Rising Focus on Cost Efficiency

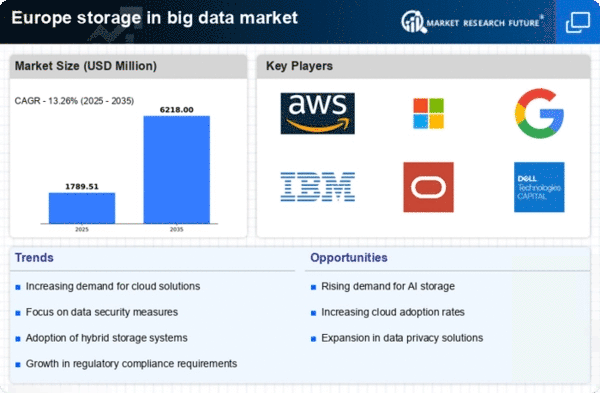

Cost efficiency is becoming increasingly critical for organizations in Europe, influencing their storage strategies in the storage in-big-data market. As data storage costs continue to decline, businesses are seeking solutions that not only reduce expenses but also enhance performance. The shift towards more cost-effective storage options, such as cloud-based solutions, is indicative of this trend. Organizations are looking to optimize their storage expenditures while ensuring that they can scale their operations effectively. This focus on cost efficiency is expected to drive market growth, with projections indicating a potential increase of 10% in the adoption of budget-friendly storage solutions in the coming years. The storage in-big-data market is thus adapting to meet these evolving financial considerations.

Advancements in Storage Technologies

Technological advancements in storage solutions are significantly influencing the storage in-big-data market in Europe. Innovations such as solid-state drives (SSDs), hybrid storage systems, and software-defined storage are enhancing data storage capabilities. These technologies offer improved speed, reliability, and efficiency, which are crucial for managing large datasets. As organizations seek to optimize their data storage infrastructure, the adoption of these advanced technologies is expected to rise. The market is likely to witness a growth rate of around 12% annually as businesses invest in modern storage solutions to enhance their data management strategies. This trend underscores the importance of technological evolution in the storage in-big-data market.

Growing Adoption of Big Data Analytics

The increasing adoption of big data analytics among European enterprises is driving the storage in-big-data market. Organizations are recognizing the value of data-driven insights for decision-making and operational efficiency. As a result, there is a growing need for robust storage solutions that can support the analytics process, which often involves processing large volumes of data. The market for big data analytics is projected to reach €100 billion by 2026, further fueling the demand for effective storage solutions. This trend indicates that the storage in-big-data market is closely linked to the broader analytics landscape, as businesses seek to leverage data for competitive advantage.

Surge in Data Generation and Consumption

The exponential growth in data generation and consumption across various sectors in Europe is a primary driver for the storage in-big-data market. With the proliferation of IoT devices, social media, and digital transactions, the volume of data created is staggering, estimated to reach 175 zettabytes by 2025. This surge necessitates efficient storage solutions capable of handling vast amounts of data. Organizations are increasingly seeking scalable storage options that can accommodate this growth while ensuring quick access and retrieval. Consequently, the storage in-big-data market is poised for substantial growth as businesses adapt to the demands of data-heavy operations.

Increasing Regulatory Compliance Requirements

The storage in-big-data market in Europe is experiencing a surge in demand due to the increasing regulatory compliance requirements imposed by various governmental bodies. Regulations such as the General Data Protection Regulation (GDPR) necessitate that organizations implement robust data storage solutions to ensure data privacy and security. This has led to a heightened focus on data governance and management practices, compelling businesses to invest in advanced storage technologies. As organizations strive to comply with these regulations, the market is projected to grow at a CAGR of approximately 15% over the next five years. The need for secure and compliant data storage solutions is thus a significant driver in the storage in-big-data market.