Expansion of E-commerce Platforms

The rise of e-commerce platforms is transforming the Specialty Tire Market by providing consumers with easier access to a wide range of specialty tires. Online retailing has become increasingly popular, allowing customers to compare products, read reviews, and make informed purchasing decisions from the comfort of their homes. This shift is particularly beneficial for niche markets, where consumers may have difficulty finding specific tire types in traditional retail settings. Data suggests that e-commerce sales in the tire industry are expected to grow by approximately 15% annually, reflecting changing consumer preferences. As more companies invest in their online presence, the Specialty Tire Market is likely to see enhanced distribution channels and increased sales.

Growth in Renewable Energy Sector

The Specialty Tire Market is witnessing growth driven by the expansion of the renewable energy sector, particularly in wind and solar energy. The installation and maintenance of renewable energy infrastructure often require specialized vehicles and equipment, which in turn necessitates the use of specialty tires. For example, the transportation of wind turbine components demands tires that can support heavy loads and navigate challenging terrains. As investments in renewable energy continue to rise, the demand for specialty tires tailored for this sector is expected to increase. Projections indicate that the renewable energy sector could contribute to a 7% growth in the Specialty Tire Market over the next few years, highlighting the interconnectedness of these industries.

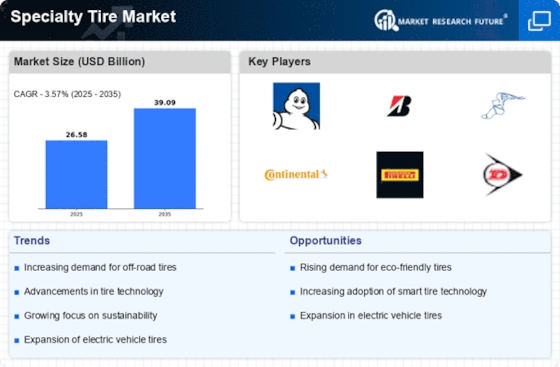

Increasing Demand for Specialty Vehicles

The Specialty Tire Market is experiencing a notable surge in demand for specialty vehicles, including agricultural, construction, and recreational vehicles. This trend is driven by the expansion of industries that rely on specialized equipment, which in turn necessitates the use of specialized tires. For instance, the agricultural sector has seen a rise in precision farming techniques, leading to a greater need for tires that can handle diverse terrains and conditions. According to recent data, the agricultural tire segment is projected to grow at a compound annual growth rate of approximately 5% over the next few years. This increasing demand for specialty vehicles is likely to propel the Specialty Tire Market forward, as manufacturers adapt to meet the specific requirements of these vehicles.

Regulatory Compliance and Safety Standards

The Specialty Tire Market is influenced by stringent regulatory compliance and safety standards that govern tire manufacturing and performance. Governments worldwide are implementing regulations aimed at improving road safety and environmental sustainability. For instance, regulations concerning tire labeling and performance metrics are becoming more prevalent, compelling manufacturers to innovate and enhance their products. Compliance with these regulations not only ensures consumer safety but also fosters competition among manufacturers to produce high-quality specialty tires. As a result, companies that prioritize adherence to these standards may gain a competitive edge in the Specialty Tire Market, potentially leading to increased market share and consumer trust.

Technological Innovations in Tire Manufacturing

Technological advancements are playing a pivotal role in shaping the Specialty Tire Market. Innovations such as advanced rubber compounds, improved tread designs, and smart tire technology are enhancing performance and safety. For example, the integration of sensors in tires allows for real-time monitoring of tire pressure and temperature, which can significantly reduce the risk of tire failure. Furthermore, the development of eco-friendly materials is gaining traction, aligning with sustainability goals across various sectors. The market for smart tires is expected to witness substantial growth, with projections indicating a potential increase of 10% in market share within the next five years. These technological innovations are likely to create new opportunities and drive growth within the Specialty Tire Market.