Regulatory Incentives for Recycling

The Steel Slag Market is positively influenced by regulatory incentives aimed at promoting recycling and sustainable waste management. Governments across various regions are implementing policies that encourage the use of recycled materials, including steel slag, in construction and manufacturing processes. These regulations often include tax breaks, grants, and subsidies for companies that utilize recycled materials, thereby enhancing the economic viability of steel slag. For instance, certain jurisdictions have set targets for the percentage of recycled content in construction materials, which directly boosts the demand for steel slag. As these regulatory frameworks evolve, the Steel Slag Market is likely to see increased participation from businesses seeking to comply with sustainability mandates, ultimately driving market growth.

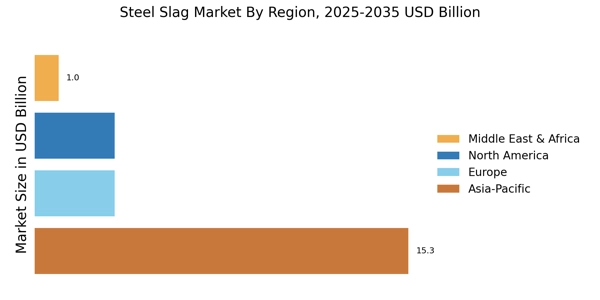

Rising Infrastructure Development Projects

The Steel Slag Market is significantly impacted by the ongoing rise in infrastructure development projects worldwide. As nations invest in upgrading their infrastructure, the demand for construction materials, including steel slag, is expected to increase. Steel slag serves as a cost-effective alternative to traditional aggregates, providing both economic and environmental advantages. Recent projections indicate that infrastructure spending could reach unprecedented levels, particularly in emerging economies, thereby creating a robust market for steel slag. This trend is further supported by the need for durable and resilient materials that can withstand the rigors of modern construction. Consequently, the Steel Slag Market stands to gain from this influx of infrastructure projects, potentially leading to substantial growth in market size and revenue.

Growing Awareness of Environmental Benefits

The Steel Slag Market is experiencing growth driven by increasing awareness of the environmental benefits associated with the use of steel slag. As stakeholders in the construction and manufacturing sectors become more conscious of their ecological footprint, the demand for sustainable materials rises. Steel slag, being a recycled product, contributes to waste reduction and resource conservation, aligning with the principles of circular economy. Furthermore, studies suggest that using steel slag can improve soil quality and reduce the need for chemical fertilizers in agricultural applications. This heightened awareness among consumers and businesses alike is likely to propel the Steel Slag Market forward, as more entities seek to adopt environmentally friendly practices.

Increasing Demand for Steel Slag in Construction

The Steel Slag Market experiences a notable surge in demand due to the increasing adoption of steel slag in construction applications. Steel slag, a byproduct of steel manufacturing, is utilized as a substitute for natural aggregates in concrete production, road construction, and asphalt mixtures. This trend is driven by the need for sustainable construction practices, as steel slag offers enhanced durability and strength compared to traditional materials. Recent data indicates that the use of steel slag in construction can reduce carbon emissions by up to 30%, making it an attractive option for environmentally conscious builders. As infrastructure projects expand, the Steel Slag Market is poised to benefit from this growing demand, potentially leading to a significant increase in market share and revenue.

Technological Innovations in Steel Slag Processing

Technological advancements in the processing of steel slag are transforming the Steel Slag Market. Innovations such as advanced crushing and screening techniques, as well as improved separation methods, enhance the quality and usability of steel slag in various applications. These technologies not only increase the efficiency of steel slag production but also expand its potential uses in construction, agriculture, and environmental remediation. For example, the development of high-performance steel slag aggregates has made them suitable for high-stress applications, further broadening their market appeal. As these technologies continue to evolve, the Steel Slag Market is expected to witness a rise in product offerings and an expansion of its customer base.