Rising Security Concerns

The increasing prevalence of crime and security threats in urban areas of Spain has led to a heightened demand for effective surveillance solutions. As businesses and public institutions seek to enhance their security measures, the video surveillance-storage market experiences significant growth. In 2025, the market is projected to expand by approximately 15%, driven by the need for advanced surveillance systems that can store and manage large volumes of video data. This trend indicates a shift towards more sophisticated storage solutions that can accommodate high-definition video feeds, ensuring that security personnel have access to critical information when needed. Consequently, the The video surveillance-storage market is becoming an essential component of security infrastructure across various sectors. This includes retail, transportation, and public safety.

Government Regulations and Initiatives

Government regulations regarding surveillance and data protection are significantly influencing the video surveillance-storage market in Spain. The implementation of stringent data privacy laws necessitates that organizations adopt compliant storage solutions to safeguard sensitive information. In 2025, it is anticipated that compliance-related expenditures will account for nearly 20% of total investments in the video surveillance-storage market. This regulatory environment compels businesses to invest in systems that not only meet legal requirements but also enhance their overall security posture. As a result, the market is likely to see an increase in demand for storage solutions that offer robust encryption and access control features, ensuring that video data is both secure and compliant with local laws.

Growing Demand for Smart City Initiatives

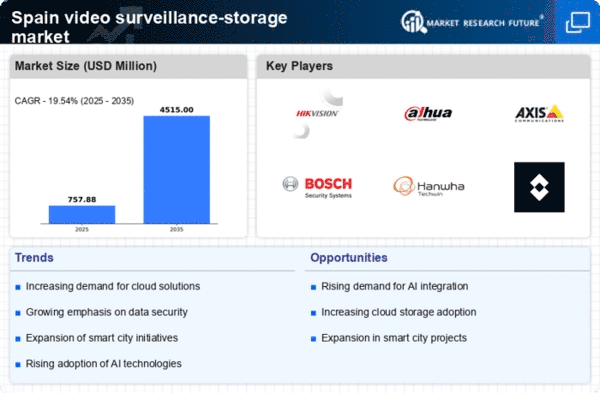

The push towards smart city initiatives in Spain is driving the expansion of the video surveillance-storage market. As municipalities invest in intelligent infrastructure, the need for integrated surveillance systems becomes paramount. These systems require advanced storage solutions capable of handling vast amounts of data generated by various sensors and cameras deployed throughout urban environments. In 2025, the market is projected to grow by approximately 18% as cities increasingly adopt smart technologies to enhance public safety and operational efficiency. This trend suggests that the video surveillance-storage market will play a crucial role in the development of smart cities, providing the necessary data storage capabilities to support real-time monitoring and analysis.

Increased Investment in Infrastructure Security

The ongoing investment in infrastructure security across Spain is significantly impacting the video surveillance-storage market. As critical infrastructure, such as transportation networks and energy facilities, becomes more vulnerable to threats, there is a pressing need for enhanced surveillance measures. In 2025, it is estimated that spending on infrastructure security will rise by 25%, directly benefiting the video surveillance-storage market. This surge in investment indicates a growing recognition of the importance of safeguarding essential services and facilities. Consequently, organizations are likely to seek advanced storage solutions that can efficiently manage the extensive video data generated by surveillance systems, ensuring that security personnel can respond effectively to potential threats.

Technological Advancements in Storage Solutions

The rapid evolution of storage technologies is transforming the video surveillance-storage market in Spain. Innovations such as solid-state drives (SSDs) and network-attached storage (NAS) systems are enabling more efficient data management and retrieval. These advancements allow for faster access to stored video footage, which is crucial for timely decision-making in security operations. In 2025, the market is expected to witness a growth rate of around 12% as organizations increasingly adopt these cutting-edge storage solutions. The integration of high-capacity storage options also facilitates the retention of video data for extended periods, aligning with regulatory requirements and enhancing overall security protocols. Thus, technological advancements play a pivotal role in shaping the landscape of the video surveillance-storage market.