Increasing Security Concerns

The rising concerns regarding security in urban areas of France appear to be a primary driver for the video surveillance-storage market. With incidents of crime and vandalism on the rise, municipalities and businesses are investing heavily in surveillance systems. In 2025, the market is projected to grow by approximately 15%, driven by the need for enhanced security measures. This trend indicates a shift towards more comprehensive surveillance solutions, which necessitate robust storage capabilities to manage the vast amounts of data generated. As a result, the the market is likely to see increased demand for high-capacity storage solutions that can efficiently handle video data.

Growth of Smart City Initiatives

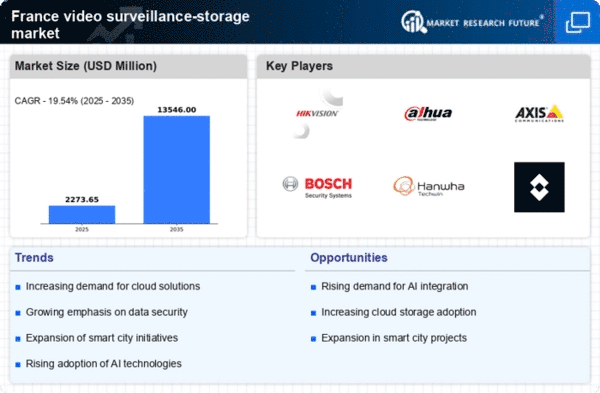

The expansion of smart city initiatives across France is driving the video surveillance-storage market. As cities invest in smart technologies to improve urban living, the integration of advanced surveillance systems becomes essential. These systems require substantial storage capabilities to handle the influx of data generated by various sensors and cameras. In 2025, it is anticipated that smart city projects will contribute to a 10% increase in the market size. This growth indicates a shift towards more interconnected and data-driven urban environments, where efficient storage solutions are crucial for the effective operation of surveillance systems. Thus, the video surveillance-storage market is poised to benefit from the ongoing development of smart city infrastructures.

Regulatory Compliance Requirements

The stringent regulatory environment in France regarding data protection and privacy is influencing the video surveillance-storage market. The implementation of laws such as the General Data Protection Regulation (GDPR) necessitates that organizations ensure compliance when storing surveillance data. This has led to a growing demand for storage solutions that not only meet security needs but also adhere to legal standards. In 2025, it is estimated that compliance-related investments will account for nearly 20% of the total market expenditure. Consequently, vendors are focusing on developing storage systems that incorporate encryption and access controls to safeguard sensitive information, thereby driving growth in the video surveillance-storage market.

Rising Demand for Remote Monitoring Solutions

The increasing demand for remote monitoring solutions is emerging as a key driver for the video surveillance-storage market in France. Businesses and homeowners are seeking ways to monitor their properties from remote locations, leading to a surge in the adoption of IP cameras and cloud-based storage systems. In 2025, the market is projected to grow by approximately 18%, fueled by the need for real-time access to surveillance footage. This trend suggests that consumers are prioritizing convenience and security, prompting vendors to enhance their offerings with user-friendly interfaces and reliable storage options. Consequently, the video surveillance-storage market is likely to experience robust growth as remote monitoring becomes a standard expectation.

Technological Advancements in Storage Solutions

Technological innovations in storage solutions are significantly impacting the video surveillance-storage market in France. The advent of high-capacity storage devices, such as Network Attached Storage (NAS) and cloud storage, is enabling organizations to store and manage large volumes of video data more efficiently. In 2025, the market is expected to witness a surge in demand for these advanced storage solutions, with a projected growth rate of 12%. This trend suggests that businesses are increasingly recognizing the importance of scalable and flexible storage options to accommodate the evolving needs of surveillance systems. As a result, the video surveillance-storage market is likely to benefit from the integration of cutting-edge technologies that enhance data management capabilities.