Innovations in Flavor Profiles

The Juice Concentrates Market is characterized by a continuous evolution in flavor profiles, as manufacturers strive to meet diverse consumer tastes. Innovations in flavor combinations, such as exotic fruit blends and unique infusions, are becoming increasingly popular. Recent market data indicates that flavor innovation is a key driver of growth, with consumers showing a willingness to experiment with new and unconventional flavors. This trend not only enhances the appeal of juice concentrates but also allows brands to differentiate themselves in a competitive landscape. As a result, companies are investing in research and development to create distinctive flavor offerings that resonate with consumers, thereby contributing to the overall expansion of the Juice Concentrates Market.

Rising Demand for Natural Ingredients

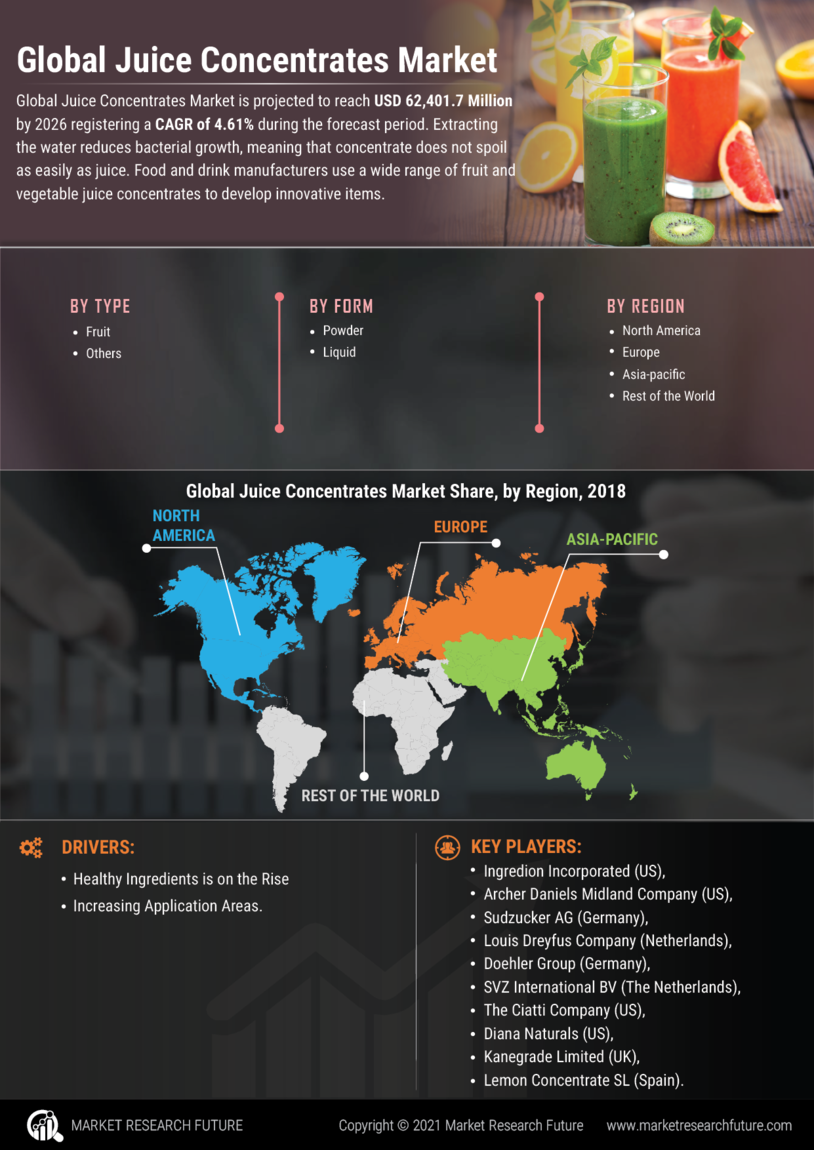

The Juice Concentrates Market is experiencing a notable shift towards natural ingredients, driven by consumer preferences for healthier options. As individuals become increasingly health-conscious, the demand for juice concentrates made from organic fruits is on the rise. According to recent data, the market for organic juice concentrates is projected to grow at a compound annual growth rate of approximately 6% over the next five years. This trend indicates a significant opportunity for manufacturers to innovate and develop products that align with consumer desires for clean labels and transparency. Furthermore, the emphasis on natural ingredients is likely to influence product formulations, leading to a broader range of offerings in the Juice Concentrates Market.

Convenience and Ready-to-Drink Options

The Juice Concentrates Market is witnessing a surge in demand for convenience-driven products, particularly ready-to-drink options. Busy lifestyles and the increasing preference for on-the-go consumption are propelling the growth of juice concentrates that can be easily mixed or consumed directly. Market analysis suggests that the ready-to-drink segment is expected to account for a substantial share of the overall juice concentrates market, with a projected growth rate of around 5% annually. This trend highlights the importance of packaging innovations and product accessibility, as consumers seek quick and convenient solutions without compromising on taste or quality. Manufacturers are thus encouraged to explore new formats and flavors to cater to this evolving consumer behavior.

Increased Focus on Nutritional Benefits

The Juice Concentrates Market is experiencing heightened attention towards the nutritional benefits of juice products. Consumers are increasingly seeking beverages that offer functional health advantages, such as added vitamins, minerals, and antioxidants. This trend is reflected in the growing popularity of fortified juice concentrates, which are designed to cater to health-conscious individuals. Market Research Future indicates that the demand for functional beverages is expected to rise significantly, with a projected increase of 7% in the next few years. This focus on nutritional value not only influences purchasing decisions but also encourages manufacturers to reformulate existing products to enhance their health benefits. Consequently, the Juice Concentrates Market is likely to see a proliferation of products that emphasize health and wellness.

Sustainability and Eco-Friendly Practices

The Juice Concentrates Market is increasingly aligning with sustainability initiatives, as consumers become more environmentally conscious. There is a growing expectation for brands to adopt eco-friendly practices, from sourcing ingredients to packaging solutions. Recent studies suggest that a significant portion of consumers is willing to pay a premium for sustainably produced products, indicating a shift in purchasing behavior. This trend is prompting manufacturers to explore sustainable sourcing methods and invest in biodegradable packaging options. As sustainability becomes a core value for many consumers, the Juice Concentrates Market is likely to witness a transformation in operational practices, ultimately leading to a more responsible and environmentally friendly market landscape.