Integration of Advanced Technologies

The integration of advanced technologies, such as artificial intelligence and machine learning, is reshaping the workforce analytics market in Japan. Organizations are increasingly adopting these technologies to enhance their analytical capabilities, enabling them to derive deeper insights from workforce data. This trend is expected to propel the market's growth, with estimates suggesting a potential market size of $2 billion by 2027. By harnessing these technologies, companies can automate data collection processes, improve predictive analytics, and facilitate real-time decision-making. This technological evolution not only streamlines operations but also empowers organizations to proactively address workforce challenges, thereby solidifying the role of workforce analytics in strategic planning.

Regulatory Changes and Compliance Needs

The evolving regulatory landscape in Japan is another critical driver of the workforce analytics market. Organizations are increasingly required to comply with various labor laws and data protection regulations. This necessitates the implementation of robust analytics solutions to ensure compliance and mitigate risks associated with non-compliance. The market is projected to grow as companies invest in workforce analytics tools that facilitate adherence to these regulations. By leveraging analytics, organizations can monitor compliance-related metrics, identify potential risks, and implement corrective actions proactively. This focus on regulatory compliance not only safeguards organizations against legal repercussions but also enhances their reputation in the marketplace.

Emphasis on Talent Management Strategies

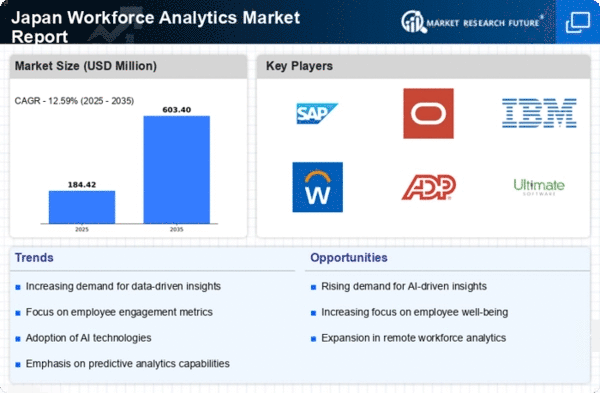

In Japan, the workforce analytics market is significantly influenced by the increasing emphasis on effective talent management strategies. Organizations are recognizing that attracting and retaining top talent is crucial for sustained growth. As a result, there is a growing reliance on analytics to assess employee performance, engagement levels, and career development needs. The market is expected to witness a compound annual growth rate (CAGR) of around 12% over the next few years, driven by the need for organizations to align their workforce capabilities with business objectives. By utilizing workforce analytics, companies can tailor their talent management initiatives, ensuring that they not only meet current demands but also anticipate future workforce needs.

Focus on Diversity and Inclusion Initiatives

The workforce analytics market in Japan is also being driven by a heightened focus on diversity and inclusion initiatives within organizations. Companies are increasingly aware of the benefits that diverse teams bring to innovation and performance. As such, there is a growing demand for analytics tools that can measure and enhance diversity metrics. This trend is likely to influence the market positively, as organizations seek to create inclusive workplaces that reflect a variety of perspectives. By utilizing workforce analytics, companies can track diversity-related data, assess the effectiveness of their initiatives, and make informed adjustments to their strategies. This commitment to diversity not only enhances organizational culture but also contributes to improved business outcomes.

Rising Demand for Data-Driven Decision Making

The workforce analytics market in Japan is experiencing a notable surge in demand for data-driven decision-making processes. Organizations are increasingly recognizing the value of leveraging data to enhance operational efficiency and employee performance. This trend is reflected in the growing investment in analytics tools, with the market projected to reach approximately $1.5 billion by 2026. Companies are utilizing workforce analytics to identify skill gaps, optimize talent acquisition, and improve employee retention strategies. As businesses strive to remain competitive, the integration of data analytics into human resource practices is becoming essential. This shift not only aids in making informed decisions but also fosters a culture of continuous improvement within organizations, thereby driving the workforce analytics market forward.