Rising Incidence of STIs

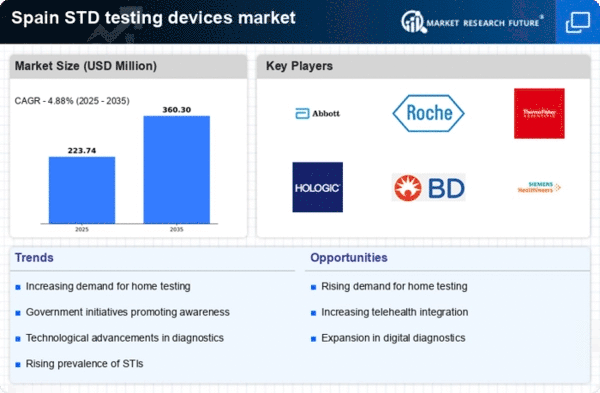

The std testing-devices market in Spain is significantly influenced by the rising incidence of sexually transmitted infections (STIs). Recent data indicates that reported cases of STIs have increased by over 30% in the last five years, prompting a greater need for effective testing solutions. This alarming trend has led to heightened awareness among healthcare providers and the general public regarding the importance of regular testing. Consequently, there is a growing demand for innovative testing devices that can provide rapid and accurate results. The market is likely to respond to this demand by introducing advanced testing technologies, which could enhance detection rates and facilitate timely treatment. As the prevalence of STIs continues to rise, the std testing-devices market is expected to expand, with projections indicating a potential market growth of 18% annually in response to these challenges.

Government Initiatives and Funding

Government initiatives in Spain are playing a crucial role in shaping the std testing-devices market. The Spanish health authorities have launched various programs aimed at increasing the availability and accessibility of testing devices. For instance, funding has been allocated to public health campaigns that promote regular testing, particularly among high-risk populations. This proactive approach is likely to enhance public awareness and encourage individuals to utilize testing devices more frequently. Additionally, partnerships between the government and private sector are fostering innovation in the development of new testing technologies. The financial support provided by the government is expected to stimulate market growth, with estimates suggesting an increase in market size by approximately 20% over the next few years. Such initiatives are essential for improving public health outcomes and reducing the incidence of sexually transmitted infections.

Increased Focus on Preventive Healthcare

The std testing-devices market is benefiting from a growing emphasis on preventive healthcare in Spain. As healthcare systems shift towards proactive measures, there is a heightened focus on early detection and prevention of sexually transmitted infections. This trend is reflected in the increasing number of health campaigns promoting regular testing and education about STIs. Public health organizations are advocating for routine testing as a means to reduce transmission rates and improve overall health outcomes. Consequently, the demand for testing devices is likely to rise, as individuals become more aware of the importance of regular screenings. Market analysts project that this focus on preventive healthcare could lead to a growth rate of around 22% in the std testing-devices market over the next few years, underscoring the critical role of testing in public health strategies.

Growing Demand for Home Testing Solutions

The std testing-devices market in Spain is experiencing a notable shift towards home testing solutions. This trend is driven by the increasing preference for privacy and convenience among consumers. A survey indicates that approximately 60% of individuals prefer testing at home rather than visiting a clinic. This demand is likely to propel the market forward, as manufacturers are investing in developing user-friendly and accurate home testing kits. The rise of e-commerce platforms further facilitates access to these devices, allowing consumers to purchase them discreetly. As a result, The STD testing devices market is expected to expand significantly, with projections suggesting a growth rate of around 15% annually over the next five years.. This shift towards home testing solutions reflects a broader trend in healthcare, where patients seek more control over their health management.

Technological Innovations in Testing Devices

Technological advancements are transforming the std testing-devices market in Spain, leading to the development of more efficient and accurate testing solutions. Innovations such as point-of-care testing and mobile health applications are becoming increasingly prevalent. These technologies allow for quicker results and improved user experience, which is likely to attract more individuals to utilize testing devices. Furthermore, the integration of artificial intelligence in testing processes is enhancing the accuracy of results, thereby increasing consumer confidence in these devices. As a result, the market is expected to witness a surge in demand, with estimates suggesting a growth rate of approximately 25% over the next few years. The continuous evolution of technology in the std testing-devices market is essential for meeting the changing needs of consumers and healthcare providers alike.