Market Trends

Key Emerging Trends in the Stolen Vehicle Recovery Market

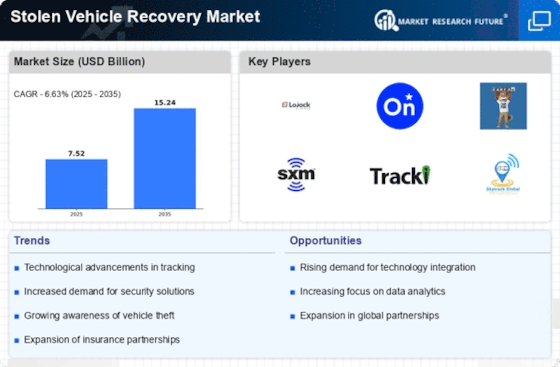

The global stolen vehicle recovery system market is growing fast because more vehicles are being stolen, and these recovery systems have a high success rate. However, the market might face challenges from advanced anti-theft technology and occasional failures in the recovery systems.

In 2017, the Federal Bureau of Investigation (FBI) reported that around $6 billion was lost due to vehicle theft, with an average loss of about $7,708 per theft. The U.S. saw 773,139 stolen vehicles that year, a slight increase from 2016. The FBI data revealed that a vehicle was stolen roughly every 40.9 seconds in the U.S. in 2017.

Efforts by law enforcement and anti-theft programs, along with technological advancements, have helped reduce thefts. However, there were increases in vehicle thefts in 2015 and 2016.

Thieves are becoming more sophisticated, using methods like obtaining smart keys or changing vehicle identification numbers. The National Insurance Crime Bureau (NICB) noted a 22% increase in vehicles stolen using such tactics in 2015.

To combat rising thefts, there's a growing demand for stolen vehicle recovery systems. These systems provide real-time location data, monitored through mobile apps, helping law enforcement recover vehicles quickly. The increasing number of thefts is expected to drive the stolen vehicle recovery system market growth.

Over time, the adoption of anti-theft systems, including video surveillance and fingerprint sensors, is likely to decrease vehicle thefts. This may moderate the impact of theft incidents on the demand for stolen vehicle recovery systems in the future. In recent years, there has been a significant increase in vehicle thefts, leading to a rising demand for stolen vehicle recovery systems. These systems play a crucial role in locating and recovering stolen vehicles, contributing to the growth of the global stolen vehicle recovery system market. However, the market may face challenges due to advancements in anti-theft technology and occasional system failures.

According to the Federal Bureau of Investigation (FBI), vehicle thefts resulted in approximately $6 billion in losses in 2017, with an average loss of around $7,708 per theft. The FBI reported 773,139 stolen vehicles in the U.S. that year, occurring at a rate of one vehicle stolen every 40.9 seconds.

While law enforcement efforts and anti-theft programs have helped reduce theft numbers, there has been an increase in vehicle theft incidents in certain years, emphasizing the need for effective recovery solutions.

Thieves are employing more sophisticated methods, such as obtaining smart keys and manipulating vehicle identification numbers, leading to a 22% increase in vehicles stolen using such tactics in 2015, according to the National Insurance Crime Bureau (NICB).

The demand for stolen vehicle recovery systems has surged as a response to these challenges. These systems provide real-time location data, monitored through mobile applications, facilitating quick recovery by law enforcement. The ongoing increase in vehicle thefts is expected to drive the growth of the stolen vehicle recovery system market.

Leave a Comment