Emphasis on Compliance and Risk Management

In the context of the workforce analytics market, compliance and risk management have emerged as critical drivers for organizations in Spain. With increasing regulatory requirements and the need for transparency in employment practices, companies are turning to workforce analytics to ensure adherence to labor laws and regulations. Approximately 60% of organizations in Spain report that they utilize analytics to monitor compliance-related metrics, such as employee hours and overtime. This focus on compliance not only mitigates legal risks but also enhances organizational reputation. Furthermore, workforce analytics can identify potential areas of risk, such as high turnover rates or employee dissatisfaction, allowing companies to proactively address these issues. As regulatory landscapes evolve, the demand for robust analytics solutions that support compliance efforts is expected to grow, further propelling the workforce analytics market.

Rising Demand for Data-Driven Decision Making

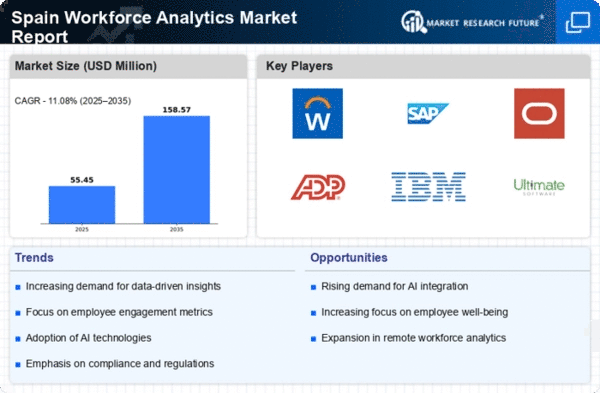

The workforce analytics market in Spain is experiencing a notable surge in demand for data-driven decision making. Organizations are increasingly recognizing the value of leveraging data to enhance operational efficiency and improve employee performance. According to recent studies, approximately 70% of companies in Spain are now utilizing some form of workforce analytics to inform their strategic decisions. This trend is likely to continue as businesses seek to optimize their human resources and align workforce strategies with overall business objectives. The integration of advanced analytics tools enables organizations to gain insights into employee productivity, retention rates, and skill gaps, thereby fostering a more agile and responsive workforce. As a result, the workforce analytics market is poised for substantial growth, driven by the need for actionable insights that can lead to improved business outcomes.

Shift Towards Remote Work and Flexible Arrangements

The workforce analytics market is being significantly influenced by the shift towards remote work and flexible arrangements in Spain. As organizations adapt to changing work environments, there is a growing need for analytics tools that can effectively manage remote teams and assess their performance. Recent data indicates that around 50% of companies in Spain have adopted hybrid work models, necessitating the use of analytics to monitor employee engagement and productivity in diverse settings. This transition presents both challenges and opportunities for workforce analytics, as organizations seek to understand the dynamics of remote work and its impact on team collaboration. Consequently, the demand for analytics solutions that provide insights into remote workforce performance is likely to increase, driving growth in the workforce analytics market.

Focus on Talent Acquisition and Retention Strategies

Talent acquisition and retention strategies are becoming increasingly vital in the workforce analytics market in Spain. Organizations are recognizing that attracting and retaining top talent is essential for maintaining competitive advantage. Approximately 65% of companies in Spain are utilizing workforce analytics to refine their recruitment processes and enhance employee retention efforts. By analyzing data related to candidate profiles, hiring trends, and employee satisfaction, organizations can develop targeted strategies that align with their workforce needs. This focus on talent management not only improves hiring outcomes but also fosters a more engaged and committed workforce. As the labor market becomes more competitive, the emphasis on effective talent acquisition and retention strategies is expected to drive further investment in workforce analytics solutions.

Integration of Advanced Technologies in Workforce Management

The integration of advanced technologies, such as artificial intelligence and machine learning, is reshaping the workforce analytics market in Spain. Organizations are increasingly adopting these technologies to enhance their workforce management capabilities. Recent surveys indicate that approximately 55% of companies in Spain are exploring AI-driven analytics tools to gain deeper insights into employee performance and operational efficiency. This technological integration allows for more sophisticated data analysis, enabling organizations to identify trends and patterns that were previously difficult to discern. As businesses seek to leverage technology for improved workforce outcomes, the demand for innovative analytics solutions is likely to rise. This trend not only enhances the capabilities of workforce analytics but also positions organizations to respond more effectively to the evolving needs of their workforce.