between May 2021 and November 2022.

The research concluded with a refined vision of what is necessary to tap into the potential of Storage in the Big Data market. It included information on several key players in the market, an understanding of their competitive positions, and a brief outlook of their strategies. The research also shed light on the growth prospects of Storage in the Big Data market, and what is needed in terms of technological innovations, marketing strategies, demand for solutions and services, and the potential of the end-user industry for successful penetration.