Rising Cybersecurity Threats

The transaction monitoring market in Spain is increasingly driven by the rising threats of cybercrime. As financial institutions face sophisticated attacks, the need for robust transaction monitoring systems becomes paramount. In 2025, it is estimated that cybercrime could cost the Spanish economy over €100 billion annually. This alarming trend compels organizations to invest in advanced monitoring solutions to detect and prevent fraudulent activities. The transaction monitoring market is thus witnessing a surge in demand for technologies that can analyze vast amounts of transaction data in real-time, ensuring compliance with security protocols and safeguarding customer information. As a result, financial institutions are prioritizing investments in transaction monitoring systems to mitigate risks associated with cyber threats.

Increased Regulatory Scrutiny

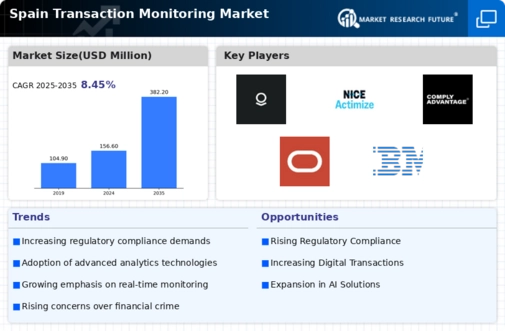

In Spain, the transaction monitoring market is significantly influenced by heightened regulatory scrutiny. The government has implemented stringent regulations aimed at combating money laundering and terrorist financing. As of 2025, compliance costs for financial institutions are projected to rise by 15%, prompting a shift towards automated transaction monitoring solutions. The transaction monitoring market is adapting to these changes by offering systems that not only ensure compliance but also enhance operational efficiency. Institutions are increasingly adopting advanced analytics and machine learning technologies to streamline their monitoring processes, thereby reducing the risk of non-compliance penalties. This regulatory environment fosters a competitive landscape where effective transaction monitoring solutions are essential for maintaining market integrity.

Consumer Demand for Transparency

In the context of the transaction monitoring market in Spain, there is a growing consumer demand for transparency in financial transactions. Customers are increasingly aware of their rights and expect financial institutions to provide clear insights into their transaction activities. This trend is pushing organizations to adopt more transparent transaction monitoring practices. By 2025, it is anticipated that 70% of consumers will prefer banks that offer detailed transaction reports and alerts. The transaction monitoring market is thus evolving to meet these expectations, with solutions that not only monitor transactions but also provide customers with easy access to their transaction histories. This shift towards transparency is likely to enhance customer trust and loyalty, ultimately benefiting financial institutions.

Growing Digital Payment Adoption

The transaction monitoring market in Spain is experiencing growth due to the rapid adoption of digital payment methods. As consumers increasingly prefer online transactions, the volume of digital payments is expected to rise by 25% in 2025. This shift necessitates enhanced transaction monitoring capabilities to detect fraudulent activities in real-time. The transaction monitoring market is responding by developing sophisticated algorithms that can analyze transaction patterns and identify anomalies. Financial institutions are investing in these technologies to protect their customers and maintain trust in digital payment systems. Consequently, the demand for effective transaction monitoring solutions is likely to escalate, as organizations strive to keep pace with the evolving landscape of digital finance.

Technological Advancements in Analytics

The transaction monitoring market in Spain is being propelled by rapid advancements in analytics technologies. As organizations seek to improve their monitoring capabilities, the integration of artificial intelligence and machine learning is becoming increasingly prevalent. These technologies enable financial institutions to process large datasets and identify suspicious activities with greater accuracy. In 2025, it is projected that the use of AI in transaction monitoring could reduce false positives by up to 30%. The transaction monitoring market is thus witnessing a transformation, as institutions leverage these innovations to enhance their fraud detection mechanisms. This technological evolution not only improves efficiency but also allows for a more proactive approach to risk management, positioning organizations to better respond to emerging threats.