Emergence of 5G Technology

The emergence of 5G technology is poised to transform the telecom analytics market in Spain. With the rollout of 5G networks, telecom operators are presented with new opportunities to leverage analytics for improved service delivery and customer experience. The increased data speeds and lower latency associated with 5G are expected to generate vast amounts of data, necessitating advanced analytics solutions. Industry forecasts suggest that the 5G market in Spain could reach €10 billion by 2025, creating a fertile ground for the telecom analytics market to flourish. This technological advancement is likely to drive innovation and investment in analytics capabilities, enabling operators to harness the full potential of 5G.

Integration of IoT Technologies

The integration of Internet of Things (IoT) technologies significantly influences the telecom analytics market in Spain. With the increasing proliferation of connected devices, telecom operators are tasked with managing and analyzing the data generated by these devices. This integration is expected to drive the market, as it allows for enhanced monitoring and management of network performance. According to recent estimates, the number of IoT devices in Spain is anticipated to reach 50 million by 2026, creating a substantial demand for analytics solutions that can process and analyze this data effectively. The telecom analytics market is thus positioned to benefit from the growing need for sophisticated analytics tools that can handle the complexities of IoT data.

Shift Towards Predictive Analytics

The shift towards predictive analytics is reshaping the telecom analytics market in Spain. Telecom operators are increasingly adopting predictive models to forecast customer behavior, network issues, and market trends. This proactive approach enables companies to enhance customer retention and optimize service offerings. Recent studies indicate that predictive analytics can improve operational efficiency by up to 30%, making it a valuable asset in the competitive landscape. As the telecom industry in Spain continues to evolve, the demand for predictive analytics solutions is likely to grow, driving innovation and investment in the telecom analytics market.

Growing Focus on Network Optimization

A growing focus on network optimization is a key driver of the telecom analytics market in Spain. As competition intensifies, telecom operators are compelled to enhance their network performance and reliability. Analytics tools play a crucial role in identifying inefficiencies and optimizing network resources. The Spanish telecom sector is witnessing an increase in investments aimed at improving network infrastructure, with expenditures projected to reach €5 billion by 2027. This emphasis on optimization not only enhances service quality but also reduces operational costs, thereby propelling the growth of the telecom analytics market.

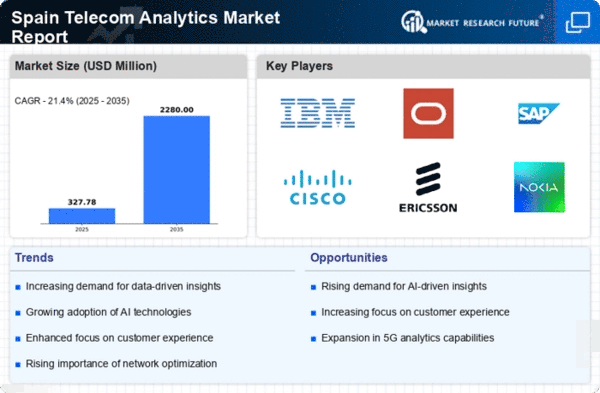

Rising Demand for Data-Driven Insights

the telecom analytics market experiences a notable surge in demand for data-driven insights. As telecommunications companies strive to enhance operational efficiency, they increasingly rely on analytics to interpret vast amounts of data generated by network operations. This trend is underscored by the fact that the Spanish telecom sector is projected to grow at a CAGR of approximately 5.2% from 2025 to 2030. Consequently, telecom operators are investing in advanced analytics tools to gain actionable insights, optimize resource allocation, and improve service delivery. The ability to analyze customer behavior and network performance in real-time is becoming essential for maintaining competitive advantage in the telecom analytics market.