Rising Incidence of STDs

The rising incidence of STDs in the US is a critical factor influencing the std testing-devices market. Recent statistics indicate that cases of chlamydia, gonorrhea, and syphilis have reached alarming levels, prompting public health officials to take action. The Centers for Disease Control and Prevention (CDC) reported a 30% increase in syphilis cases over the past five years, highlighting the urgent need for effective testing solutions. This trend is likely to drive demand for testing devices, as healthcare providers seek to address the growing public health crisis. The std testing-devices market is positioned to respond to this challenge by offering innovative and accessible testing options, ultimately contributing to better health outcomes and reduced transmission rates.

Growing Awareness of STDs

The increasing awareness of sexually transmitted diseases (STDs) among the population is a crucial driver for the std testing-devices market. Educational campaigns and public health initiatives have contributed to a heightened understanding of the risks associated with STDs. As individuals become more informed about the potential health implications, they are more likely to seek testing. This trend is reflected in the rising number of tests conducted annually, with estimates suggesting that over 20 million cases of STDs occur in the US each year. Consequently, the demand for testing devices is expected to grow, as individuals prioritize their sexual health and seek timely diagnosis and treatment. The std testing-devices market is thus positioned to benefit from this growing awareness, leading to increased sales and innovation in testing technologies.

Supportive Government Policies

Supportive government policies and initiatives are instrumental in shaping the std testing-devices market. Federal and state governments have implemented various programs aimed at increasing access to STD testing and treatment. Funding for public health campaigns and the establishment of testing centers have made it easier for individuals to obtain necessary screenings. Additionally, regulatory bodies are working to streamline the approval processes for new testing devices, fostering innovation within the industry. As a result, the std testing-devices market is likely to experience growth driven by these supportive measures. Increased funding and resources allocated to STD prevention and treatment initiatives will further enhance the availability and accessibility of testing devices, ultimately benefiting public health.

Technological Advancements in Testing

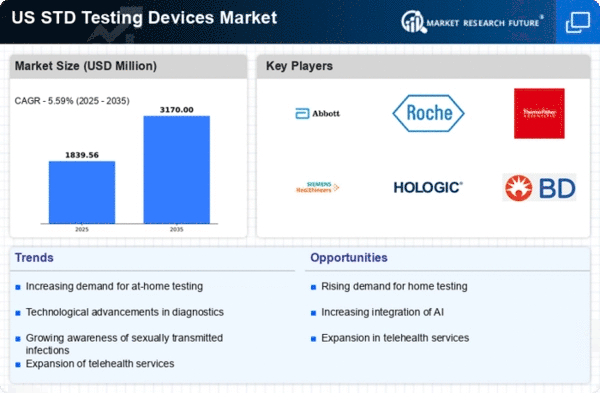

Technological advancements play a pivotal role in shaping the std testing-devices market. Innovations such as rapid testing methods, point-of-care testing, and enhanced accuracy in results have transformed the landscape of STD testing. For instance, the introduction of molecular testing techniques has significantly improved the sensitivity and specificity of tests, allowing for earlier detection of infections. The market is projected to witness a compound annual growth rate (CAGR) of approximately 8% over the next five years, driven by these advancements. Furthermore, the integration of mobile health applications with testing devices is likely to enhance user experience and accessibility. As technology continues to evolve, the std testing-devices market is expected to expand, catering to the needs of a more tech-savvy population seeking efficient and reliable testing solutions.

Increased Focus on Preventive Healthcare

The shift towards preventive healthcare is a significant driver for the std testing-devices market. As healthcare systems emphasize early detection and prevention of diseases, individuals are encouraged to undergo regular testing for STDs. This proactive approach is supported by various health organizations advocating for routine screenings, particularly among high-risk populations. The std testing-devices market is likely to see a surge in demand as more individuals recognize the importance of preventive measures. Reports indicate that regular testing can reduce the transmission rates of STDs, thereby improving public health outcomes. Consequently, the market is expected to expand as healthcare providers and patients alike prioritize preventive strategies, leading to increased utilization of testing devices.