Rising Awareness of Sexual Health

Rising awareness of sexual health is significantly influencing the std testing-devices market. Educational campaigns and outreach programs have contributed to a more informed public regarding the importance of regular testing. This heightened awareness is reflected in the increasing number of individuals seeking testing services, with reports indicating a 30% rise in testing rates over the past year. As more people recognize the benefits of early detection and treatment, the demand for testing devices is likely to grow. Additionally, the integration of educational resources into testing services enhances user engagement, further driving the market. The std testing-devices market is thus positioned to benefit from this cultural shift towards prioritizing sexual health.

Government Initiatives and Funding

Government initiatives and funding are pivotal in shaping the std testing-devices market. The UK government has been actively investing in public health initiatives aimed at reducing the incidence of STIs. Recent allocations of £10 million towards enhancing testing facilities and promoting awareness campaigns have been reported. Such funding not only supports the development of new testing devices but also facilitates access to existing ones, particularly in underserved communities. This proactive approach by the government is expected to bolster the std testing-devices market, as increased accessibility leads to higher testing rates and, consequently, better public health outcomes. The ongoing commitment to improving sexual health services suggests a promising future for the market.

Shift Towards Preventive Healthcare

The shift towards preventive healthcare is significantly reshaping the STD testing devices market. As healthcare systems increasingly emphasize prevention over treatment, there is a growing focus on regular testing as a means to curb the spread of STIs. This paradigm shift is supported by evidence suggesting that early detection can significantly reduce transmission rates. Consequently, the market is witnessing an influx of preventive testing devices designed to encourage routine screening. The potential for preventive healthcare to reduce long-term healthcare costs is also a driving factor, with estimates suggesting that every £1 spent on prevention could save the NHS £5 in treatment costs. This economic rationale is likely to further propel the growth of the std testing-devices market.

Increased Demand for Rapid Testing Solutions

The std testing-devices market is experiencing a notable surge in demand for rapid testing solutions. This trend is driven by the growing need for quick and accurate results, particularly in high-risk populations. Recent data indicates that the market for rapid testing devices has expanded by approximately 25% in the last year alone. The convenience of obtaining results within minutes appeals to both healthcare providers and patients. This enhances the overall testing experience. Furthermore, the increasing prevalence of sexually transmitted infections (STIs) in the UK has prompted healthcare systems to seek efficient testing methods. As a result, manufacturers are focusing on developing innovative rapid testing devices that cater to this demand, ultimately shaping the future landscape of the std testing-devices market.

Technological Advancements in Testing Devices

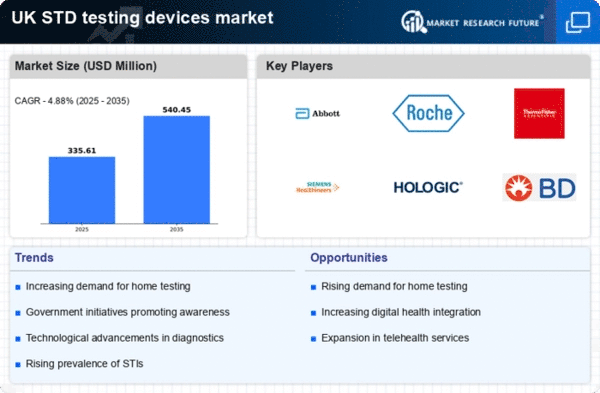

Technological advancements play a crucial role in the evolution of the std testing-devices market. Innovations such as point-of-care testing and mobile health applications are transforming how testing is conducted. These advancements not only improve the accuracy of results but also enhance user experience. For instance, the integration of artificial intelligence in testing devices has shown potential in streamlining the testing process and providing real-time data analysis. The market was projected to grow at a compound annual growth rate (CAGR) of 15% over the next five years, driven by these technological innovations. As healthcare providers increasingly adopt these advanced solutions, the std testing-devices market is likely to witness significant growth and transformation.