Innovative Product Offerings

Innovation plays a crucial role in shaping the juice concentrate market in South Korea. Companies are increasingly introducing new flavors, blends, and formulations to cater to diverse consumer preferences. The introduction of functional beverages, which combine juice concentrates with added health benefits such as vitamins and minerals, is particularly noteworthy. This trend is supported by market data indicating that functional beverages account for nearly 30% of the total beverage market in South Korea. As consumers become more adventurous in their taste preferences, the juice concentrate market is likely to see a surge in demand for unique and innovative products. This focus on innovation not only attracts new customers but also encourages brand loyalty, as consumers are drawn to companies that consistently offer exciting and novel options.

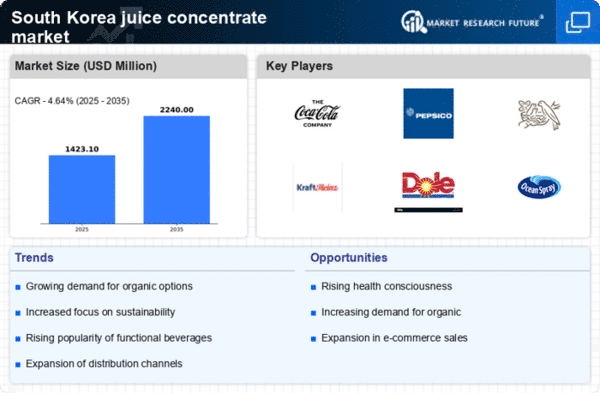

Increased Focus on Sustainability

Sustainability is becoming a pivotal consideration within the juice concentrate market in South Korea. Consumers are increasingly aware of environmental issues and are favoring brands that demonstrate a commitment to sustainable practices. This includes sourcing ingredients responsibly, reducing packaging waste, and implementing eco-friendly production methods. Recent surveys indicate that approximately 70% of consumers are willing to pay a premium for products that are environmentally friendly. As a result, companies in the juice concentrate market are likely to invest in sustainable sourcing and production techniques to align with consumer values. This focus on sustainability not only enhances brand reputation but also opens avenues for differentiation in a crowded market, potentially leading to increased customer loyalty and market share.

Expansion of Distribution Channels

The juice concentrate market in South Korea is experiencing an expansion of distribution channels, which is likely to enhance product accessibility. Traditional retail outlets are being complemented by online platforms, allowing consumers to purchase juice concentrates with greater ease. The rise of e-commerce has transformed shopping habits, with online sales of beverages increasing by over 25% in recent years. This trend suggests that companies must adapt their distribution strategies to include both physical and digital channels. By leveraging multiple distribution avenues, businesses in the juice concentrate market can reach a broader audience and cater to varying consumer preferences. This expansion not only facilitates growth but also positions companies to respond effectively to changing market dynamics.

Rising Demand for Natural Ingredients

The juice concentrate market in South Korea experiences a notable increase in demand for natural ingredients. Consumers are increasingly seeking products that are free from artificial additives and preservatives. This trend aligns with a broader shift towards health-conscious consumption patterns. According to recent data, the market for natural juice concentrates has grown by approximately 15% annually, reflecting a significant consumer preference for organic and minimally processed options. This demand is likely to drive innovation within the juice concentrate market, as manufacturers strive to meet the expectations of discerning consumers who prioritize health and wellness. The emphasis on natural ingredients not only enhances product appeal but also positions companies favorably in a competitive landscape, potentially leading to increased market share and profitability.

Growing Popularity of On-the-Go Consumption

The juice concentrate market in South Korea is witnessing a shift towards on-the-go consumption. Busy lifestyles and the increasing prevalence of convenience-oriented products are driving this trend. Consumers are seeking quick and easy options that fit into their fast-paced routines. As a result, ready-to-drink juice products and single-serve juice concentrates are gaining traction. Market analysis suggests that the on-the-go segment could account for over 40% of total juice sales in the coming years. This shift presents opportunities for manufacturers to develop packaging solutions that enhance convenience while maintaining product quality. The focus on on-the-go consumption is likely to reshape marketing strategies within the juice concentrate market, as companies aim to capture the attention of time-strapped consumers looking for nutritious and convenient beverage options.